Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions its 22 of them not only 4 ultiple Choice Questions The General Fund levies property taxes in the amount of

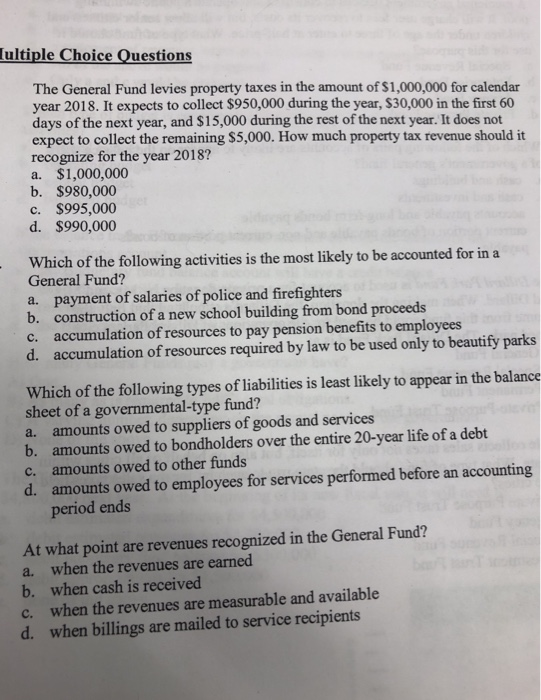

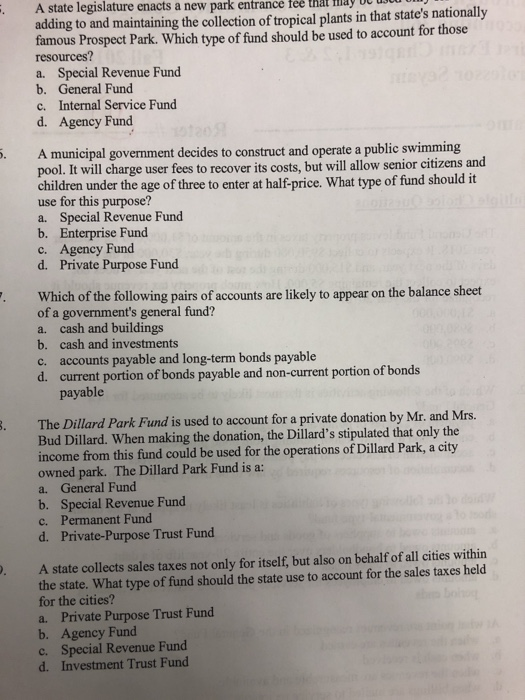

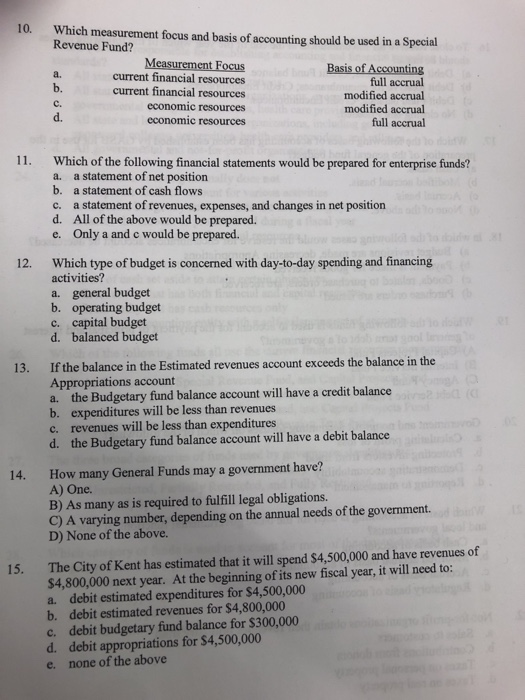

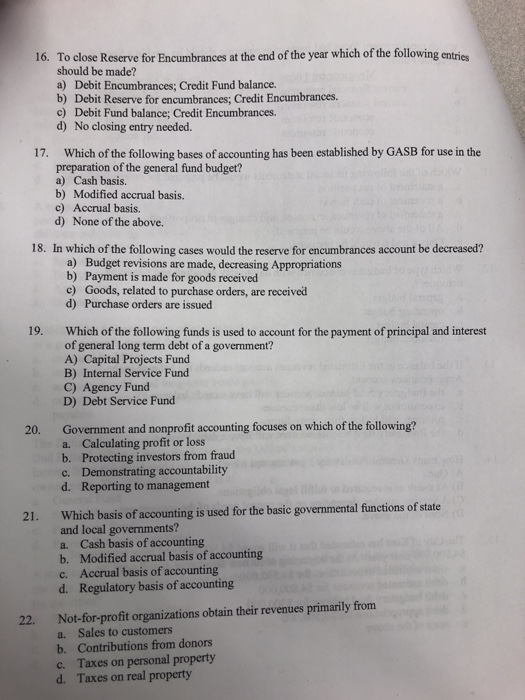

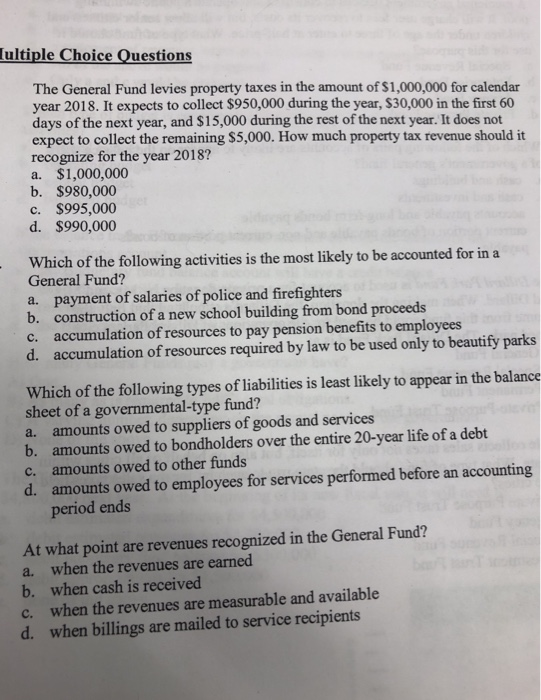

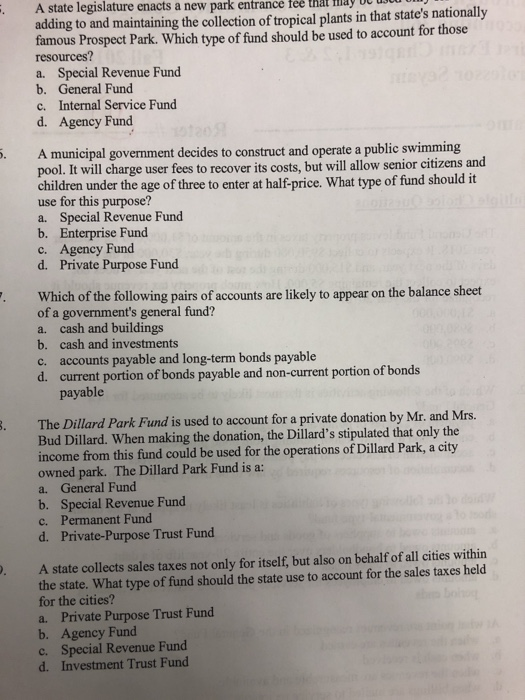

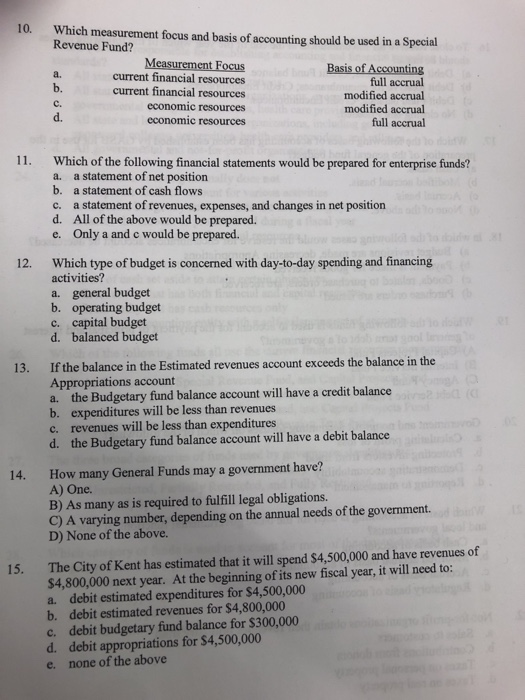

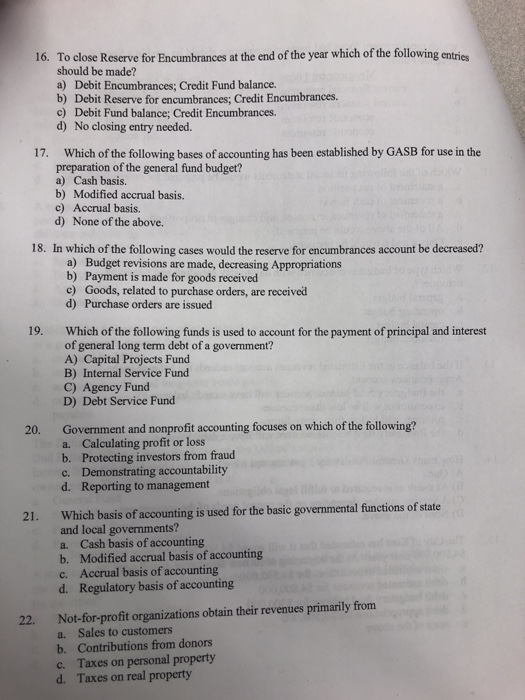

please answer all the questions its 22 of them not only 4 ultiple Choice Questions The General Fund levies property taxes in the amount of $1,000,000 for calendar year 2018. It expects to collect $950,000 during the year, $30,000 in the first 60 days of the next year, and $15,000 during the rest of the next year. It does not expect to collect the remaining $5,000. How much property tax revenue should it recognize for the year 2018? a. $1,000,000 b. $980,000 c. $995,000 d. $990,000 Which of the following activities is the most likely to be accounted for in a General Fund? a. payment of salaries of police and firefighters b. construction of a new school building from bond proceeds c. accumulation of resources to pay pension benefits to employees d. accumulation of resources required by law to be used only to beautify parks Which of the following types of liabilities is least likely to appear in the balance sheet of a governmental-type fund? a. amounts owed to suppliers of goods and services b. amounts owed to bondholders over the entire 20-year life of a debt c. amounts owed to other funds d. amounts owed to employees for services performed before an accounting period ends At what point are revenues recognized in the General Fund? a. when the revenues are earned b. when cash is received c. when the revenues are measurable and available d. when billings are mailed to service recipients . A state legislature enacts a new park entrance tee that ay ds adding to and maintaining the collection of tropical plants in that state's nationally famous Prospect Park. Which type of fund should be used to account for those resources? a. Special Revenue Fund b. General Fund c. Internal Service Fund d. Agency Fund A municipal government decides to construct and operate a public swimming pool. children under the age of three to enter at half-price. What type of fund should it use for this purpose? a. Special Revenue Fund b. Enterprise Fund c. Agency Fund d. Private Purpose Fund It will charge user fees to recover its costs, but will allow senior citizens and Which of the following pairs of accounts are likely to appear on the balance sheet of a government's general fund? a. cash and buildings b. cash and investments c. accounts payable and long-term bonds payable d. current portion of bonds payable and non-current portion of bonds payable The Dillard Park Fund is used to account for a private donation by Mr. and Mrs Bud Dillard. When making the donation, the Dillard's stipulated that only the income from this fund could be used for the operations of Dillard Park, a city owned park. The Dillard Park Fund is a: a. General Fund b. Special Revenue Fund c. Permanent Fund d. Private-Purpose Trust Fund . A state collects sales taxes not only for itself, but also on behalf of all cities withirn the state. What type of fund should the state use to account for the sales taxes held for the cities? a. Private Purpose Trust Fund b. Agency Fund c. Special Revenue Fund d. Investment Trust Fund 10. Which measurement focus and basis of accounting should be used in a Special Revenue Fund? a. b. c. d. current financial resources current financial resources economic resources economic resources full accrual modified accrual modified accrual full accrual 11. Which of the following financial statements would be prepared for enterprise funds? a. a statement of net position b. a statement of cash flows a statement of revenues, expenses, and changes in net position d. c. All of the above would be prepared. e. Only a and c would be prepared. Which type of budget is concerned with day-to-day spending and financing activities? a. general budget b. operating budget c. capital budget d. balanced budget 12. If the balance in the Estimated revenues account exceeds the balance in the Appropriations account a. the Budgetary fund balance account will have a credit balance b. expenditures will be less than revenues c. revenues will be less than expenditures d. the Budgetary fund balance account will have a debit balance 13. How many General Funds may a government have? A) One. B) As many as is required to fulfill legal obligations. C) A varying number, depending on the annual needs of the government. D) None of the above. 14. $4,800,000 next year. At the beginning of its new fiscal year, it will need to: a. debit estimated expenditures for $4,500,000 b. debit estimated revenues for $4,800,000 c. debit budgetary fund balance for $300,000 d. debit appropriations for $4,500,000 e. none of the above 15. The City of Kent has estimated that it will spend $4,500,000 and have revenues of 16. To close Reserve for Encumbrances at the end of the year which of the following entries should be made? a) Debit Encumbrances; Credit Fund balance. b) Debit Reserve for encumbrances; Credit Encumbrances. c) Debit Fund balance; Credit Encumbrances. d) No closing entry needed. 17. Which of the following bases of accounting has been established by GASB for use in the preparation of the general fund budget? a) Cash basis. b) Modified accrual basis. c) Accrual basis. d) None of the above. 18. In which of the following cases would the reserve for encumbrances account be decreased? a) Budget revisions are made, decreasing Appropriations b) Payment is made for goods received c) Goods, related to purchase orders, are received d) Purchase orders are issued 19. Which of the following funds is used to account for the payment of principal and interest of general long term debt of a government? A) Capital Projects Fund B) Internal Service Fund C) Agency Fund D) Debt Service Fund unting focuses on which of the following? Government and nonprofit acco a. Calculating profit or loss b. Protecting investors from fraud c. Demonstrating accountability d. Reporting to management 20 Which basis of accounting is used for the basic governmental functions of state and local governments? a. Cash basis of accounting b. Modified accrual basis of accounting c. Accrual basis of accounting d. Regulatory basis of accounting 21. 22. Not-for-profit organizations obtain their revenues primarily from a. Sales to customers b. Contributions from donors c. Taxes on personal property d. Taxes on real property

please answer all the questions its 22 of them not only 4 ultiple Choice Questions The General Fund levies property taxes in the amount of $1,000,000 for calendar year 2018. It expects to collect $950,000 during the year, $30,000 in the first 60 days of the next year, and $15,000 during the rest of the next year. It does not expect to collect the remaining $5,000. How much property tax revenue should it recognize for the year 2018? a. $1,000,000 b. $980,000 c. $995,000 d. $990,000 Which of the following activities is the most likely to be accounted for in a General Fund? a. payment of salaries of police and firefighters b. construction of a new school building from bond proceeds c. accumulation of resources to pay pension benefits to employees d. accumulation of resources required by law to be used only to beautify parks Which of the following types of liabilities is least likely to appear in the balance sheet of a governmental-type fund? a. amounts owed to suppliers of goods and services b. amounts owed to bondholders over the entire 20-year life of a debt c. amounts owed to other funds d. amounts owed to employees for services performed before an accounting period ends At what point are revenues recognized in the General Fund? a. when the revenues are earned b. when cash is received c. when the revenues are measurable and available d. when billings are mailed to service recipients . A state legislature enacts a new park entrance tee that ay ds adding to and maintaining the collection of tropical plants in that state's nationally famous Prospect Park. Which type of fund should be used to account for those resources? a. Special Revenue Fund b. General Fund c. Internal Service Fund d. Agency Fund A municipal government decides to construct and operate a public swimming pool. children under the age of three to enter at half-price. What type of fund should it use for this purpose? a. Special Revenue Fund b. Enterprise Fund c. Agency Fund d. Private Purpose Fund It will charge user fees to recover its costs, but will allow senior citizens and Which of the following pairs of accounts are likely to appear on the balance sheet of a government's general fund? a. cash and buildings b. cash and investments c. accounts payable and long-term bonds payable d. current portion of bonds payable and non-current portion of bonds payable The Dillard Park Fund is used to account for a private donation by Mr. and Mrs Bud Dillard. When making the donation, the Dillard's stipulated that only the income from this fund could be used for the operations of Dillard Park, a city owned park. The Dillard Park Fund is a: a. General Fund b. Special Revenue Fund c. Permanent Fund d. Private-Purpose Trust Fund . A state collects sales taxes not only for itself, but also on behalf of all cities withirn the state. What type of fund should the state use to account for the sales taxes held for the cities? a. Private Purpose Trust Fund b. Agency Fund c. Special Revenue Fund d. Investment Trust Fund 10. Which measurement focus and basis of accounting should be used in a Special Revenue Fund? a. b. c. d. current financial resources current financial resources economic resources economic resources full accrual modified accrual modified accrual full accrual 11. Which of the following financial statements would be prepared for enterprise funds? a. a statement of net position b. a statement of cash flows a statement of revenues, expenses, and changes in net position d. c. All of the above would be prepared. e. Only a and c would be prepared. Which type of budget is concerned with day-to-day spending and financing activities? a. general budget b. operating budget c. capital budget d. balanced budget 12. If the balance in the Estimated revenues account exceeds the balance in the Appropriations account a. the Budgetary fund balance account will have a credit balance b. expenditures will be less than revenues c. revenues will be less than expenditures d. the Budgetary fund balance account will have a debit balance 13. How many General Funds may a government have? A) One. B) As many as is required to fulfill legal obligations. C) A varying number, depending on the annual needs of the government. D) None of the above. 14. $4,800,000 next year. At the beginning of its new fiscal year, it will need to: a. debit estimated expenditures for $4,500,000 b. debit estimated revenues for $4,800,000 c. debit budgetary fund balance for $300,000 d. debit appropriations for $4,500,000 e. none of the above 15. The City of Kent has estimated that it will spend $4,500,000 and have revenues of 16. To close Reserve for Encumbrances at the end of the year which of the following entries should be made? a) Debit Encumbrances; Credit Fund balance. b) Debit Reserve for encumbrances; Credit Encumbrances. c) Debit Fund balance; Credit Encumbrances. d) No closing entry needed. 17. Which of the following bases of accounting has been established by GASB for use in the preparation of the general fund budget? a) Cash basis. b) Modified accrual basis. c) Accrual basis. d) None of the above. 18. In which of the following cases would the reserve for encumbrances account be decreased? a) Budget revisions are made, decreasing Appropriations b) Payment is made for goods received c) Goods, related to purchase orders, are received d) Purchase orders are issued 19. Which of the following funds is used to account for the payment of principal and interest of general long term debt of a government? A) Capital Projects Fund B) Internal Service Fund C) Agency Fund D) Debt Service Fund unting focuses on which of the following? Government and nonprofit acco a. Calculating profit or loss b. Protecting investors from fraud c. Demonstrating accountability d. Reporting to management 20 Which basis of accounting is used for the basic governmental functions of state and local governments? a. Cash basis of accounting b. Modified accrual basis of accounting c. Accrual basis of accounting d. Regulatory basis of accounting 21. 22. Not-for-profit organizations obtain their revenues primarily from a. Sales to customers b. Contributions from donors c. Taxes on personal property d. Taxes on real property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started