Answered step by step

Verified Expert Solution

Question

1 Approved Answer

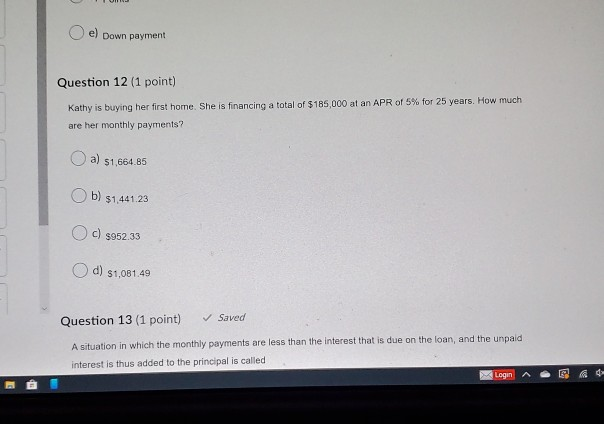

Please answer all the questions. e) Down payment Question 12 (1 point) Kathy is buying her first home. She is financing a total of $185.000

Please answer all the questions.

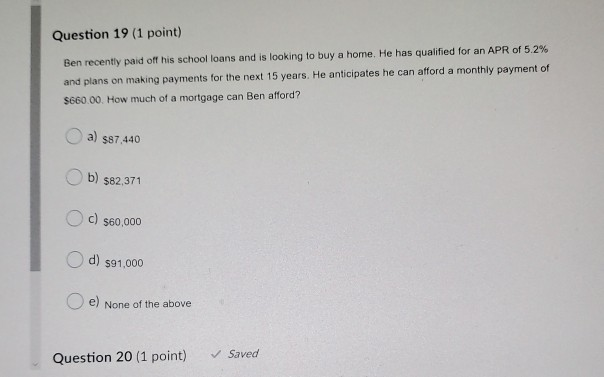

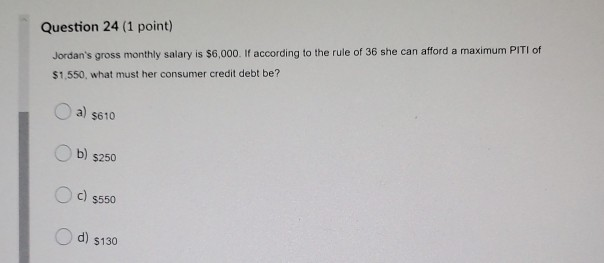

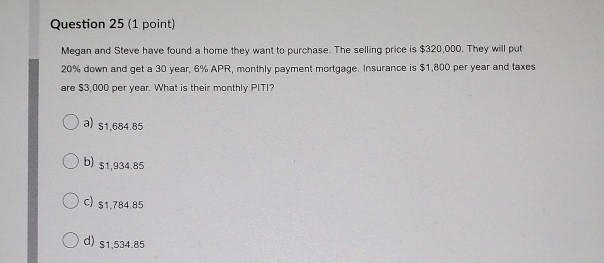

e) Down payment Question 12 (1 point) Kathy is buying her first home. She is financing a total of $185.000 at an APR of 5% for 25 years. How much are her monthly payments? a) $1,664.85 b) $1,441.23 C) 952.33 d) $1,081,49 Question 13 (1 point) Saved A situation in which the monthly payments are less than the interest that is due on the loan, and the unpaid interest is thus added to the principal is called Login A . Question 19 (1 point) Ben recently paid off his school loans and is looking to buy a home. He has qualified for an APR of 5.2% and plans on making payments for the next 15 years. He anticipates he can afford a monthly payment of $660.00. How much of a mortgage can Ben afford? a) 587.440 b) $82,371 c) $60,000 d) $91,000 e) None of the above Question 20 (1 point) Saved Question 24 (1 point) Jordan's gross monthly salary is $6,000. If according to the rule of 36 she can afford a maximum PITI of $1,550, what must her consumer credit debt be? O a) $610 b) $250 c) $550 d) $130 Question 25 (1 point) Megan and Steve have found a home they want to purchase. The selling price is $320,000. They will put 20% down and get a 30 year, 6% APR, monthly payment mortgage Insurance is $1,800 per year and taxes are $3,000 per year. What is their monthly PITI? a) 51,684.85 O b) $1,934 85 OC) $1,784.85 d) $1,534.85Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started