Question

Please answer all the questions Consider a stock that will have dividend growth rates in the next three periods of 16%, 8%, and 5%, respectively.

Please answer all the questions

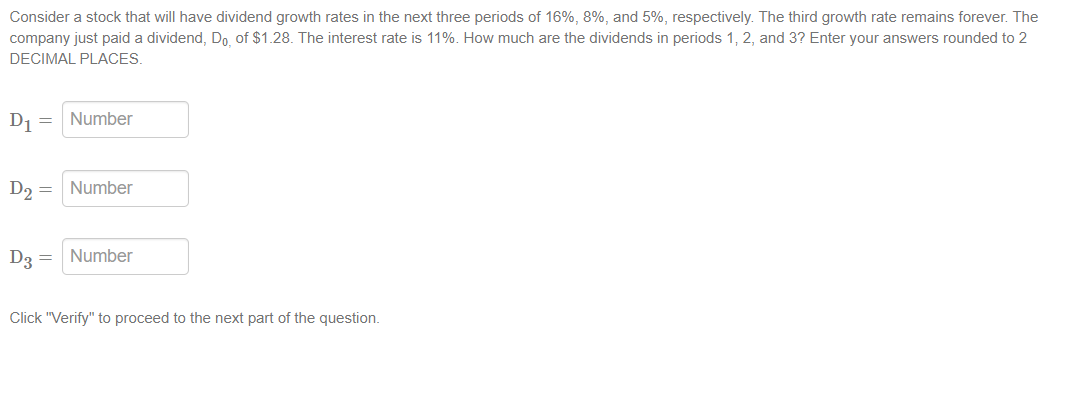

Consider a stock that will have dividend growth rates in the next three periods of 16%, 8%, and 5%, respectively. The third growth rate remains forever. The company just paid a dividend, D0, of $1.28. The interest rate is 11%. How much are the dividends in periods 1, 2, and 3? Enter your answers rounded to 2 DECIMAL PLACES.

D1=

D2=

D3=

2. Grape Co. has a stock that has a current price of $39.73. A year from now, the stock is expected to pay a dividend of $3.75 and the price will be $38.13. What is the expected rate of return for this stock? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES.

3. Fortress of Solitude Co. expects an earnings per share of $2.20 and reinvests 30% of its earnings. Management projects a rate of return of 9% on new projects and investors expect a 9% rate of return on the stock.

What is the price of the stock with growth?

Enter your response below rounded to 2 DECIMAL PLACES.

4. A stock has a return on equity of 9.5% and a plowback ratio of 55%. What is the sustainable growth rate? Enter you answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES.

Consider a stock that will have dividend growth rates in the next three periods of 16%,8%, and 5%, respectively. The third growth rate remains forever. The company just paid a dividend, D0, of $1.28. The interest rate is 11%. How much are the dividends in periods 1,2 , and 3 ? Enter your answers rounded to 2 DECIMAL PLACES. D1= D2= D3= Click "Verify" to proceed to the next part of theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started