Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 25 On January 1,2020, A and B formed a partnership. A contributed capital of P 275,000 and B

please answer all the questions immediately thankyou

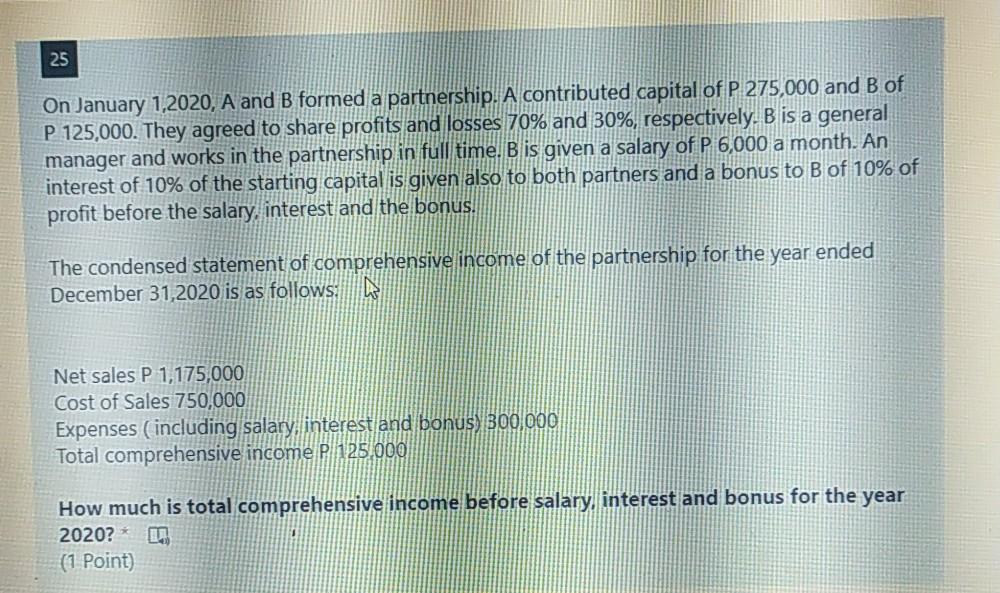

25 On January 1,2020, A and B formed a partnership. A contributed capital of P 275,000 and B of P 125,000. They agreed to share profits and losses 70% and 30%, respectively. B is a general manager and works in the partnership in full time. B is given a salary of P 6,000 a month. An interest of 10% of the starting capital is given also to both partners and a bonus to B of 10% of profit before the salary, interest and the bonus. The condensed statement of comprehensive income of the partnership for the year ended December 31,2020 is as follows: Net sales P 1,175,000 Cost of Sales 750,000 Expenses (including salary interest and bonus) 300.000 Total comprehensive income P 125.000 How much is total comprehensive income before salary interest and bonus for the year 2020?* (1 Point) How much is total comprehensive income before salary, interest and bonus for the year 2020? * (1 Point) 263,333.33 236,666.67 400,000 720,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started