Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 14. On January 2,2019, B and P formed a partnership. B contributed capital of P 175,000 and P,

please answer all the questions immediately thankyou

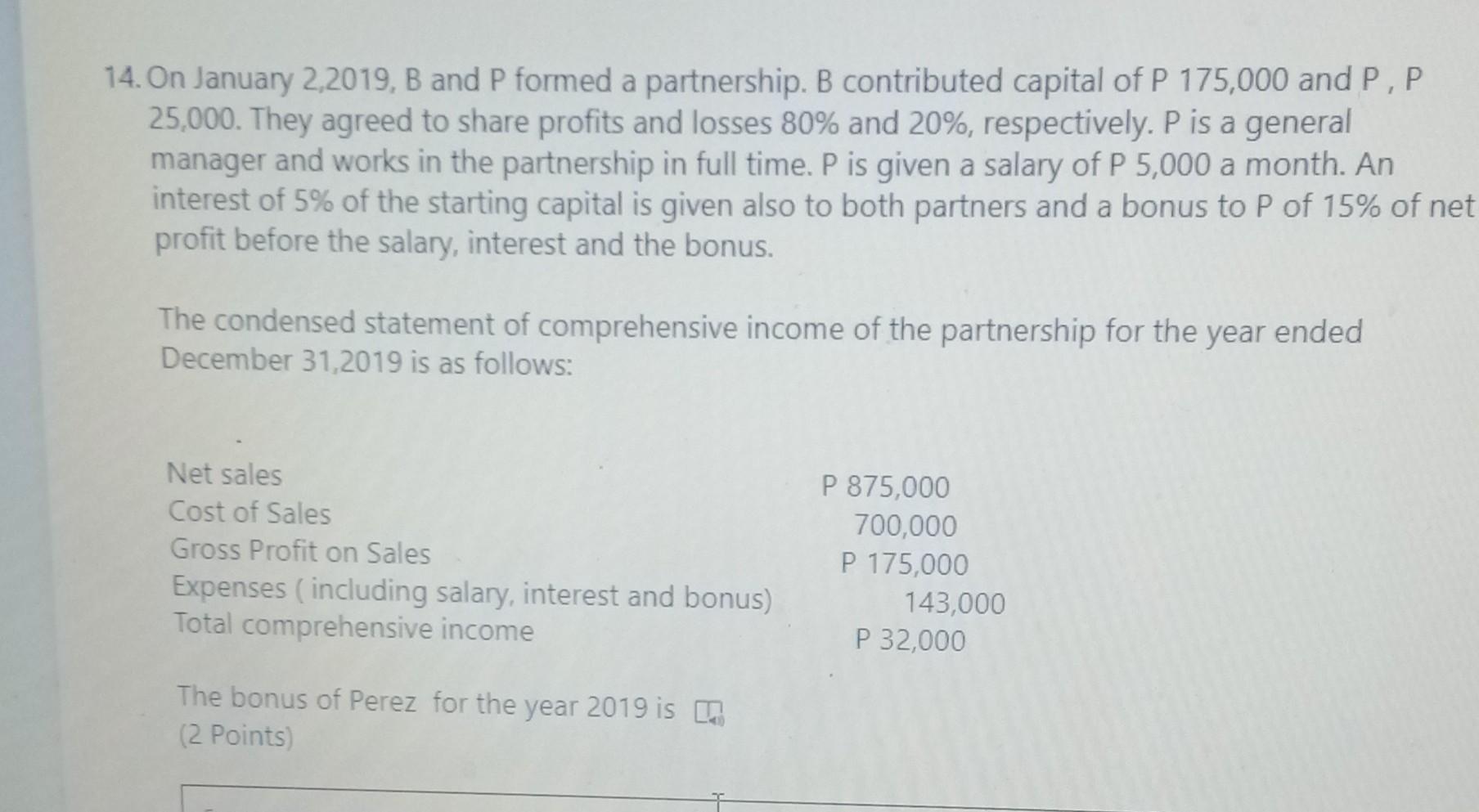

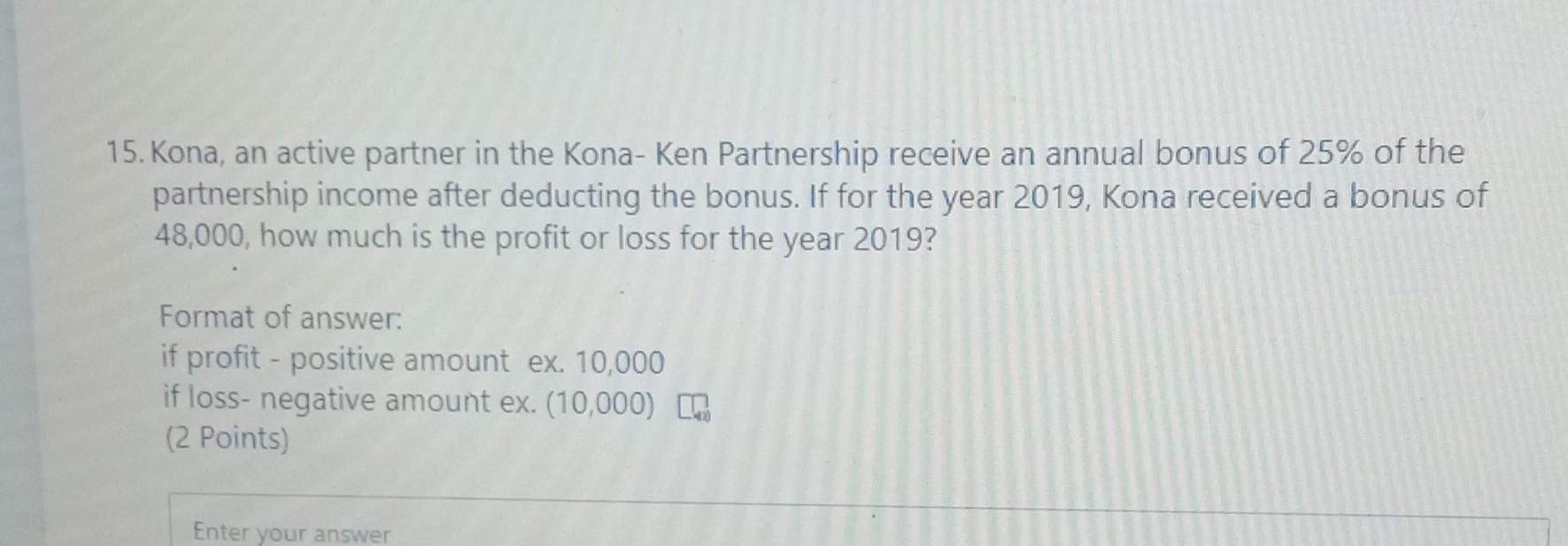

14. On January 2,2019, B and P formed a partnership. B contributed capital of P 175,000 and P, P 25,000. They agreed to share profits and losses 80% and 20%, respectively. P is a general manager and works in the partnership in full time. P is given a salary of P 5,000 a month. An interest of 5% of the starting capital is given also to both partners and a bonus to P of 15% of net profit before the salary, interest and the bonus. The condensed statement of comprehensive income of the partnership for the year ended December 31,2019 is as follows: Net sales Cost of Sales Gross Profit on Sales Expenses (including salary, interest and bonus) Total comprehensive income P 875,000 700,000 P 175,000 143,000 P 32,000 The bonus of Perez for the year 2019 is on (2 points) 15. Kona, an active partner in the Kona- Ken Partnership receive an annual bonus of 25% of the partnership income after deducting the bonus. If for the year 2019, Kona received a bonus of 48,000, how much is the profit or loss for the year 2019? Format of answer: if profit - positive amount ex. 10,000 if loss- negative amount ex. (10,000) LT (2 points) Enter yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started