Please answer all the questions

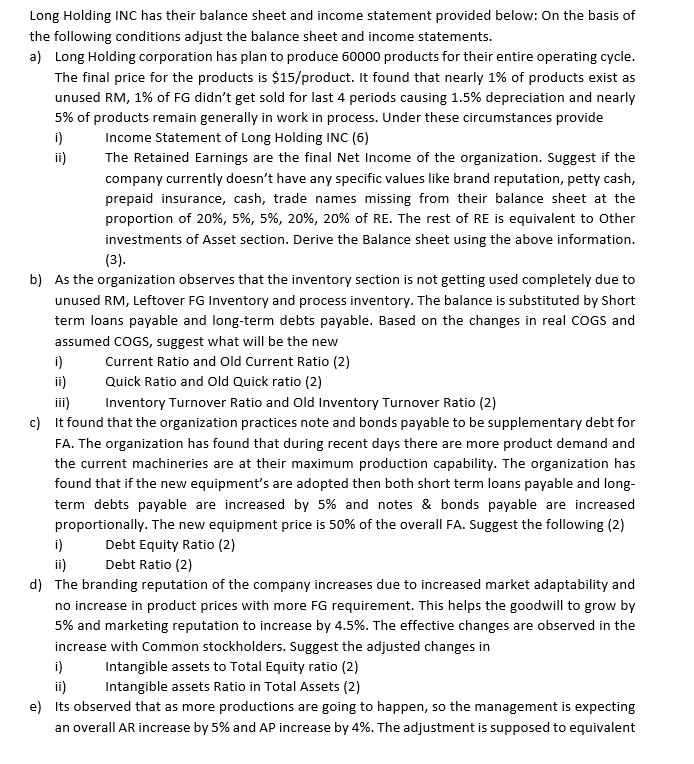

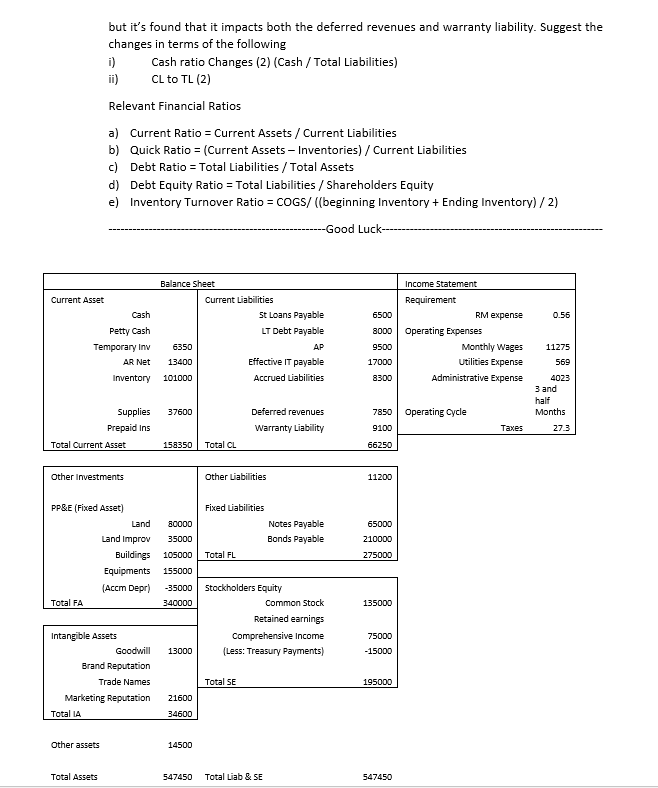

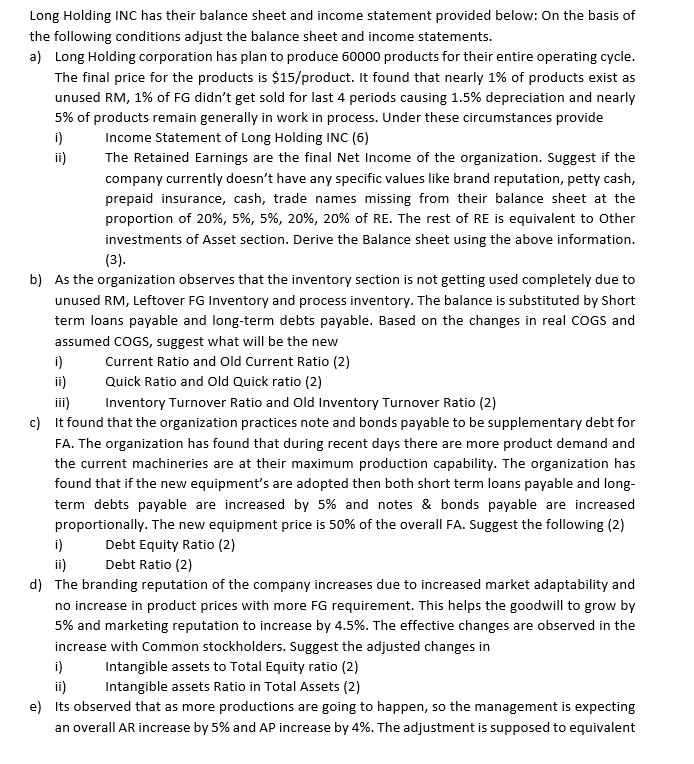

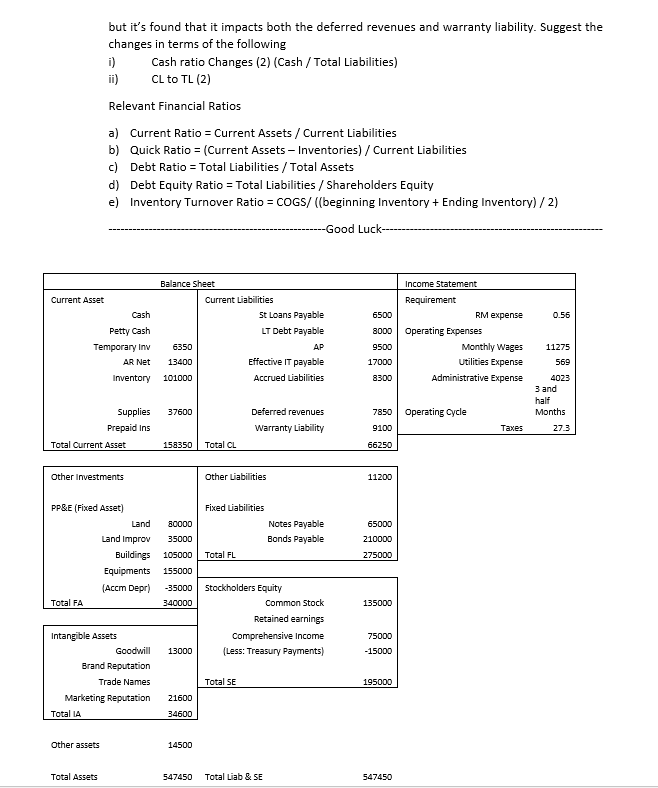

Long Holding INC has their balance sheet and income statement provided below: On the basis of the following conditions adjust the balance sheet and income statements. a) Long Holding corporation has plan to produce 60000 products for their entire operating cycle. The final price for the products is $15 /product. It found that nearly 1% of products exist as unused RM, 1\% of FG didn't get sold for last 4 periods causing 1.5% depreciation and nearly 5% of products remain generally in work in process. Under these circumstances provide i) Income Statement of Long Holding INC (6) ii) The Retained Earnings are the final Net Income of the organization. Suggest if the company currently doesn't have any specific values like brand reputation, petty cash, prepaid insurance, cash, trade names missing from their balance sheet at the proportion of 20%,5%,5%,20%,20% of RE. The rest of RE is equivalent to Other investments of Asset section. Derive the Balance sheet using the above information. (3). b) As the organization observes that the inventory section is not getting used completely due to unused RM, Leftover FG Inventory and process inventory. The balance is substituted by Short term loans payable and long-term debts payable. Based on the changes in real COGS and assumed COGS, suggest what will be the new i) Current Ratio and Old Current Ratio (2) ii) Quick Ratio and Old Quick ratio (2) iii) Inventory Turnover Ratio and Old Inventory Turnover Ratio (2) c) It found that the organization practices note and bonds payable to be supplementary debt for FA. The organization has found that during recent days there are more product demand and the current machineries are at their maximum production capability. The organization has found that if the new equipment's are adopted then both short term loans payable and longterm debts payable are increased by 5% and notes \& bonds payable are increased proportionally. The new equipment price is 50% of the overall FA. Suggest the following (2) i) Debt Equity Ratio (2) ii) Debt Ratio (2) d) The branding reputation of the company increases due to increased market adaptability and no increase in product prices with more FG requirement. This helps the goodwill to grow by 5% and marketing reputation to increase by 4.5%. The effective changes are observed in the increase with Common stockholders. Suggest the adjusted changes in i) Intangible assets to Total Equity ratio (2) ii) Intangible assets Ratio in Total Assets (2) e) Its observed that as more productions are going to happen, so the management is expecting an overall AR increase by 5% and AP increase by 4%. The adjustment is supposed to equivalent but it's found that it impacts both the deferred revenues and warranty liability. Suggest the changes in terms of the following i) Cash ratio Changes (2) (Cash / Total Liabilities) ii) CL to TL(2) Relevant Financial Ratios a) Current Ratio = Current Assets / Current Liabilities b) Quick Ratio = (Current Assets - Inventories) / Current Liabilities c) Debt Ratio = Total Liabilities / Total Assets d) Debt Equity Ratio = Total Liabilities / Shareholders Equity e) Inventory Turnover Ratio = COGS/ ((beginning Inventory + Ending Inventory) / 2) -Good Luck- Long Holding INC has their balance sheet and income statement provided below: On the basis of the following conditions adjust the balance sheet and income statements. a) Long Holding corporation has plan to produce 60000 products for their entire operating cycle. The final price for the products is $15 /product. It found that nearly 1% of products exist as unused RM, 1\% of FG didn't get sold for last 4 periods causing 1.5% depreciation and nearly 5% of products remain generally in work in process. Under these circumstances provide i) Income Statement of Long Holding INC (6) ii) The Retained Earnings are the final Net Income of the organization. Suggest if the company currently doesn't have any specific values like brand reputation, petty cash, prepaid insurance, cash, trade names missing from their balance sheet at the proportion of 20%,5%,5%,20%,20% of RE. The rest of RE is equivalent to Other investments of Asset section. Derive the Balance sheet using the above information. (3). b) As the organization observes that the inventory section is not getting used completely due to unused RM, Leftover FG Inventory and process inventory. The balance is substituted by Short term loans payable and long-term debts payable. Based on the changes in real COGS and assumed COGS, suggest what will be the new i) Current Ratio and Old Current Ratio (2) ii) Quick Ratio and Old Quick ratio (2) iii) Inventory Turnover Ratio and Old Inventory Turnover Ratio (2) c) It found that the organization practices note and bonds payable to be supplementary debt for FA. The organization has found that during recent days there are more product demand and the current machineries are at their maximum production capability. The organization has found that if the new equipment's are adopted then both short term loans payable and longterm debts payable are increased by 5% and notes \& bonds payable are increased proportionally. The new equipment price is 50% of the overall FA. Suggest the following (2) i) Debt Equity Ratio (2) ii) Debt Ratio (2) d) The branding reputation of the company increases due to increased market adaptability and no increase in product prices with more FG requirement. This helps the goodwill to grow by 5% and marketing reputation to increase by 4.5%. The effective changes are observed in the increase with Common stockholders. Suggest the adjusted changes in i) Intangible assets to Total Equity ratio (2) ii) Intangible assets Ratio in Total Assets (2) e) Its observed that as more productions are going to happen, so the management is expecting an overall AR increase by 5% and AP increase by 4%. The adjustment is supposed to equivalent but it's found that it impacts both the deferred revenues and warranty liability. Suggest the changes in terms of the following i) Cash ratio Changes (2) (Cash / Total Liabilities) ii) CL to TL(2) Relevant Financial Ratios a) Current Ratio = Current Assets / Current Liabilities b) Quick Ratio = (Current Assets - Inventories) / Current Liabilities c) Debt Ratio = Total Liabilities / Total Assets d) Debt Equity Ratio = Total Liabilities / Shareholders Equity e) Inventory Turnover Ratio = COGS/ ((beginning Inventory + Ending Inventory) / 2) -Good Luck