Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 26. Under PAS 19, which of the following statement is true? 1. Current service cost is the increase

please answer all the questions immediately thankyou

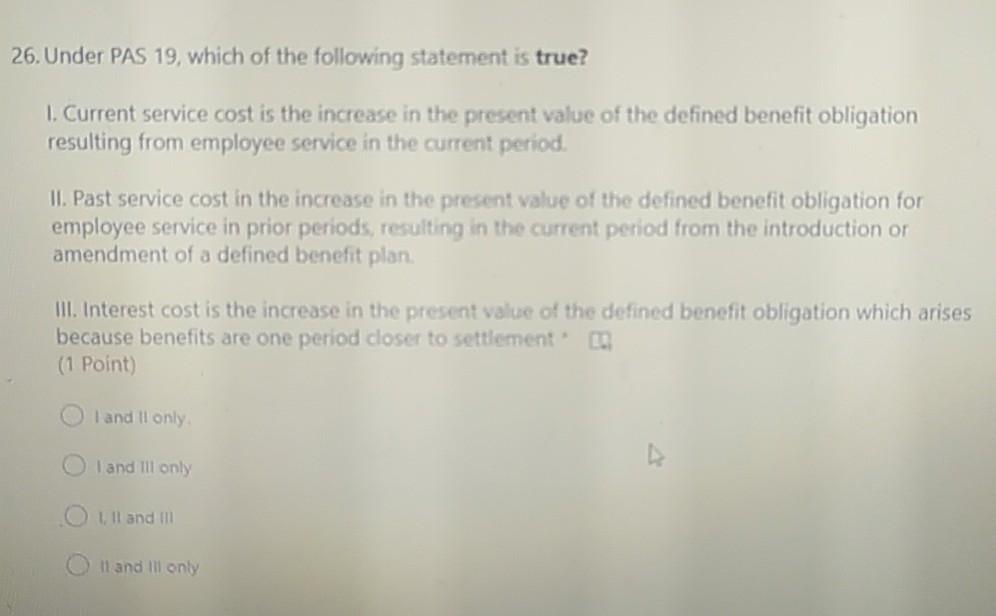

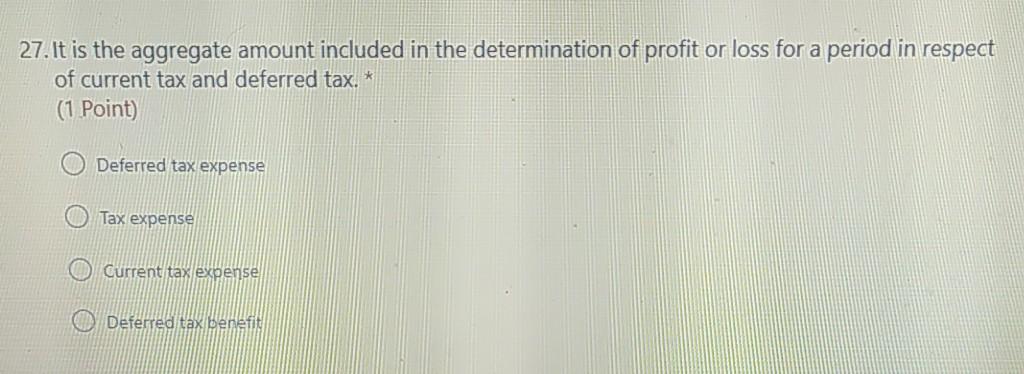

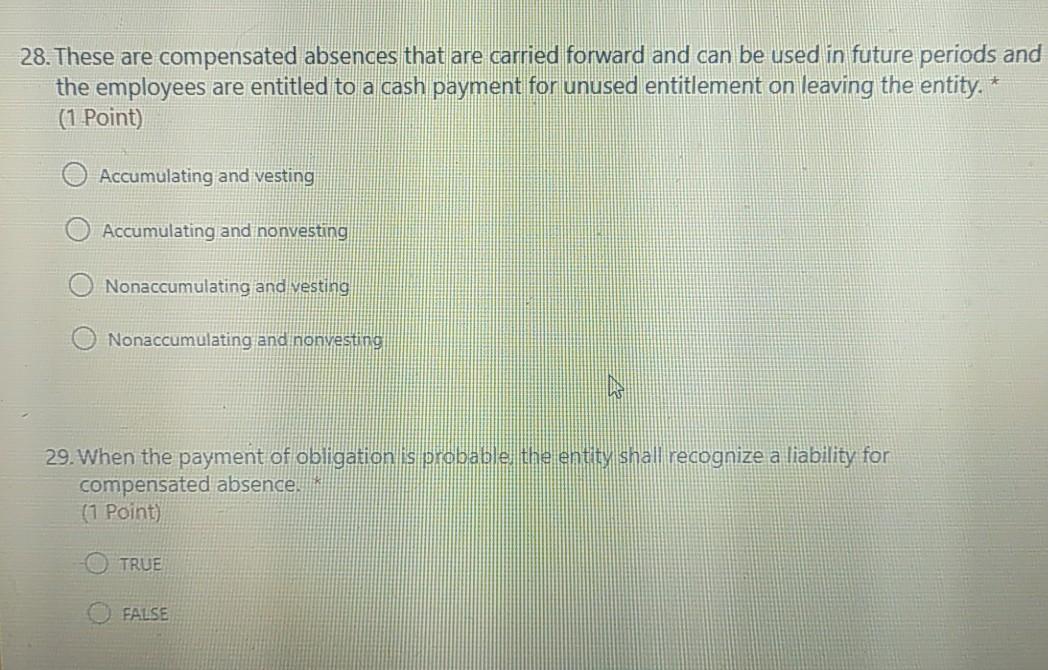

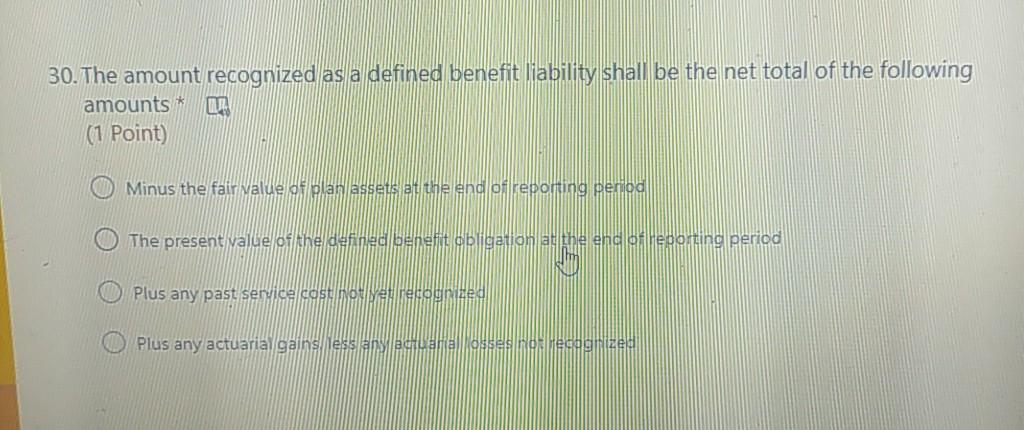

26. Under PAS 19, which of the following statement is true? 1. Current service cost is the increase in the present value of the defined benefit obligation resulting from employee service in the current period. II. Past service cost in the increase in the present value of the defined benefit obligation for employee service in prior periods, resulting in the current period from the introduction on amendment of a defined benefit plan III. Interest cost is the increase in the present value of the defined benefit obligation which arises because benefits are one period doser to settlement (1 Point) land il only land Ill only 1. Il and 11 and ill only 27. It is the aggregate amount included in the determination of profit or loss for a period in respect of current tax and deferred tax. * (1 Point) Deferred tax expense Tax expense Current tax expense Deferred tax benefit 28. These are compensated absences that are carried forward and can be used in future periods and the employees are entitled to a cash payment for unused entitlement on leaving the entity. + (1 Point) Accumulating and vesting Accumulating and nonvesting Nonaccumulating and vesting Nonaccumulating and nonvesting 29. When the payment of obligation is probable the entity shall recognize a liability for compensated absence. (1 Point) TRUE FALSE 30. The amount recognized as a defined benefit liability shall be the net total of the following amounts (1 Point) Minus the fair value of plan assets at the end of reporting period The present value of the defined benefit obligation at the end of reporting period Plus any past service cost ouvet recognized Plus any actuaria gains less an equania osses normecognizedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started