Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 1. On January 1, 2019, David and Enrile decided to form a partnership. At the end of the

please answer all the questions immediately thankyou

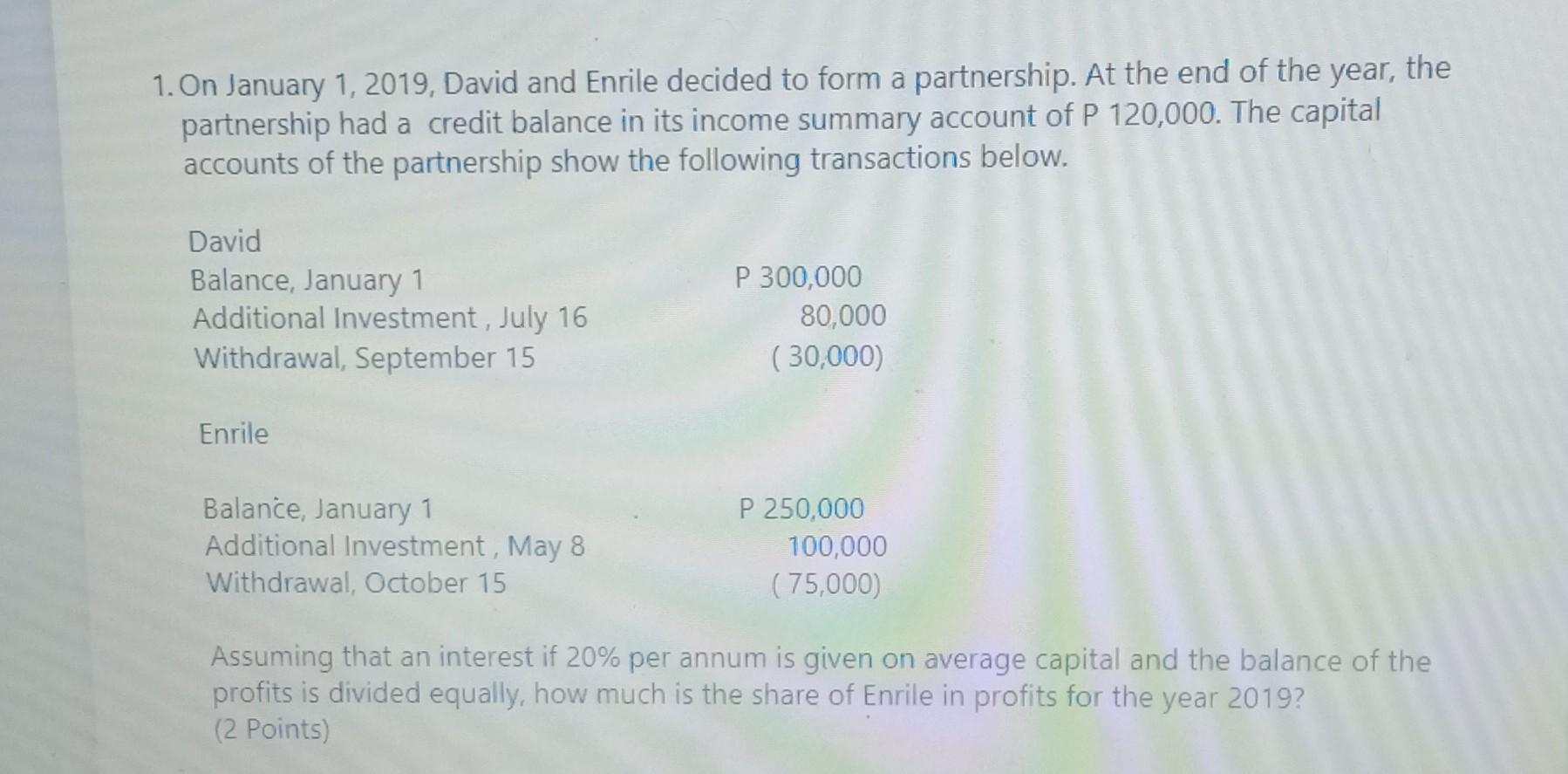

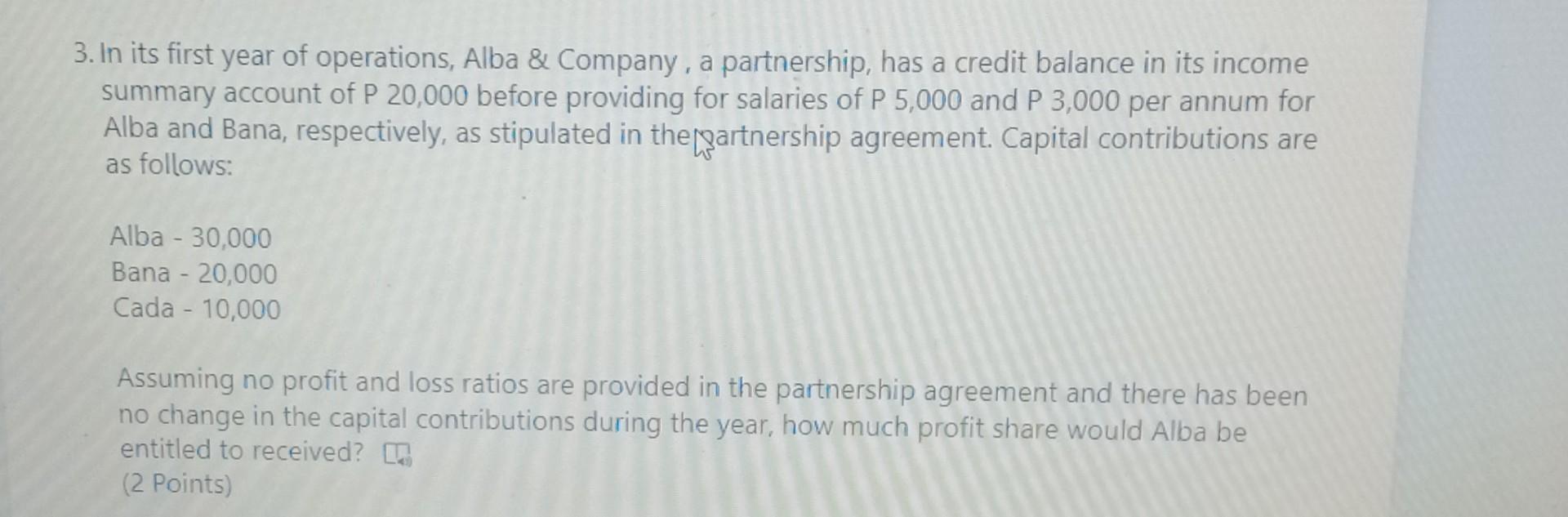

1. On January 1, 2019, David and Enrile decided to form a partnership. At the end of the year, the partnership had a credit balance in its income summary account of P 120,000. The capital accounts of the partnership show the following transactions below. David Balance, January 1 Additional Investment, July 16 Withdrawal, September 15 P 300,000 80,000 ( 30,000) Enrile Balance, January 1 Additional Investment, May 8 Withdrawal, October 15 P 250,000 100,000 (75,000) Assuming that an interest if 20% per annum is given on average capital and the balance of the profits is divided equally, how much is the share of Enrile in profits for the year 2019? (2 points) 3. In its first year of operations, Alba & Company, a partnership, has a credit balance in its income summary account of P 20,000 before providing for salaries of P 5,000 and P 3,000 per annum for Alba and Bana, respectively, as stipulated in the partnership agreement. Capital contributions are as follows: Alba - 30,000 Bana - 20,000 Cada - 10,000 Assuming no profit and loss ratios are provided in the partnership agreement and there has been no change in the capital contributions during the year, how much profit share would Alba be entitled to received? (2 Points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started