Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions and show the works, I will give you a like! Thanks! Insurance Company (a Property Casuaity company) has the following

please answer all the questions and show the works, I will give you a like! Thanks!

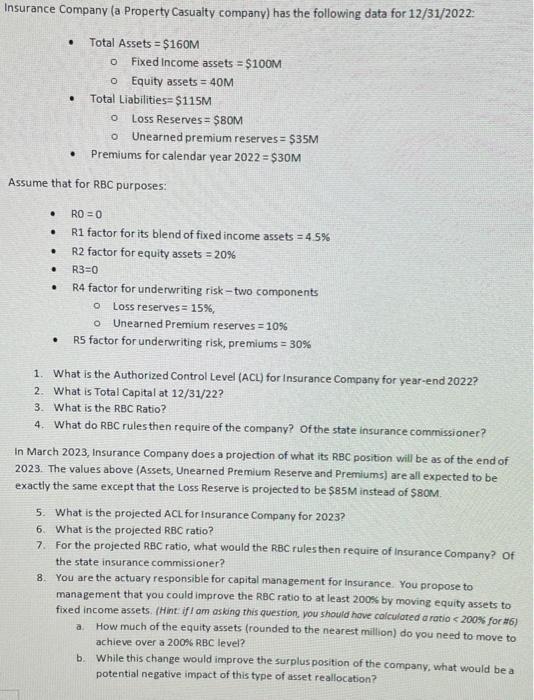

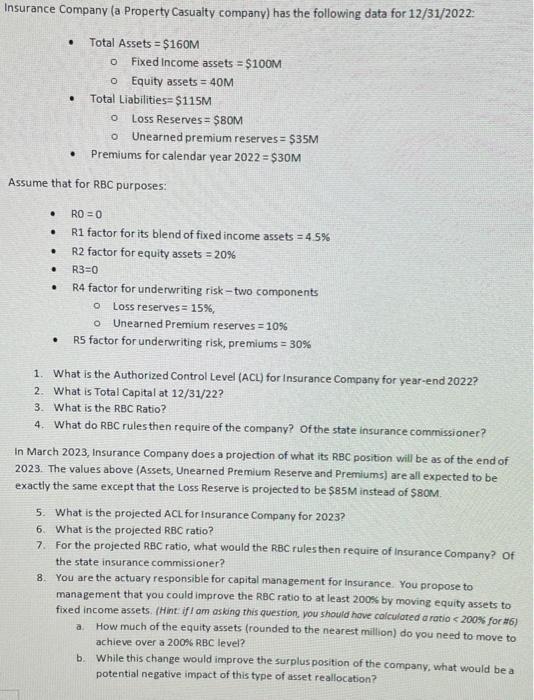

Insurance Company (a Property Casuaity company) has the following data for 12/31/2022 : - Total Assets =$160M Fixed income assets =$100M Equity assets =40M Total Liabilities =$115M Loss Reserves =$80M Unearned premium reserves =$35M Premiums for calendar year 2022=$30M Assume that for RBC purposes: RO=0 - R1 factor for its blend of fixed income assets =4.5% - R2 factor for equity assets =20% - R3=0 - R4 factor for underwriting risk - two components Loss reserves =15% Unearned Premium reserves =10% - R5 factor for underwriting risk, premiums =30% 1. What is the Authorized Control Level (ACL) for Insurance Company for year-end 2022 ? 2. What is Total Capital at 12/31/22 ? 3. What is the RBC Ratio? 4. What do RBC rules then require of the company? Of the state insurance commissioner? In March 2023, Insurance Company does a projection of what its RBC position will be as of the end of 2023. The values above (Assets, Unearned Premium Reserve and Premiums) are all expected to be exactiy the same except that the Loss Reserve is projected to be $85M instead of $80M. 5. What is the projected ACL for Insurance Company for 2023 ? 6. What is the projected RBC ratio? 7. For the projected RBC ratio, what would the RBC rules then require of insurance Company? the state insurance commissioner? 8. You are the actuary responsible for capital management for insurance. You propose to management that you could improve the RBC ratio to at least 2008 by moving equity assets to fixed income assets. (Hint iff am asking this question, you should hove colculated a ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started