Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 43 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively.

please answer all the questions immediately thankyou

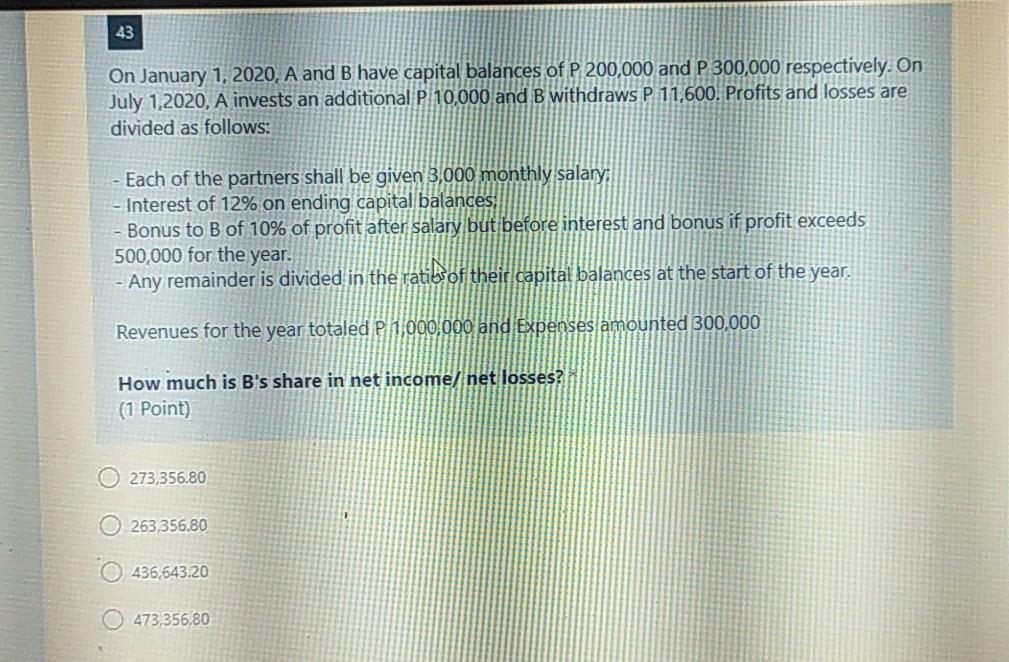

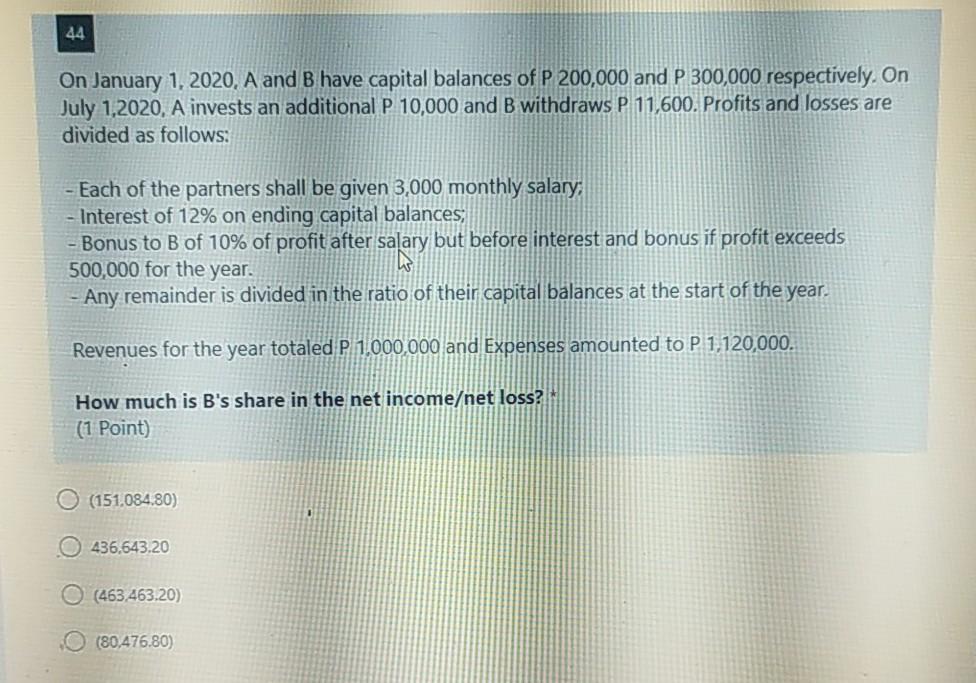

43 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively. On July 1,2020, A invests an additional P 10,000 and B withdraws P 11,600. Profits and losses are divided as follows: Each of the partners shall be given 3,000 monthly salary, Interest of 12% on ending capital balances Bonus to B of 10% of profit after salary but before interest and bonus if profit exceeds 500,000 for the year. Any remainder is divided in the ratiof their capital balances at the start of the year. Revenues for the year totaled P 1,000,000 and Expenses amounted 300,000 How much is B's share in net income) net losses? (1 Point) 0 273,356.80 263,356.80 436,643.20 473,356.80 44 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively. On July 1,2020, A invests an additional P 10,000 and B withdraws P 11,600. Profits and losses are divided as follows: - Each of the partners shall be given 3,000 monthly salary, Interest of 12% on ending capital balances, Bonus to B of 10% of profit after salary but before interest and bonus if profit exceeds 500,000 for the year. - Any remainder is divided in the ratio of their capital balances at the start of the year. Revenues for the year totaled P 1,000,000 and Expenses amounted to P 1,120,000. How much is B's share in the net incomeet loss? (1 Point) (151.084.80) 436.643.20 (463,463.20) O (80,476.80)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started