Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou How much is capital credited to D at the time of formation of the partnership? To input answers,

please answer all the questions immediately thankyou

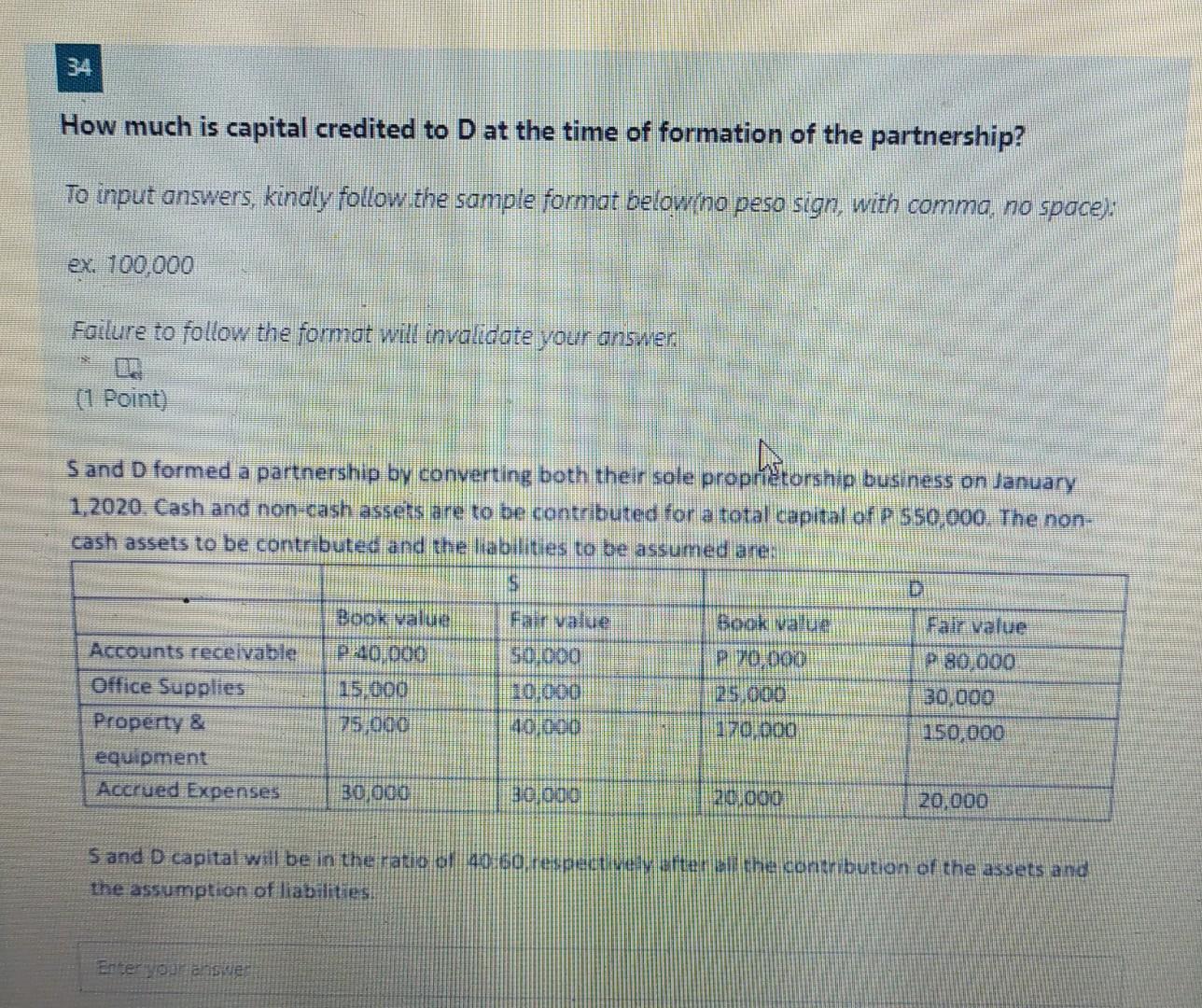

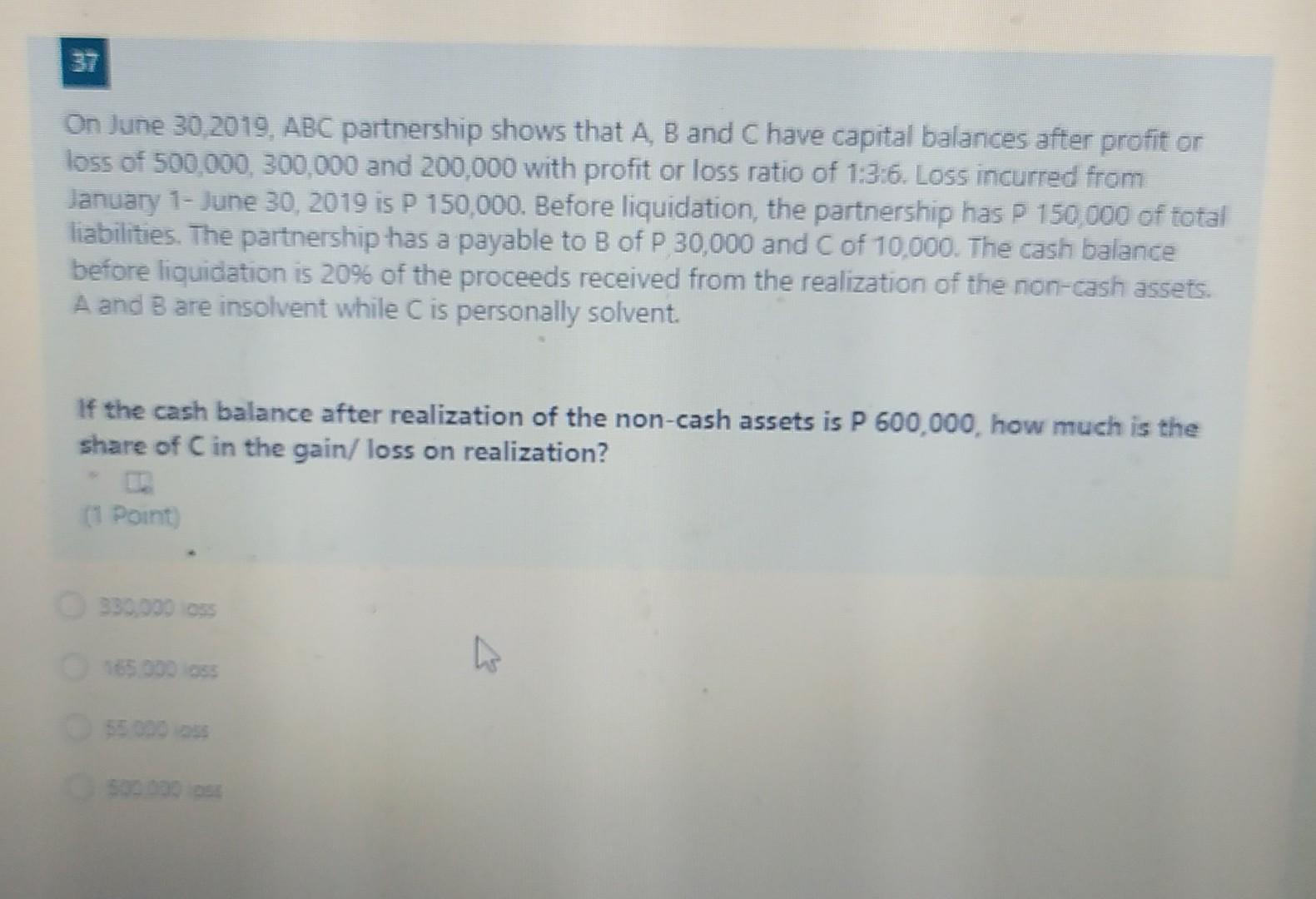

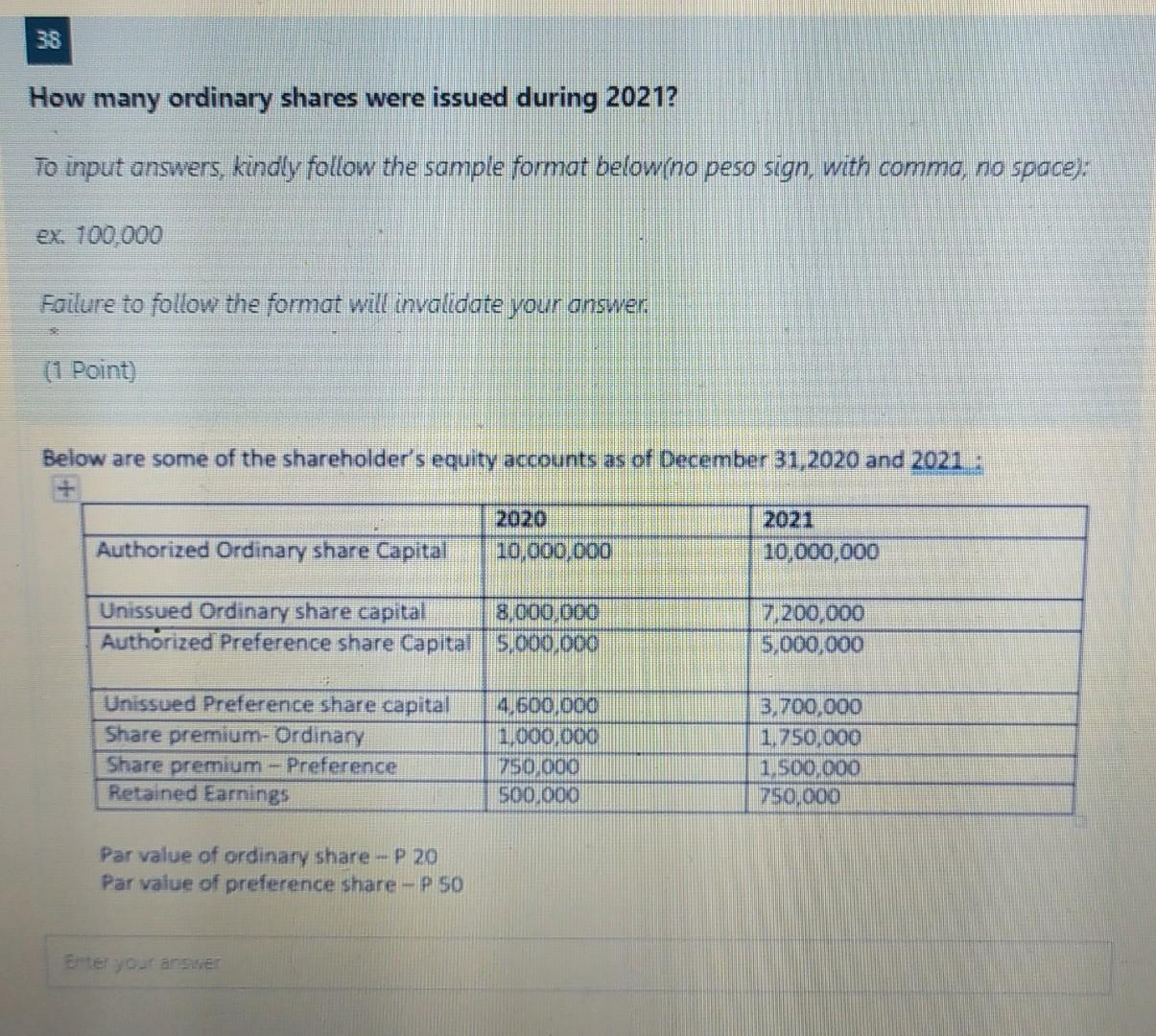

How much is capital credited to D at the time of formation of the partnership? To input answers, kindly follow the sample format belowno peso sign, with comma, no space): ex. 100.000 Failure to follow the format will invalidate your answer. (1 Point) S and D formed a partnership by converting both their sole proprietorship business on January 1,2020. Cash and non-cash assets are to be contributed for a total capital of P550,000. The non- cash assets to be contributed and the abilities to be assumed are S D Book value ir value Bok value Fair value SO1000 PO 100 P 40.000 115.00) P 80.000 0 000 30,000 Accounts receivable Office Supplies Property & equipment Accrued Expenses 25000 170,000 75 000 10 000 150,000 30,000 30 000 120.000 20.000 S and D capital will be in the ratio or to do, respectanter the contribution of the assets and the assumption of liabilities, Entergarden 37 On June 30, 2019, ABC partnership shows that A, B and C have capital balances after profit or loss of 500,000, 300,000 and 200,000 with profit or loss ratio of 1:3:6. Loss incurred from January 1- June 30, 2019 is P 150,000. Before liquidation, the partnership has P 150,000 of total liabilities. The partnership has a payable to B of P 30,000 and C of 10,000. The cash balance before liquidation is 20% of the proceeds received from the realization of the non-cash assets. A and B are insolvent while C is personally solvent. If the cash balance after realization of the non-cash assets is P 600,000, how much is the share of C in the gain/ loss on realization? (1 Point 330.000 oss 165.000 550000 SO 38 How many ordinary shares were issued during 2021? To input answers, kindly follow the sample format belowino peso sign, with comma, no space): ex. 100,000 Failure to follow the format will invalidate your answer. (1 Point) Below are some of the shareholder's equity accounts as of December 31, 2020 and 2021 : Authorized Ordinary share Capital 2020 10.000.000 2021 10,000,000 Unissued Ordinary share capital 8.000 DOO Authorized Preference share Capital 5.000.000 7,200,000 5,000,000 Unissued Preference share capital Share premium-Ordinary Share premium - Preference Retained Earnings 4,600,000 1 000 000 750.000 500.000 3,700,000 1,750,000 1,500,000 750,000 Par value of ordinary share - P 20 Par value of preference share-P 50 Enter yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started