Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 8. The partners, A and B, share profits 3:2. However, A is to receive a yearly bonus of

please answer all the questions immediately thankyou

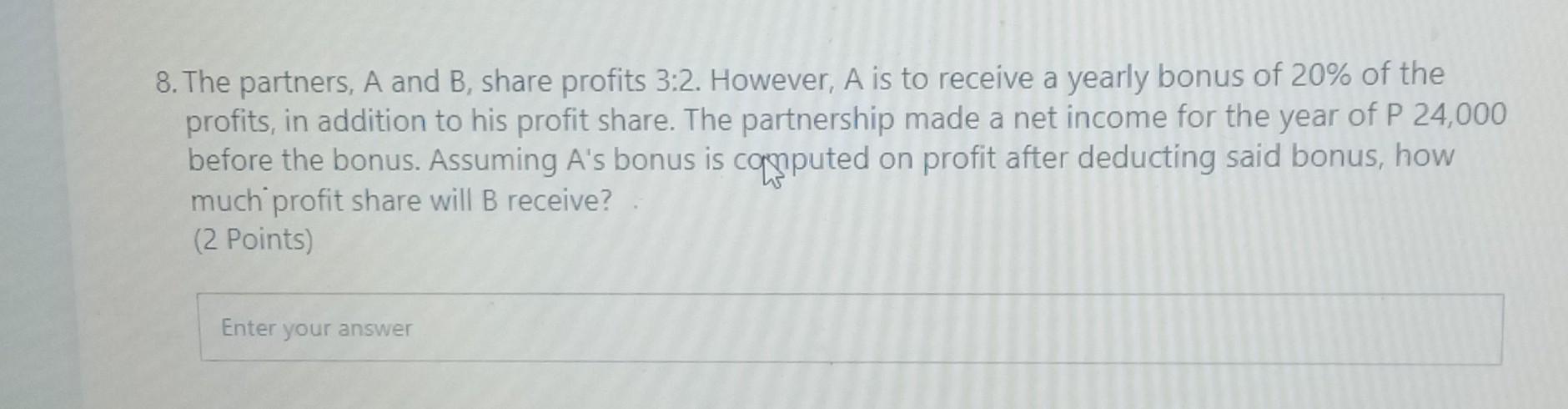

8. The partners, A and B, share profits 3:2. However, A is to receive a yearly bonus of 20% of the profits, in addition to his profit share. The partnership made a net income for the year of P 24,000 before the bonus. Assuming A's bonus is computed on profit after deducting said bonus, how much profit share will B receive? (2 points) Enter your answer 12. If for the year 2019, the partnership business resulted to a net loss and the partners Al capitalist partner), B ( industrial partner) and C ( capitalist-industrial partner) share in the profits 2:2:1, all the partners will share in the losses base on their profit sharing ratio. In (1 Point) O True I O False 18. Salaries, interest and bonus are expenses of the business and considered in the computation of net income or loss. (1 Point) O True FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started