Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 21. It is the profit for a period determined in accordance with the rules established by taxation authorities

please answer all the questions immediately thankyou

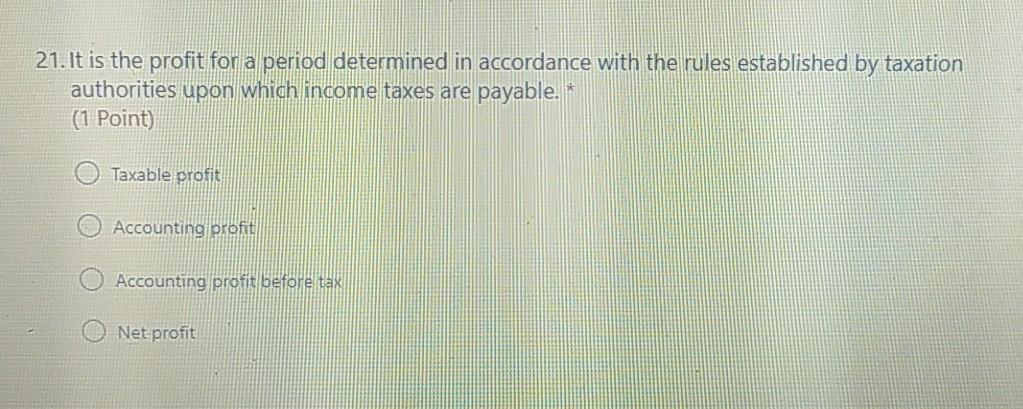

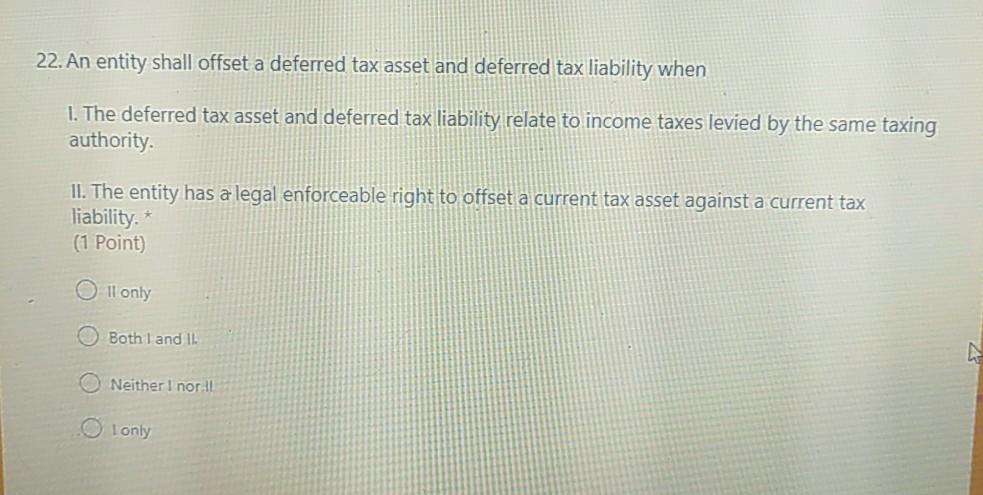

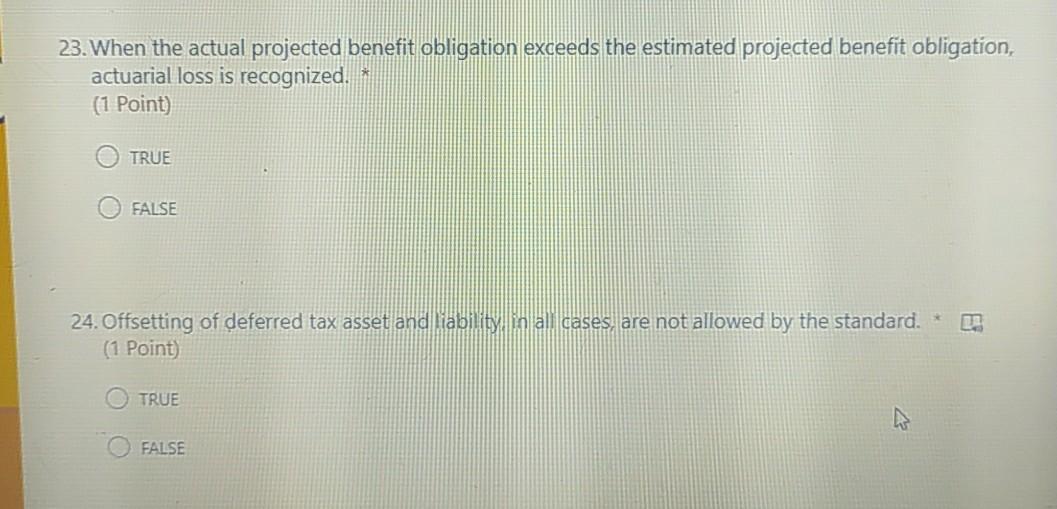

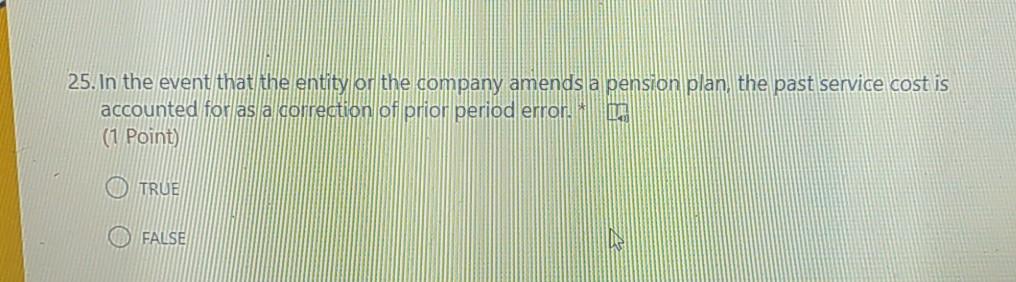

21. It is the profit for a period determined in accordance with the rules established by taxation authorities upon which income taxes are payable. * (1 Point) Taxable profit Accounting profit Accounting profit before tax Net profit 22. An entity shall offset a deferred tax asset and deferred tax liability when 1. The deferred tax asset and deferred tax liability relate to income taxes levied by the same taxing authority II. The entity has a legal enforceable right to offset a current tax asset against a current tax liability. * (1 Point) oll only Both I and 11. Neither i nori Lonly 23. When the actual projected benefit obligation exceeds the estimated projected benefit obligation, actuarial loss is recognized. * (1 Point) TRUE FALSE 24. Offsetting of deferred tax asset and liability in ay cases, are not allowed by the standard. (1 Point) TRUE FALSE 25. In the event that the entity or the company amends a pension plan the past service cost is accounted for as a correction of prior period error: (1 Point) TRUE FALSEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started