Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all the questions, especially details in the question b) thanks 1. Accounting Treatment and Positive Accounting Theory. The finance director of Oak plc

Please answer all the questions, especially details in the question b) thanks

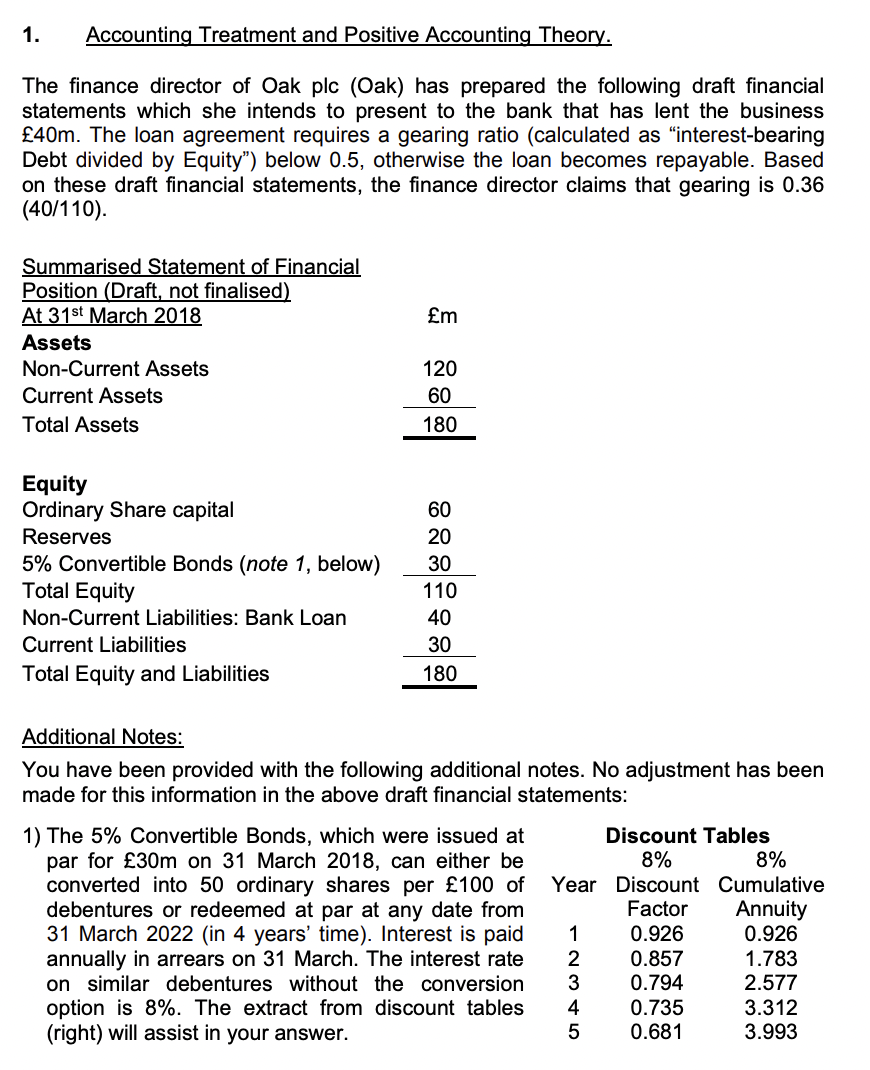

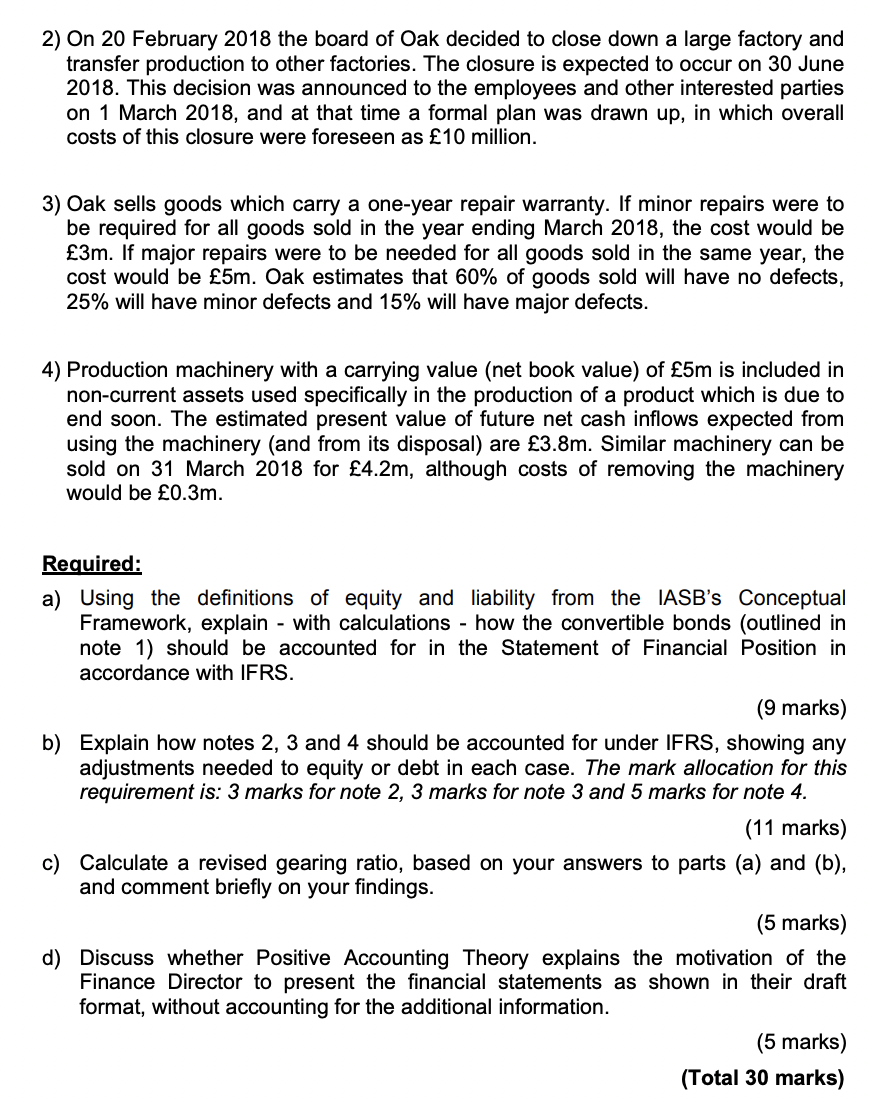

1. Accounting Treatment and Positive Accounting Theory. The finance director of Oak plc (Oak) has prepared the following draft financial statements which she intends to present to the bank that has lent the business 40m. The loan agreement requires a gearing ratio (calculated as "interest-bearing Debt divided by Equity") below 0.5, otherwise the loan becomes repayable. Based on these draft financial statements, the finance director claims that gearing is 0.36 (40/110). Summarised Statement of Financial Position (Draft, not finalised) At 31st March 2018 m Assets Non-Current Assets Current Assets Total Assets Equity Ordinary Share capital Reserves 5% Convertible Bonds (note 1, below) Total Equity Non-Current Liabilities: Bank Loan Current Liabilities Total Equity and Liabilities Additional Notes: You have been provided with the following additional notes. No adjustment has been made for this information in the above draft financial statements: Discount Tables 8% 8% 1) The 5% Convertible Bonds, which were issued at par for 30m on 31 March 2018, can either be converted into 50 ordinary shares per 100 of debentures or redeemed at par at any date from 31 March 2022 (in 4 years' time). Interest is paid 1 annually in arrears on 31 March. The interest rate Year Discount Cumulative Factor Annuity 0.926 0.926 1.783 0.857 0.794 2.577 on similar debentures without the conversion option is 8%. The extract from discount tables (right) will assist in your answer. 3.312 0.735 0.681 3.993 888 8882988 2345 2) On 20 February 2018 the board of Oak decided to close down a large factory and transfer production to other factories. The closure is expected to occur on 30 June 2018. This decision was announced to the employees and other interested parties on 1 March 2018, and at that time a formal plan was drawn up, in which overall costs of this closure were foreseen as 10 million. 3) Oak sells goods which carry a one-year repair warranty. If minor repairs were to be required for all goods sold in the year ending March 2018, the cost would be 3m. If major repairs were to be needed for all goods sold in the same year, the cost would be 5m. Oak estimates that 60% of goods sold will have no defects, 25% will have minor defects and 15% will have major defects. 4) Production machinery with a carrying value (net book value) of 5m is included in non-current assets used specifically in the production of a product which is due to end soon. The estimated present value of future net cash inflows expected from using the machinery (and from its disposal) are 3.8m. Similar machinery can be sold on 31 March 2018 for 4.2m, although costs of removing the machinery would be 0.3m. Required: a) Using the definitions of equity and liability from the IASB's Conceptual Framework, explain - with calculations - how the convertible bonds (outlined in note 1) should be accounted for in the Statement of Financial Position in accordance with IFRS. (9 marks) b) Explain how notes 2, 3 and 4 should be accounted for under IFRS, showing any adjustments needed to equity or debt in each case. The mark allocation for this requirement is: 3 marks for note 2, 3 marks for note 3 and 5 marks for note 4. (11 marks) c) Calculate a revised gearing ratio, based on your answers to parts (a) and (b), and comment briefly on your findings. (5 marks) d) Discuss whether Positive Accounting Theory explains the motivation of the Finance Director to present the financial statements as shown in their draft format, without accounting for the additional information. (5 marks) (Total 30 marks) 1. Accounting Treatment and Positive Accounting Theory. The finance director of Oak plc (Oak) has prepared the following draft financial statements which she intends to present to the bank that has lent the business 40m. The loan agreement requires a gearing ratio (calculated as "interest-bearing Debt divided by Equity") below 0.5, otherwise the loan becomes repayable. Based on these draft financial statements, the finance director claims that gearing is 0.36 (40/110). Summarised Statement of Financial Position (Draft, not finalised) At 31st March 2018 m Assets Non-Current Assets Current Assets Total Assets Equity Ordinary Share capital Reserves 5% Convertible Bonds (note 1, below) Total Equity Non-Current Liabilities: Bank Loan Current Liabilities Total Equity and Liabilities Additional Notes: You have been provided with the following additional notes. No adjustment has been made for this information in the above draft financial statements: Discount Tables 8% 8% 1) The 5% Convertible Bonds, which were issued at par for 30m on 31 March 2018, can either be converted into 50 ordinary shares per 100 of debentures or redeemed at par at any date from 31 March 2022 (in 4 years' time). Interest is paid 1 annually in arrears on 31 March. The interest rate Year Discount Cumulative Factor Annuity 0.926 0.926 1.783 0.857 0.794 2.577 on similar debentures without the conversion option is 8%. The extract from discount tables (right) will assist in your answer. 3.312 0.735 0.681 3.993 888 8882988 2345 2) On 20 February 2018 the board of Oak decided to close down a large factory and transfer production to other factories. The closure is expected to occur on 30 June 2018. This decision was announced to the employees and other interested parties on 1 March 2018, and at that time a formal plan was drawn up, in which overall costs of this closure were foreseen as 10 million. 3) Oak sells goods which carry a one-year repair warranty. If minor repairs were to be required for all goods sold in the year ending March 2018, the cost would be 3m. If major repairs were to be needed for all goods sold in the same year, the cost would be 5m. Oak estimates that 60% of goods sold will have no defects, 25% will have minor defects and 15% will have major defects. 4) Production machinery with a carrying value (net book value) of 5m is included in non-current assets used specifically in the production of a product which is due to end soon. The estimated present value of future net cash inflows expected from using the machinery (and from its disposal) are 3.8m. Similar machinery can be sold on 31 March 2018 for 4.2m, although costs of removing the machinery would be 0.3m. Required: a) Using the definitions of equity and liability from the IASB's Conceptual Framework, explain - with calculations - how the convertible bonds (outlined in note 1) should be accounted for in the Statement of Financial Position in accordance with IFRS. (9 marks) b) Explain how notes 2, 3 and 4 should be accounted for under IFRS, showing any adjustments needed to equity or debt in each case. The mark allocation for this requirement is: 3 marks for note 2, 3 marks for note 3 and 5 marks for note 4. (11 marks) c) Calculate a revised gearing ratio, based on your answers to parts (a) and (b), and comment briefly on your findings. (5 marks) d) Discuss whether Positive Accounting Theory explains the motivation of the Finance Director to present the financial statements as shown in their draft format, without accounting for the additional information. (5 marks) (Total 30 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started