Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 49 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively.

please answer all the questions immediately thankyou

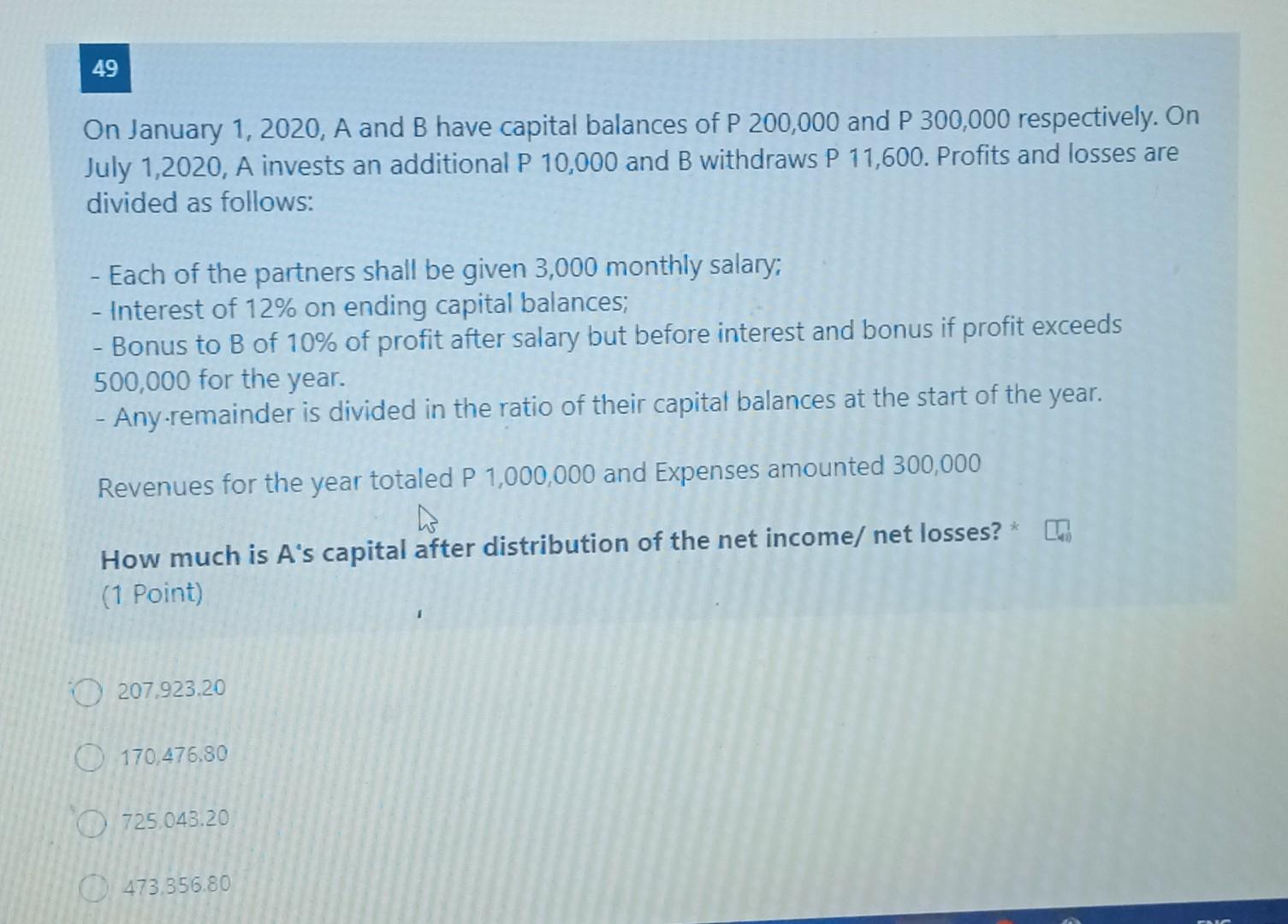

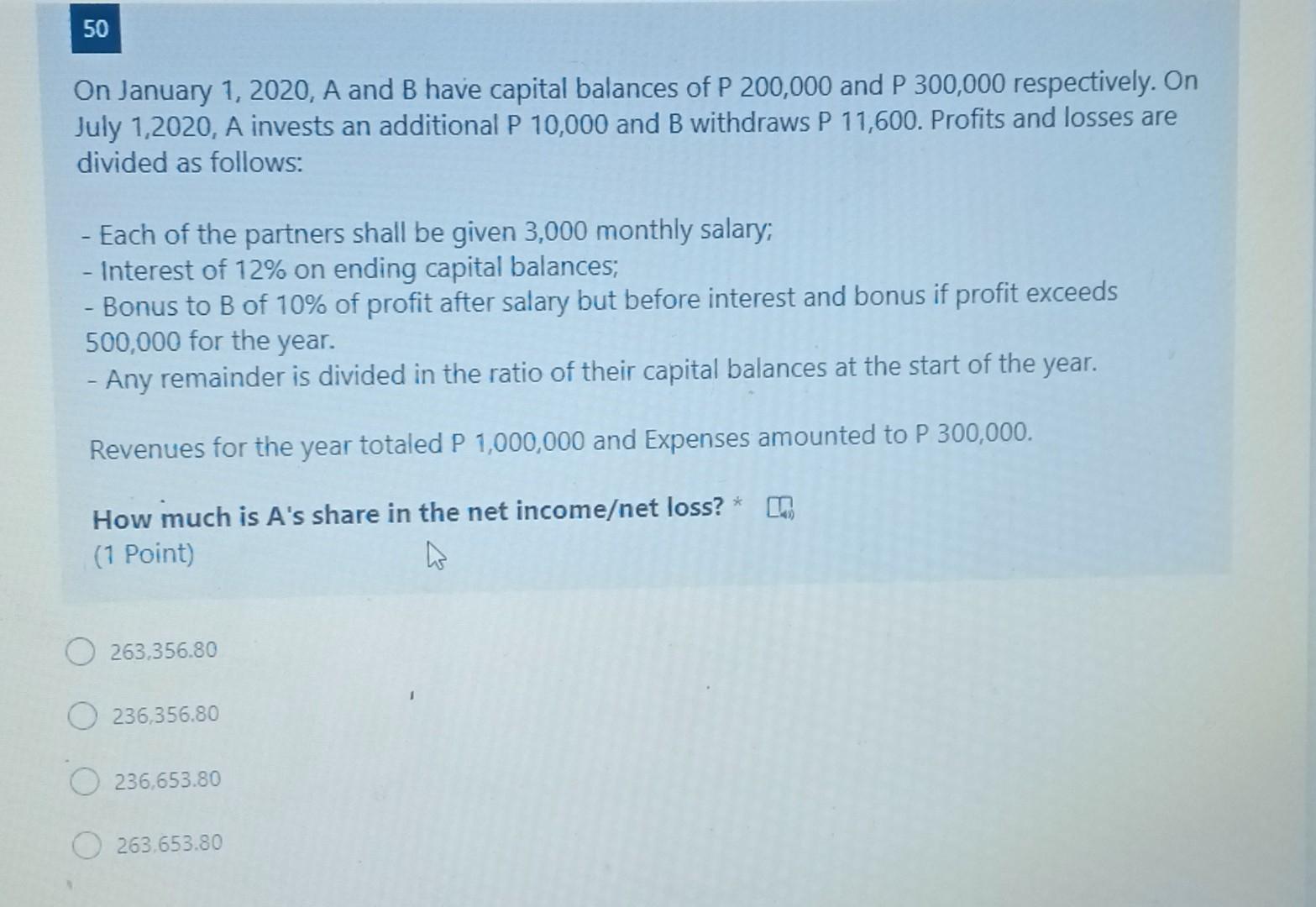

49 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively. On July 1,2020, A invests an additional P 10,000 and B withdraws P 11,600. Profits and losses are divided as follows: Each of the partners shall be given 3,000 monthly salary: - Interest of 12% on ending capital balances; Bonus to B of 10% of profit after salary but before interest and bonus if profit exceeds 500,000 for the year. - Any remainder is divided in the ratio of their capital balances at the start of the year. Revenues for the year totaled P 1,000,000 and Expenses amounted 300,000 How much is A's capital after distribution of the net income/ net losses? * (1 Point) 0 207.923.20 0 170.476.80 O 725 043.20 O 473.356.80 50 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively. On July 1,2020, A invests an additional P 10,000 and B withdraws P 11,600. Profits and losses are divided as follows: - Each of the partners shall be given 3,000 monthly salary; - Interest of 12% on ending capital balances; - Bonus to B of 10% of profit after salary but before interest and bonus if profit exceeds 500,000 for the year. - Any remainder is divided in the ratio of their capital balances at the start of the year. Revenues for the year totaled P 1,000,000 and Expenses amounted to P 300,000. How much is A's share in the net incomeet loss?* m (1 Point) 0 263,356.80 236,356.80 0 236,653.80 263.653.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started