PLEASE ANSWER ALL THE QUESTIONS... PLEASE

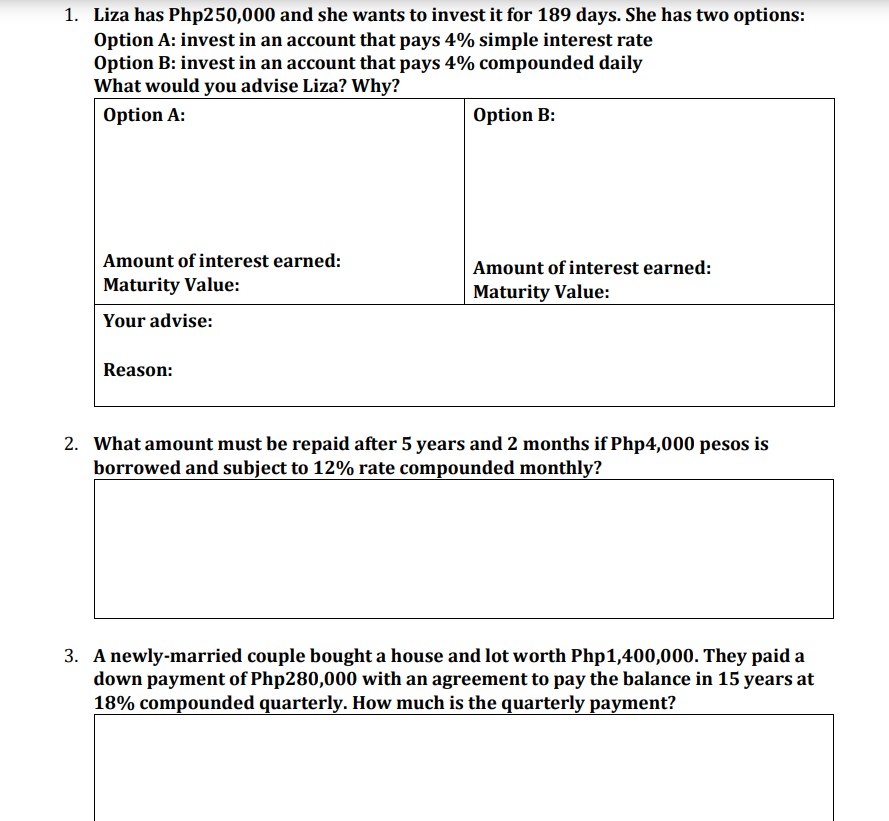

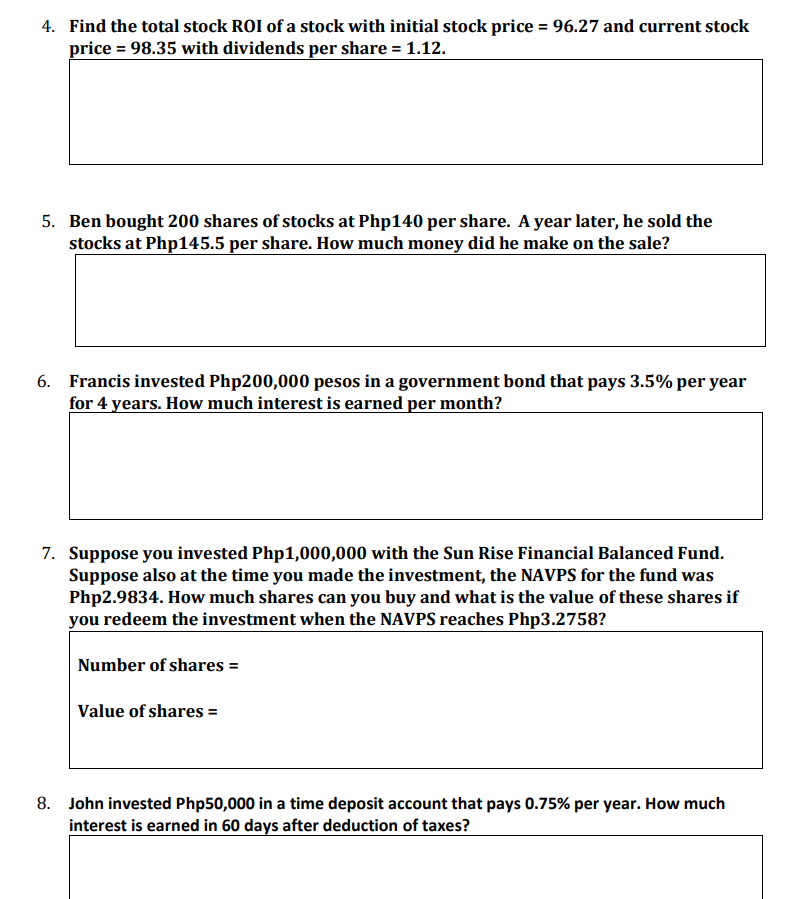

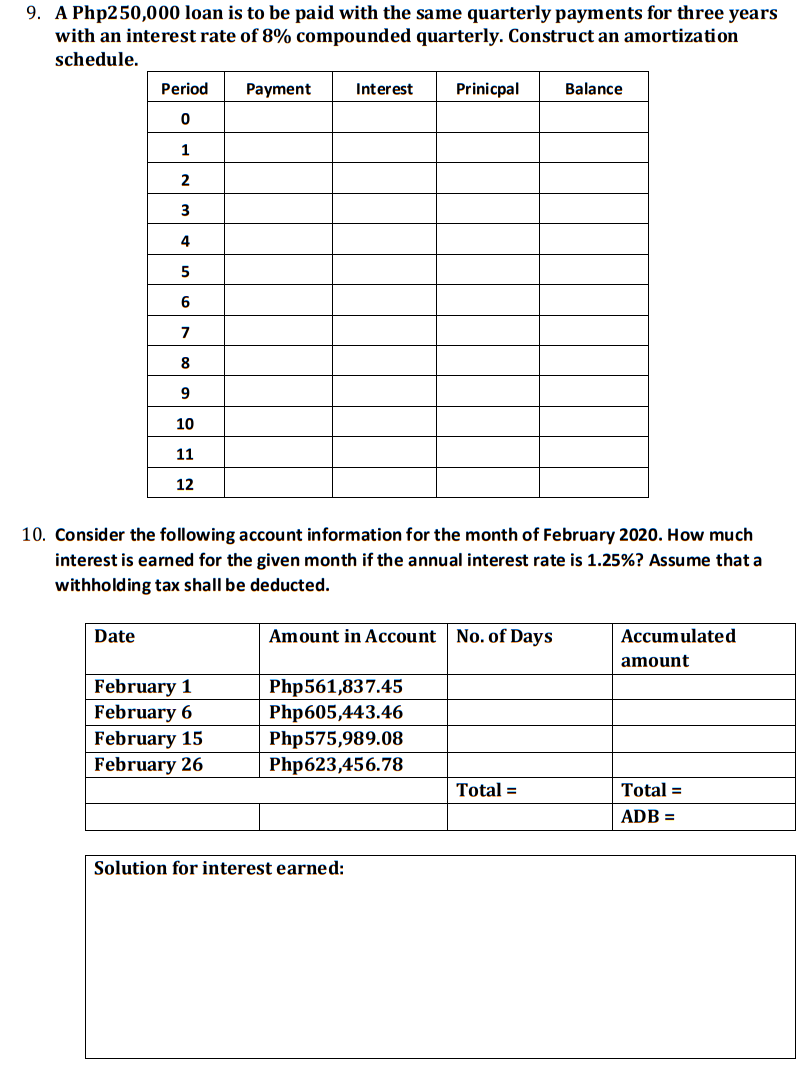

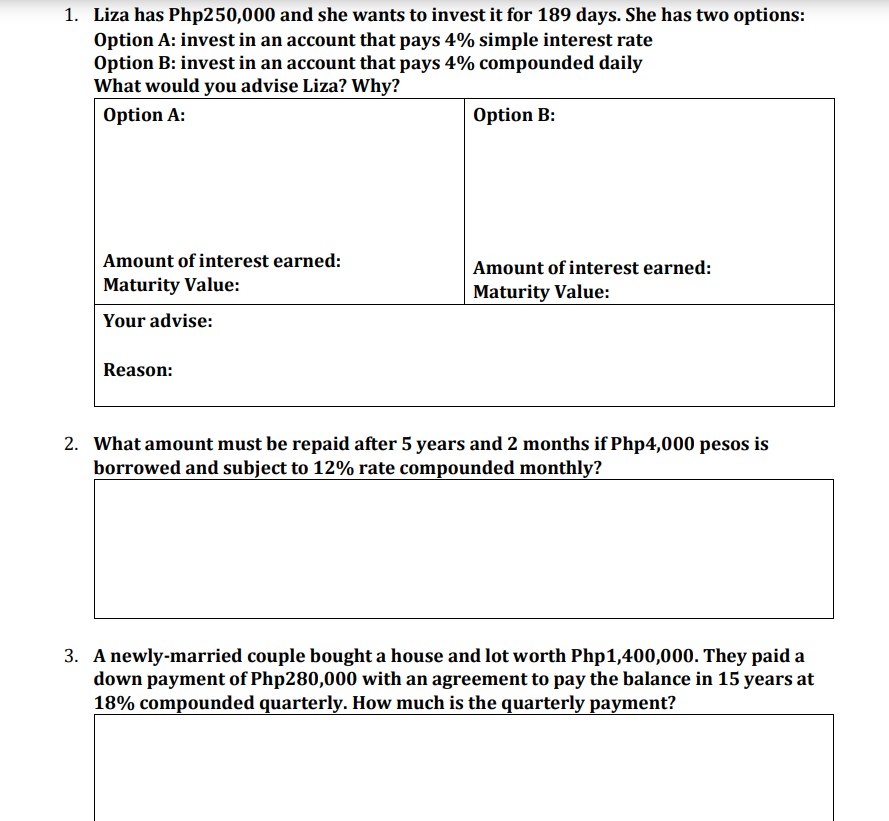

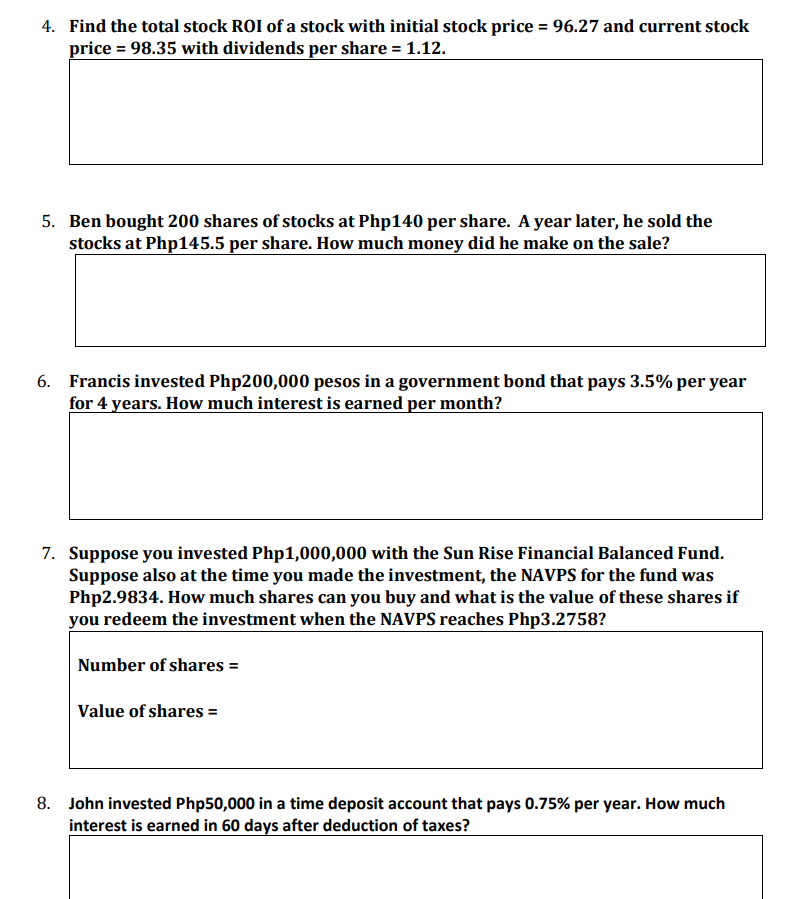

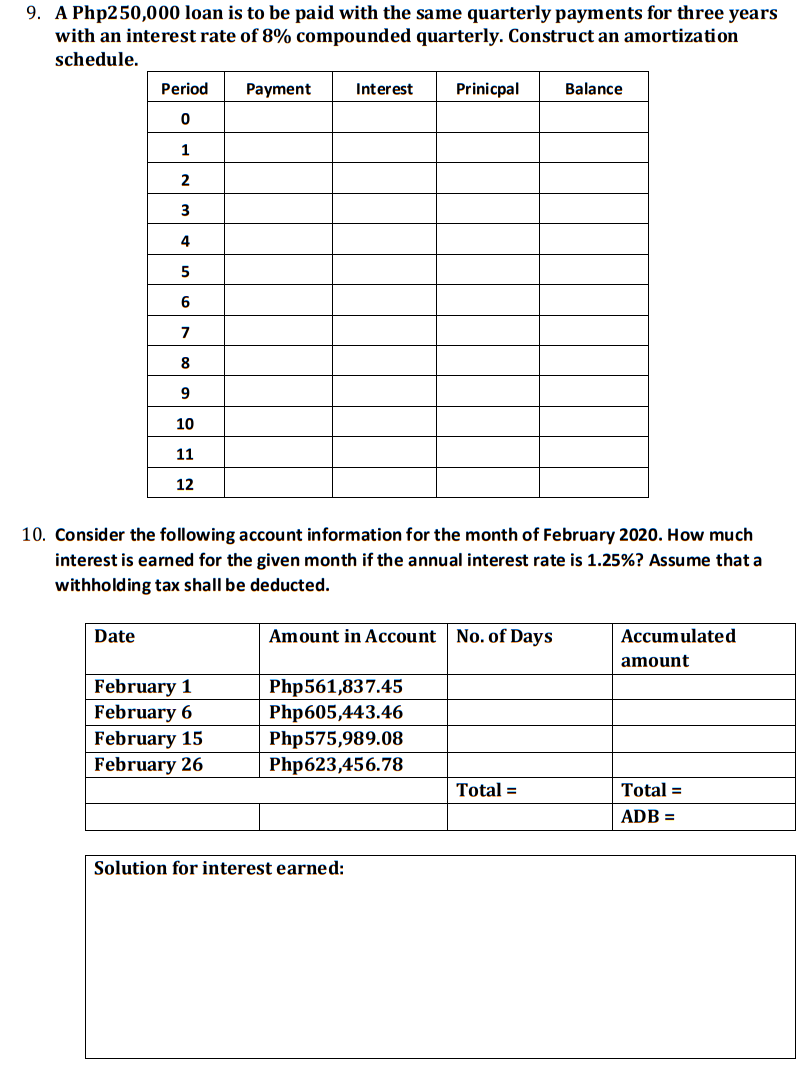

1. Liza has Php250,000 and she wants to invest it for 189 days. She has two options: Option A: invest in an account that pays 4% simple interest rate Option B: invest in an account that pays 4% compounded daily What would you advise Liza? Why? Option A: Option B: Amount of interest earned: Maturity Value: Amount of interest earned: Maturity Value: Your advise: Reason: 2. What amount must be repaid after 5 years and 2 months if Php4,000 pesos is borrowed and subject to 12% rate compounded monthly? 3. A newly-married couple bought a house and lot worth Php1,400,000. They paid a down payment of Php280,000 with an agreement to pay the balance in 15 years at 18% compounded quarterly. How much is the quarterly payment? 4. Find the total stock ROI of a stock with initial stock price = 96.27 and current stock price = 98.35 with dividends per share = 1.12. 5. Ben bought 200 shares of stocks at Php140 per share. A year later, he sold the stocks at Php145.5 per share. How much money did he make on the sale? 6. Francis invested Php200,000 pesos in a government bond that pays 3.5% per year for 4 years. How much interest is earned per month? 7. Suppose you invested Php1,000,000 with the Sun Rise Financial Balanced Fund. Suppose also at the time you made the investment, the NAVPS for the fund was Php2.9834. How much shares can you buy and what is the value of these shares if you redeem the investment when the NAVPS reaches Php3.2758? Number of shares = Value of shares = 8. John invested Php50,000 in a time deposit account that pays 0.75% per year. How much interest is earned in 60 days after deduction of taxes? 9. A Php250,000 loan is to be paid with the same quarterly payments for three years with an interest rate of 8% compounded quarterly. Construct an amortization schedule. Period Payment Interest Prinicpal Balance 0 1 2 3 4 5 6 7 8 9 10 11 12 10. Consider the following account information for the month of February 2020. How much interest is earned for the given month if the annual interest rate is 1.25%? Assume that a withholding tax shall be deducted. Date Amount in Account No. of Days Accumulated amount February 1 February 6 February 15 February 26 Php561,837.45 Php605,443.46 Php 575,989.08 Php623,456.78 Total = Total = ADB = Solution for interest earned: 1. Liza has Php250,000 and she wants to invest it for 189 days. She has two options: Option A: invest in an account that pays 4% simple interest rate Option B: invest in an account that pays 4% compounded daily What would you advise Liza? Why? Option A: Option B: Amount of interest earned: Maturity Value: Amount of interest earned: Maturity Value: Your advise: Reason: 2. What amount must be repaid after 5 years and 2 months if Php4,000 pesos is borrowed and subject to 12% rate compounded monthly? 3. A newly-married couple bought a house and lot worth Php1,400,000. They paid a down payment of Php280,000 with an agreement to pay the balance in 15 years at 18% compounded quarterly. How much is the quarterly payment? 4. Find the total stock ROI of a stock with initial stock price = 96.27 and current stock price = 98.35 with dividends per share = 1.12. 5. Ben bought 200 shares of stocks at Php140 per share. A year later, he sold the stocks at Php145.5 per share. How much money did he make on the sale? 6. Francis invested Php200,000 pesos in a government bond that pays 3.5% per year for 4 years. How much interest is earned per month? 7. Suppose you invested Php1,000,000 with the Sun Rise Financial Balanced Fund. Suppose also at the time you made the investment, the NAVPS for the fund was Php2.9834. How much shares can you buy and what is the value of these shares if you redeem the investment when the NAVPS reaches Php3.2758? Number of shares = Value of shares = 8. John invested Php50,000 in a time deposit account that pays 0.75% per year. How much interest is earned in 60 days after deduction of taxes? 9. A Php250,000 loan is to be paid with the same quarterly payments for three years with an interest rate of 8% compounded quarterly. Construct an amortization schedule. Period Payment Interest Prinicpal Balance 0 1 2 3 4 5 6 7 8 9 10 11 12 10. Consider the following account information for the month of February 2020. How much interest is earned for the given month if the annual interest rate is 1.25%? Assume that a withholding tax shall be deducted. Date Amount in Account No. of Days Accumulated amount February 1 February 6 February 15 February 26 Php561,837.45 Php605,443.46 Php 575,989.08 Php623,456.78 Total = Total = ADB = Solution for interest earned