Answered step by step

Verified Expert Solution

Question

1 Approved Answer

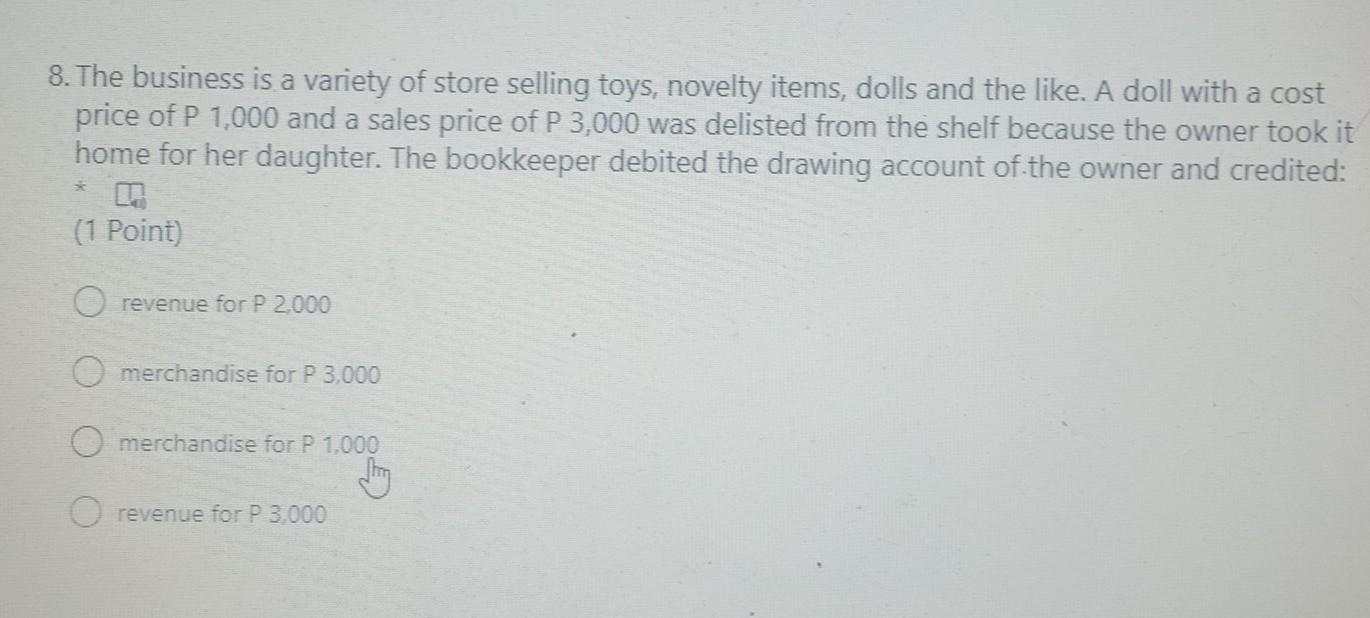

please answer all the questions immediately thankyou a 8. The business is a variety of store selling toys, novelty items, dolls and the like. A

please answer all the questions immediately thankyou

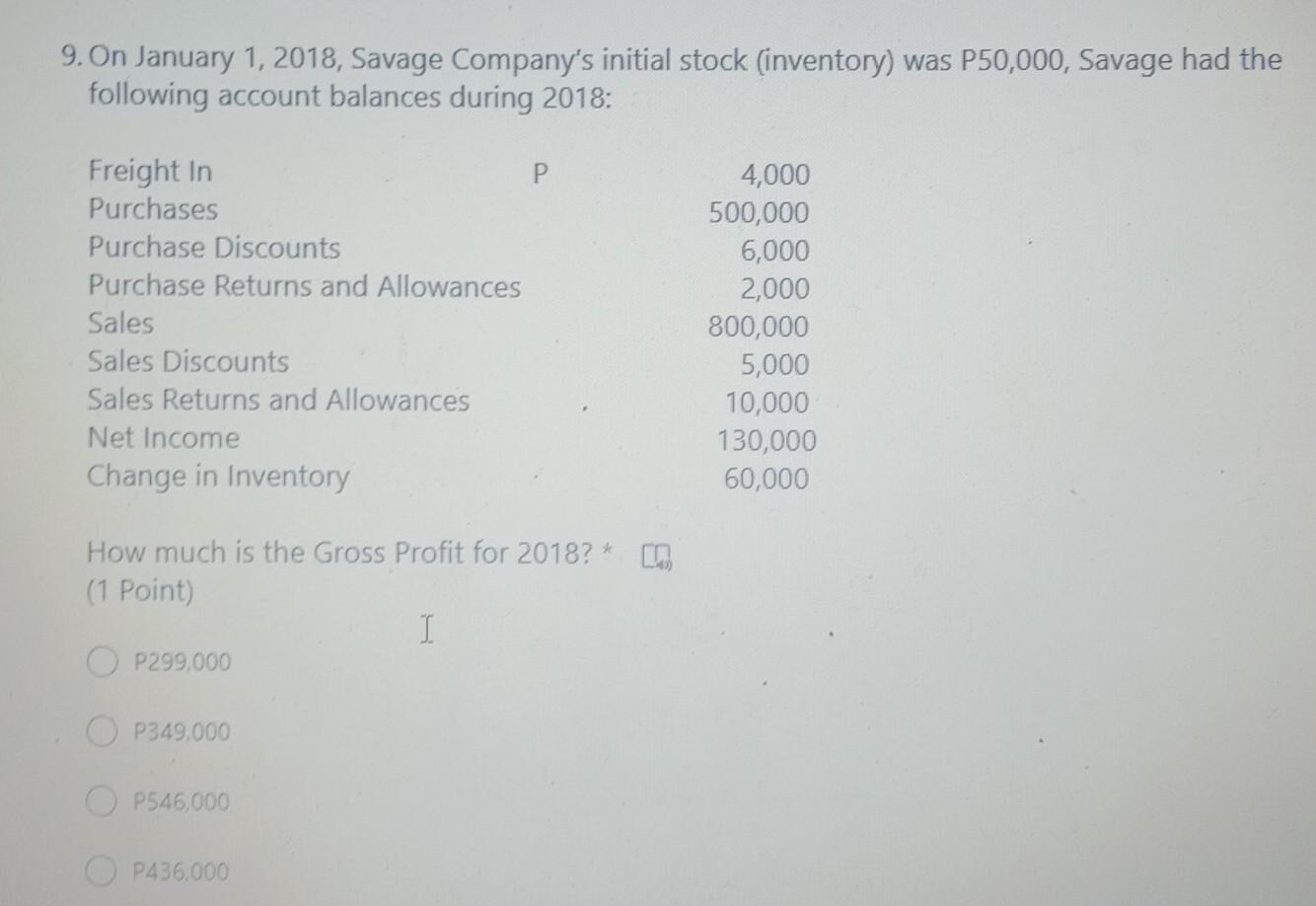

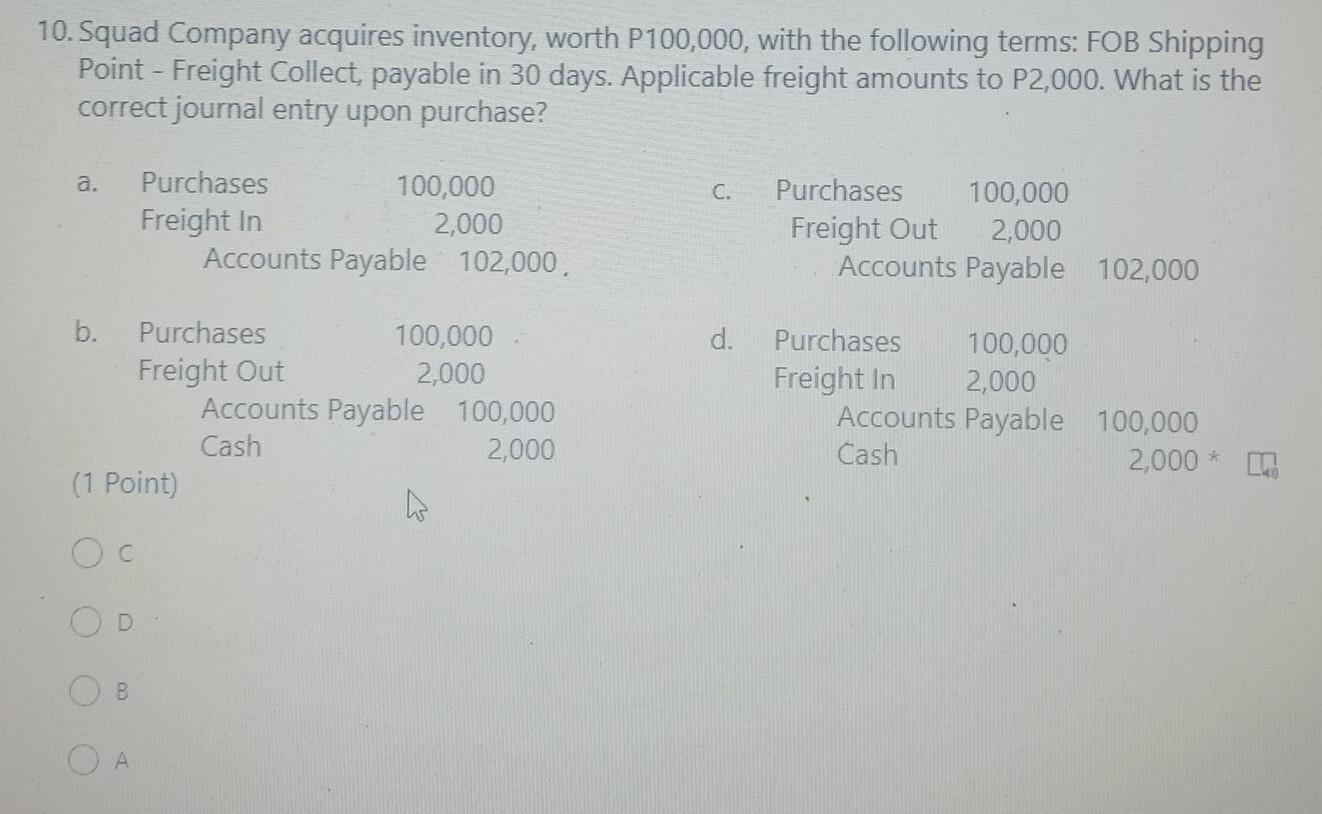

a 8. The business is a variety of store selling toys, novelty items, dolls and the like. A doll with a cost price of P 1,000 and a sales price of P 3,000 was delisted from the shelf because the owner took it home for her daughter. The bookkeeper debited the drawing account of the owner and credited: * (1 Point) revenue for P 2.000 merchandise for P 3.000 O merchandise for P 1.000 hing revenue for P 3,000 9. On January 1, 2018, Savage Company's initial stock (inventory) was P50,000, Savage had the following account balances during 2018: Freight In P Purchases Purchase Discounts Purchase Returns and Allowances Sales Sales Discounts Sales Returns and Allowances Net Income Change in Inventory 4,000 500,000 6,000 2,000 800,000 5,000 10,000 130,000 60,000 How much is the Gross Profit for 2018?* mm (1 Point) I OP299,000 O P349.000 OP546,000 O P436,000 10. Squad Company acquires inventory, worth P100,000, with the following terms: FOB Shipping Point - Freight Collect, payable in 30 days. Applicable freight amounts to P2,000. What is the correct journal entry upon purchase? a. C. Purchases 100,000 Freight in 2,000 Accounts Payable 102,000, Purchases 100,000 Freight Out 2,000 Accounts Payable 102,000 d. b. Purchases 100,000 Freight Out 2,000 Accounts Payable 100,000 Cash 2,000 (1 Point) Purchases 100,000 Freight In 2,000 Accounts Payable 100,000 Cash 2,000* D B AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started