Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 27 How much would be credited to the capital account of Ces on April 1,2019 To input answers,

please answer all the questions immediately thankyou

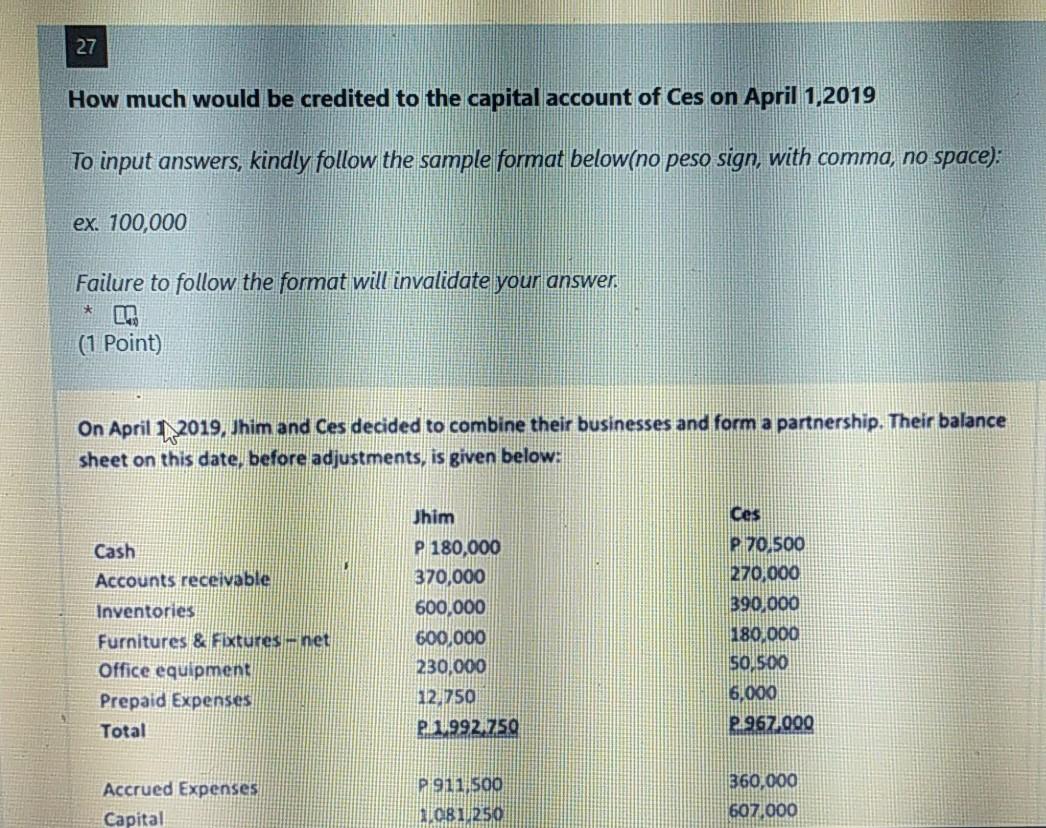

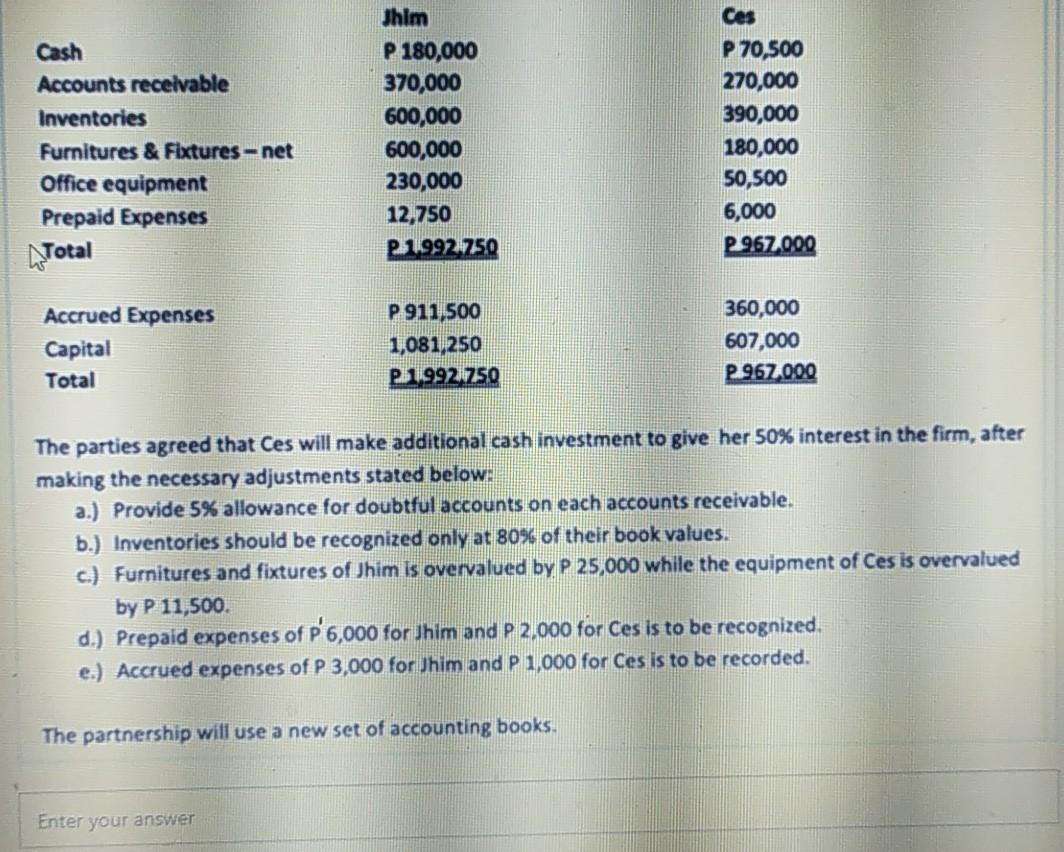

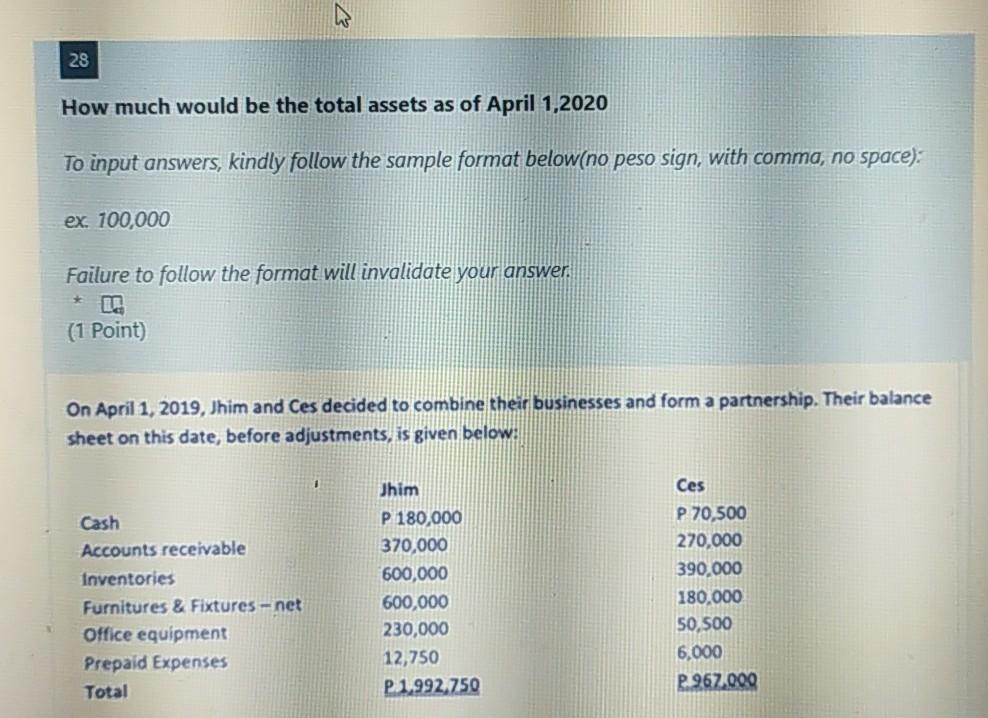

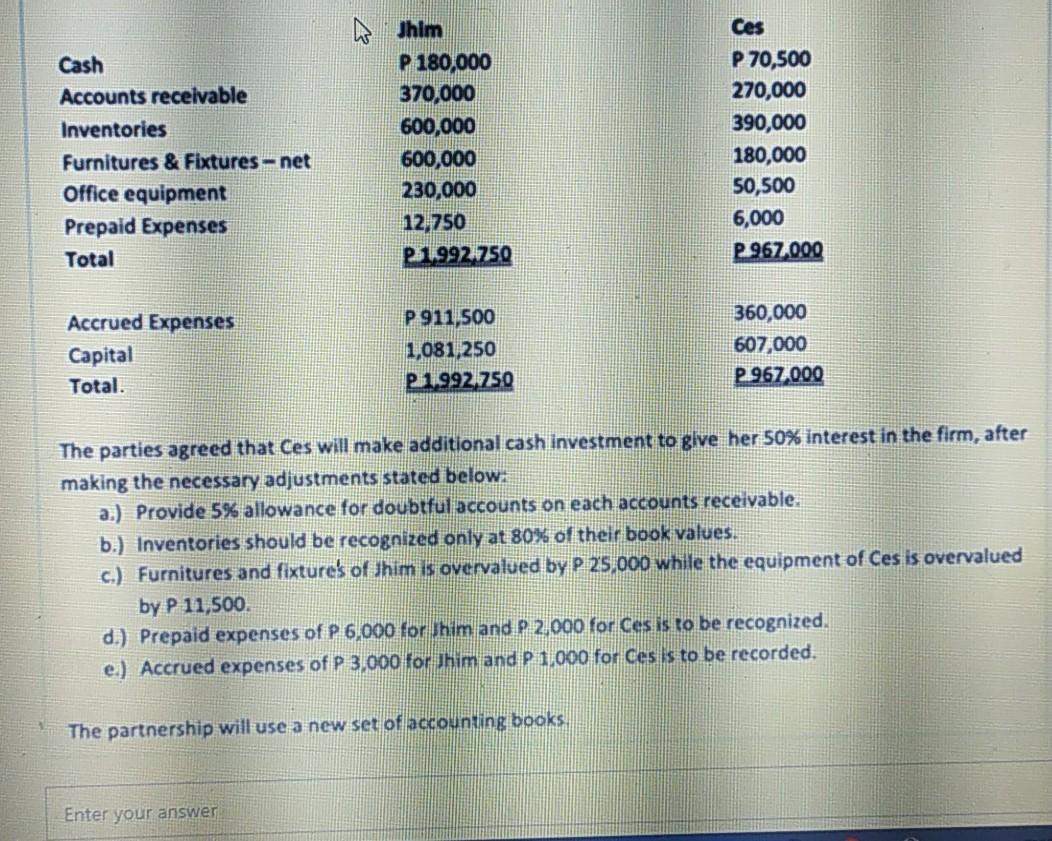

27 How much would be credited to the capital account of Ces on April 1,2019 To input answers, kindly follow the sample format below(no peso sign, with comma, no space): ex. 100,000 Failure to follow the format will invalidate your answer. * (1 Point) On April 1 2019. Jhim and Ces decided to combine their businesses and form a partnership. Their balance sheet on this date, before adjustments, is given below: Cash Accounts receivable Inventories Furnitures & Fixtures net Office equipment Prepaid Expenses Total Jhim P 180,000 370,000 600,000 600,000 230,000 12.750 P. 1992759 ces P 70,500 270,000 390,000 1180.000 50 500 6.000 P29672099 Accrued Expenses Capital P 911 500 081/250 360,000 607.000 Cash Accounts receivable Inventories Furnitures & Fixtures - net Office equipment Prepaid Expenses Total Jhim P 180,000 370,000 600,000 600,000 230,000 12,750 P. 1992.750 Ces P 70,500 270,000 390,000 180,000 50,500 6,000 2.967.000 Accrued Expenses Capital Total P 911,500 1,081,250 P31992.750 360,000 607,000 2.967.000 The parties agreed that Ces will make additional cash investment to give her 50% interest in the firm, after making the necessary adjustments stated below: a.) Provide 5% allowance for doubtful accounts on each accounts receivable. b.) Inventories should be recognized only at 80% of their book values. c.) Furnitures and fixtures of Jhim is overvalued by P 25,000 while the equipment of Ces is overvalued by P 11,500. d.) Prepaid expenses of P6,000 for Jhim and P 2,000 for Ces is to be recognized. e.) Accrued expenses of P 3,000 for Jhim and P 1,000 for Ces is to be recorded. The partnership will use a new set of accounting books. Enter your answer 28 How much would be the total assets as of April 1,2020 To input answers, kindly follow the sample format below(no peso sign, with comma, no space). ex. 100,000 Failure to follow the format will invalidate your answer. (1 Point) On April 1, 2019, Jhim and Ces decided to combine their businesses and form a partnership. Their balance sheet on this date, before adjustments, is given below: Ces Cash Accounts receivable Inventories Furnitures & Fixtures -net Office equipment Prepaid Expenses Total Jhim P 180,000 370,000 600,000 600,000 230,000 12,750 P.1,992.750 P 70,500 270,000 390,000 180,000 50,500 6,000 P.967,000 Cash Accounts receivable Inventories Furnitures & Fixtures - net Office equipment Prepaid Expenses Total Jhim P 180,000 370,000 600,000 600,000 230,000 12,750 P51992,750 Ces P 70,500 270,000 390,000 180,000 50,500 6,000 P.967,000 Accrued Expenses Capital Total. P 911,500 1,081,250 P 1992,750 360,000 607,000 P.967,000 The parties agreed that Ces will make additional cash investment to give her 50% interest in the firm, after making the necessary adjustments stated below: a.) Provide 5% allowance for doubtful accounts on each accounts receivable. b.) Inventories should be recognized only at 80% of their book values. c.) Furnitures and fixtures of Thim is overvalued by P 25,000 while the equipment of Ces is overvalued by P 11,500. d.) Prepaid expenses of P 6,000 for Jhim and P 2,000 for Ces is to be recognized. e) Accrued expenses of P 3,000 for Thim and P 1,000 for Ces is to be recorded. The partnership will use a new set of accounting books, Enter yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started