Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions. thank you so much DIVISION OF PARTNERSHIP NET INCOME (LOSS) (18 points) Chaim, David & Ephraim have formed a partnership

please answer all the questions. thank you so much

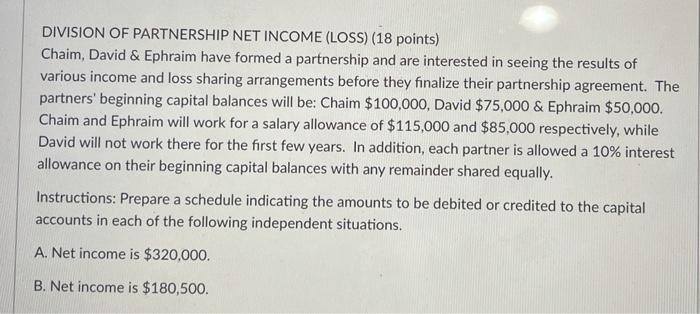

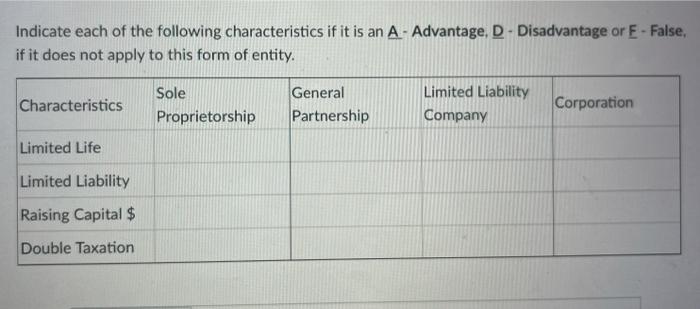

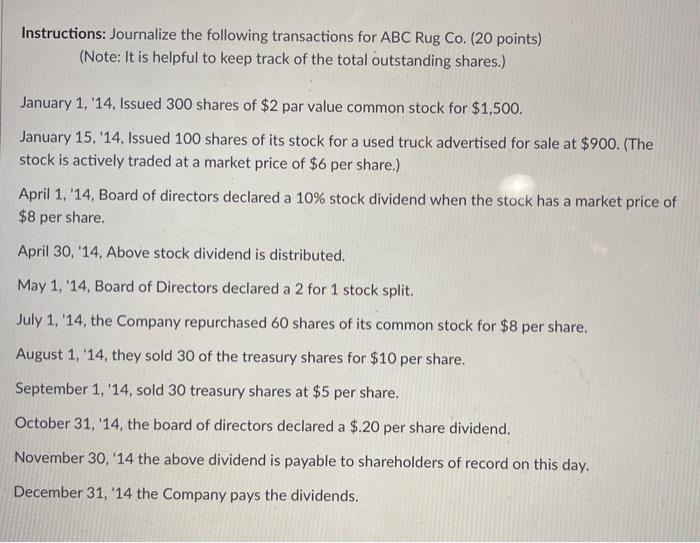

DIVISION OF PARTNERSHIP NET INCOME (LOSS) (18 points) Chaim, David & Ephraim have formed a partnership and are interested in seeing the results of various income and loss sharing arrangements before they finalize their partnership agreement. The partners' beginning capital balances will be: Chaim $100,000, David $75,000 & Ephraim $50,000. Chaim and Ephraim will work for a salary allowance of $115,000 and $85,000 respectively, while David will not work there for the first few years. In addition, each partner is allowed a 10% interest allowance on their beginning capital balances with any remainder shared equally. Instructions: Prepare a schedule indicating the amounts to be debited or credited to the capital accounts in each of the following independent situations. A. Net income is $320,000. B. Net income is $180,500. Indicate each of the following characteristics if it is an A - Advantage, D- Disadvantage or E-False, if it does not apply to this form of entity. Characteristics Sole Proprietorship General Partnership Limited Liability Company Corporation Limited Life Limited Liability Raising Capital $ Double Taxation Instructions: Journalize the following transactions for ABC Rug Co. (20 points) (Note: It is helpful to keep track of the total outstanding shares.) January 1, '14, Issued 300 shares of $2 par value common stock for $1,500. January 15, '14, Issued 100 shares of its stock for a used truck advertised for sale at $900. (The stock is actively traded at a market price of $6 per share.) April 1, '14, Board of directors declared a 10% stock dividend when the stock has a market price of $8 per share. April 30, '14. Above stock dividend is distributed. May 1, '14, Board of Directors declared a 2 for 1 stock split. July 1, '14, the Company repurchased 60 shares of its common stock for $8 per share. August 1, '14, they sold 30 of the treasury shares for $10 per share. September 1, '14, sold 30 treasury shares at $5 per share. October 31, '14, the board of directors declared a $.20 per share dividend. November 30, '14 the above dividend is payable to shareholders of record on this day. December 31, '14 the Company pays the dividends Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started