Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 1. Which of the following scenario will result in a Deferred tax asset? * (1 Point) A revenue

please answer all the questions immediately thankyou

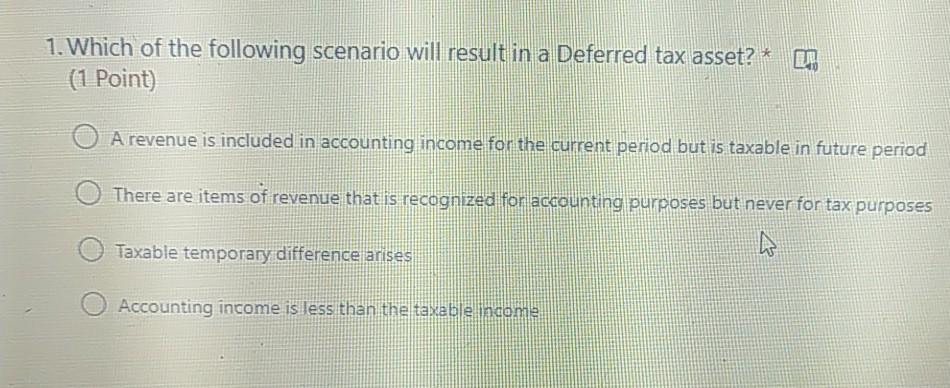

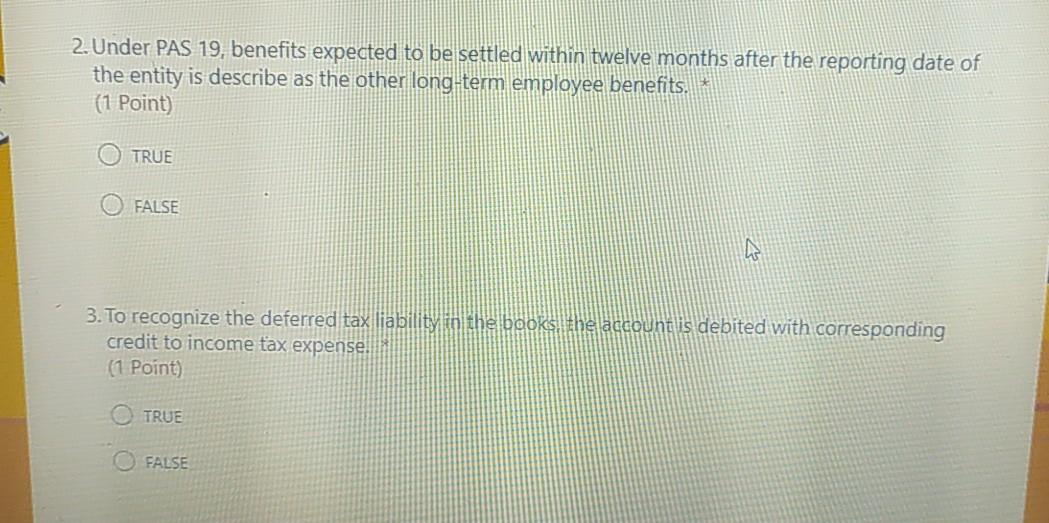

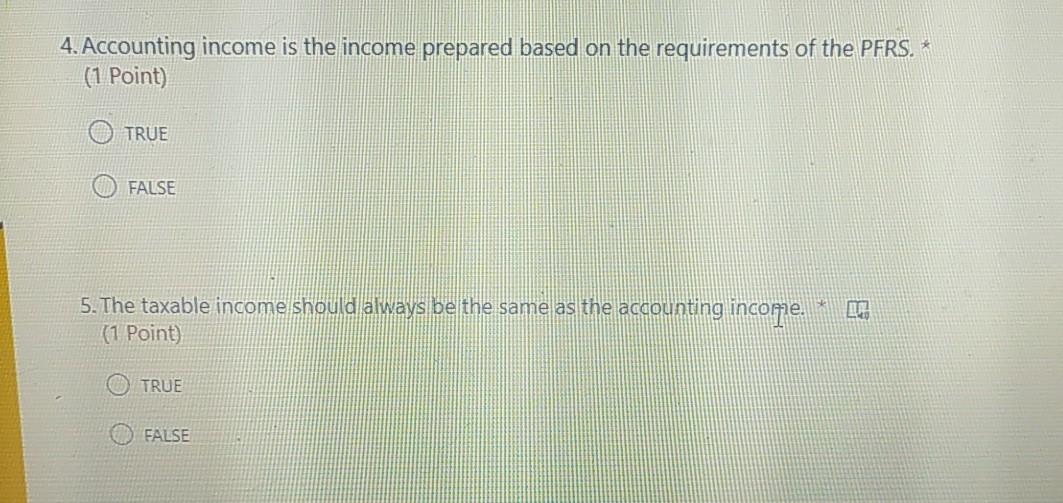

1. Which of the following scenario will result in a Deferred tax asset? * (1 Point) A revenue is included in accounting income for the current period but is taxable in future period There are items of revenue that is recognized for accounting purposes but never for tax purposes Taxable temporary difference arises Accounting income is less than the texable income 2. Under PAS 19, benefits expected to be settled within twelve months after the reporting date of the entity is describe as the other long-term employee benefits. * (1 Point) TRUE FALSE 3. To recognize the deferred tax liability in the books, the account is debited with corresponding credit to income tax expense (1 Point) TRUE FALSE 4. Accounting income is the income prepared based on the requirements of the PFRS. * (1 Point) TRUE FALSE 5. The taxable income should always be the same as the accounting incone. (1 Point) LT TRUE FALSEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started