Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 32 Andres and Santiago form a partnership and have capital balances of P100,000 and P200,000, respectively. If they

please answer all the questions immediately thankyou

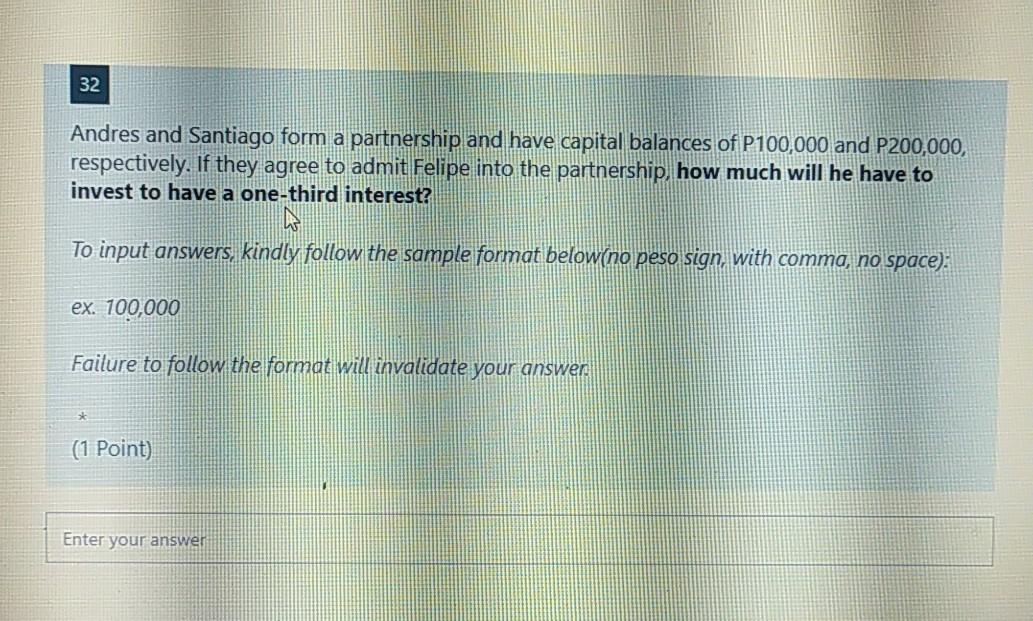

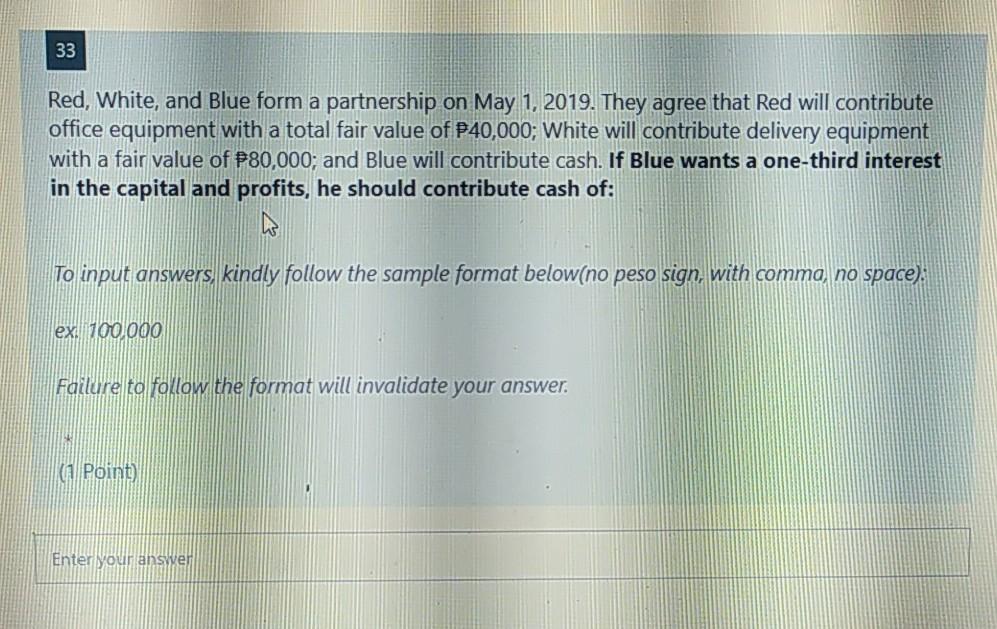

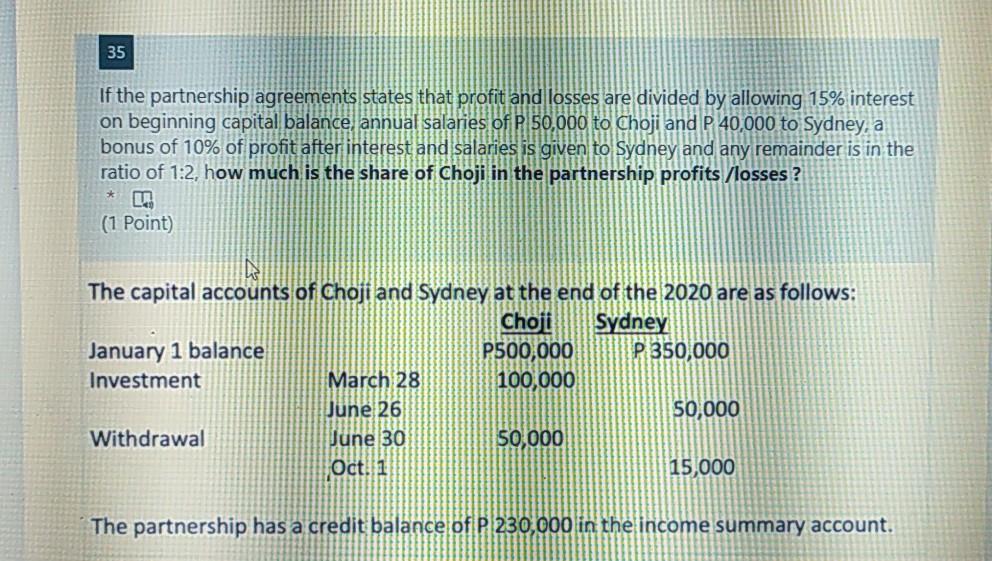

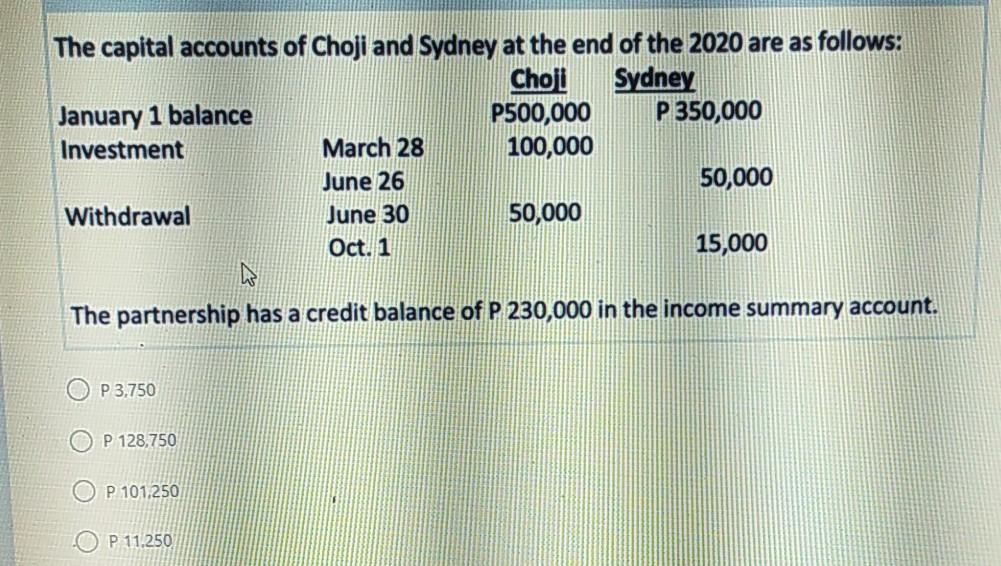

32 Andres and Santiago form a partnership and have capital balances of P100,000 and P200,000, respectively. If they agree to admit Felipe into the partnership, how much will he have to invest to have a one-third interest? To input answers, kindly follow the sample format below (no peso sign with comma, no space): ex. 100,000 Failure to follow the format will invalidate your answer (1 Point) Enter your answer 33 Red, White, and Blue form a partnership on May 1, 2019. They agree that Red will contribute office equipment with a total fair value of P40,000; White will contribute delivery equipment with a fair value of $80,000; and Blue will contribute cash. If Blue wants a one-third interest in the capital and profits, he should contribute cash of: To input answers, kindly follow the sample format below(no peso sign with comma, no space). ex 100,000 Failure to follow the format will invalidate your answer. Point Enter your answer 35 If the partnership agreements states that profit and losses are divided by allowing 15% interest on beginning capital balance annual salaries of P50,000 to Choji and P 40,000 to Sydney, a bonus of 10% of profit after interest and salaries is given to Sydney and any remainder is in the ratio of 1:2, how much is the share of Choji in the partnership profits /losses ? * (1 Point) The capital accounts of Choji and Sydney at the end of the 2020 are as follows: Choji Sydney January 1 balance P500,000 P 350,000 Investment March 28 100,000 June 26 50,000 Withdrawal June 30 50,000 Oct. 1 15,000 The partnership has a credit balance of P 230,000 in the income summary account. The capital accounts of Choji and Sydney at the end of the 2020 are as follows: Choji Sydney January 1 balance P500,000 P 350,000 Investment March 28 100,000 June 26 50,000 Withdrawal June 30 50,000 Oct. 1 15,000 The partnership has a credit balance of P 230,000 in the income summary account. OP 3.750 P 128,750 P 101,250 P 11.250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started