PLEASE ANSWER ALL THE QUESTIONS OR DO NOT ANSWER, WILL GIVE THUMBS UP IF THEY ARE ALL ANSWERED

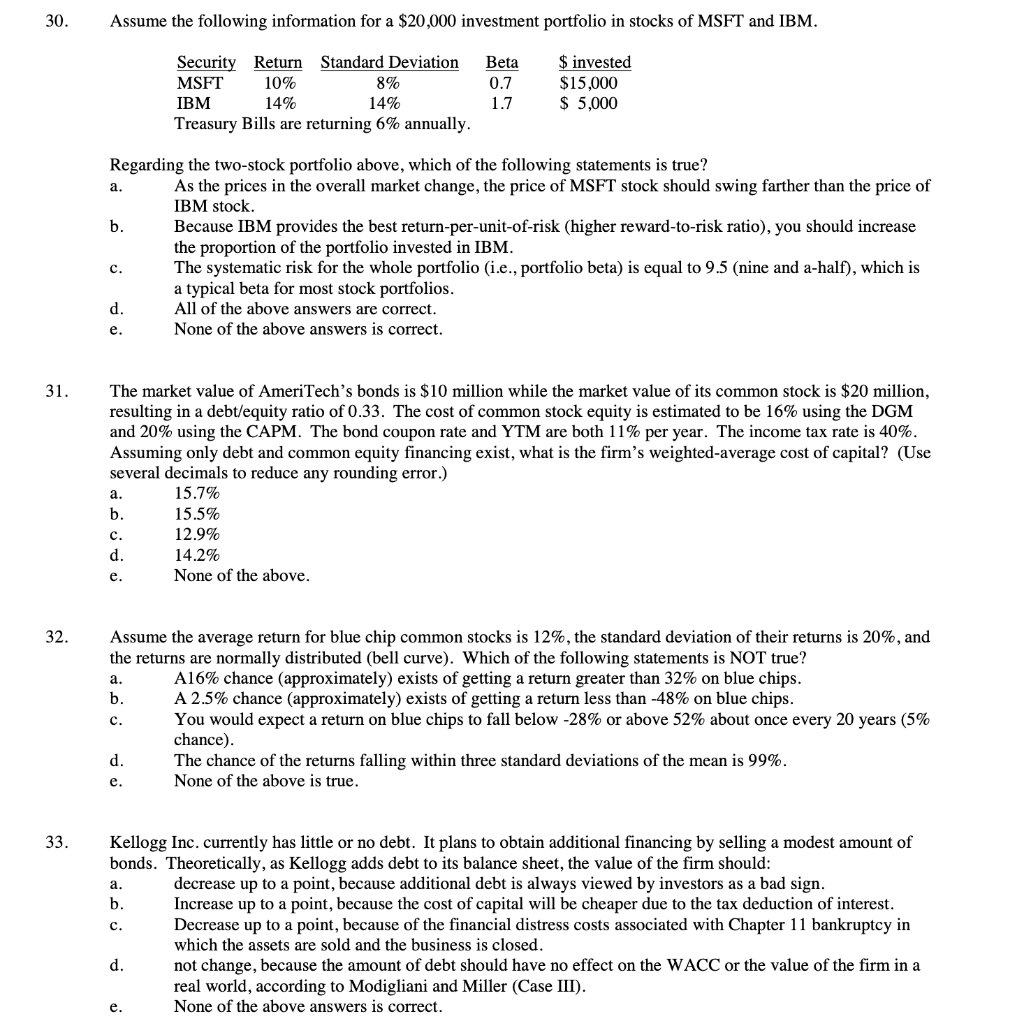

30. Assume the following information for a $20,000 investment portfolio in stocks of MSFT and IBM. Security Return Standard Deviation MSFT 10% 8% IBM 14% 14% Treasury Bills are returning 6% annually. Beta 0.7 1.7 $ invested $15,000 $ 5,000 a. Regarding the two-stock portfolio above, which of the following statements is true? As the prices in the overall market change, the price of MSFT stock should swing farther than the price of IBM stock. b. Because IBM provides the best return-per-unit-of-risk (higher reward-to-risk ratio), you should increase the proportion of the portfolio invested in IBM. The systematic risk for the whole portfolio (i.e., portfolio beta) is equal to 9.5 (nine and a half), which is a typical beta for most stock portfolios. d. All of the above answers are correct. None of the above answers is correct. c. e. 31. The market value of AmeriTech's bonds is $10 million while the market value of its common stock is $20 million, resulting in a debt/equity ratio of 0.33. The cost of common stock equity is estimated to be 16% using the DGM and 20% using the CAPM. The bond coupon rate and YTM are both 11% per year. The income tax rate is 40%. Assuming only debt and common equity financing exist, what is the firm's weighted-average cost of capital? (Use several decimals to reduce any rounding error.) 15.7% 15.5% 12.9% 14.2% None of the above. a. b. c. d. e. 32. a. b Assume the average return for blue chip common stocks is 12%, the standard deviation of their returns is 20%, and the returns are normally distributed (bell curve). Which of the following statements is NOT true? A16% chance (approximately) exists of getting a return greater than 32% on blue chips. A 2.5% chance (approximately) exists of getting a return less than -48% on blue chips. You would expect a return on blue chips to fall below -28% or above 52% about once every 20 years (5% chance) d. The chance of the returns falling within three standard deviations of the mean is 99%. None of the above is true. C. e. 33. a. Kellogg Inc. currently has little or no debt. It plans to obtain additional financing by selling a modest amount of bonds. Theoretically, as Kellogg adds debt to its balance sheet, the value of the firm should: decrease up to a point, because additional debt is always viewed by investors as a bad sign. b. Increase up to a point, because the cost of capital will be cheaper due to the tax deduction of interest. Decrease up to a point, because of the financial distress costs associated with Chapter 11 bankruptcy in which the assets are sold and the business is closed. d. not change, because the amount of debt should have no effect on the WACC or the value of the firm in a real world, according to Modigliani and Miller (Case III). None of the above answers is correct. c. e