Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou EXERCISE Dorothy, Marks and Spencer decided to form a partnership. They are to engage in the business of

please answer all the questions immediately thankyou

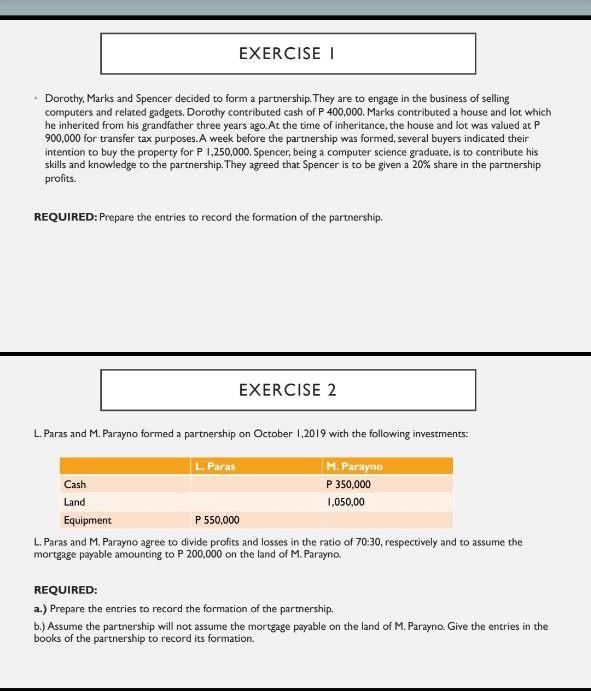

EXERCISE Dorothy, Marks and Spencer decided to form a partnership. They are to engage in the business of selling computers and related gadgets. Dorothy contributed cash of P 400,000. Marks contributed a house and lot which he inherited from his grandfather three years ago. At the time of inheritance, the house and lot was valued at P 900,000 for transfer tax purposes. A week before the partnership was formed, several buyers indicated their intention to buy the property for p 1,250,000. Spencer, being a computer science graduate, is to contribute his skills and knowledge to the partnership. They agreed that Spencer is to be given a 20% share in the partnership profits. REQUIRED: Prepare the entries to record the formation of the partnership EXERCISE 2 L. Paras and M. Parayno formed a partnership on October 1,2019 with the following investments: L Paras M. Parayno Cash P 350,000 Land 1,050,00 Equipment P 550,000 L. Paras and M. Parayno agree to divide profits and losses in the ratio of 70:30, respectively and to assume the mortgage payable amounting to P 200,000 on the land of M. Parayno. REQUIRED: a.) Prepare the entries to record the formation of the partnership. b.) Assume the partnership will not assume the mortgage payable on the land of M. Parayno. Give the entries in the books of the partnership to record its formationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started