Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions, thank you! Use the following information to answer the next several questions. The Norris Company is looking to fund a

please answer all the questions, thank you!

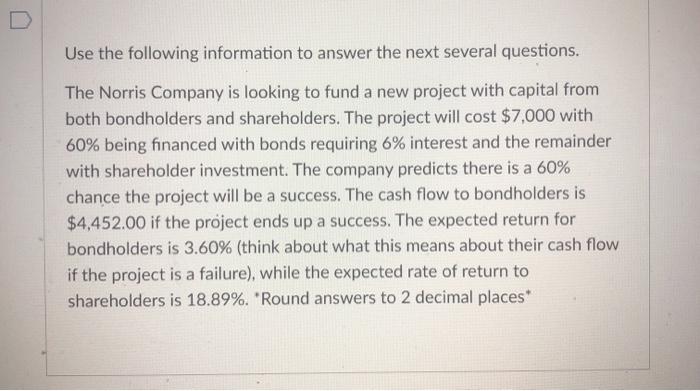

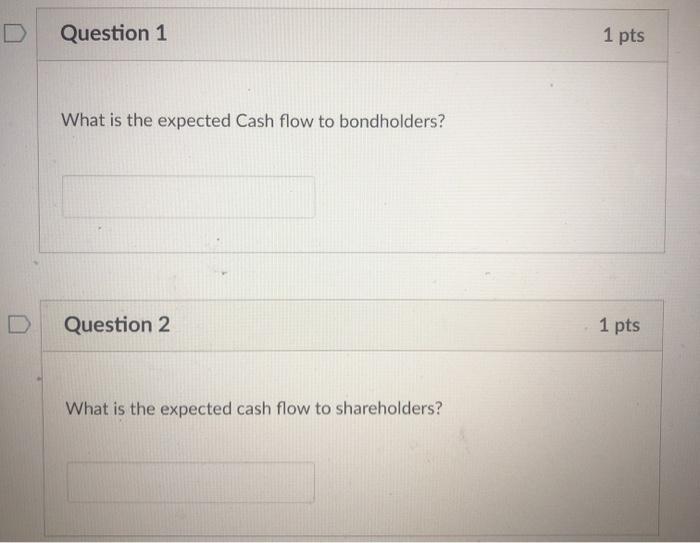

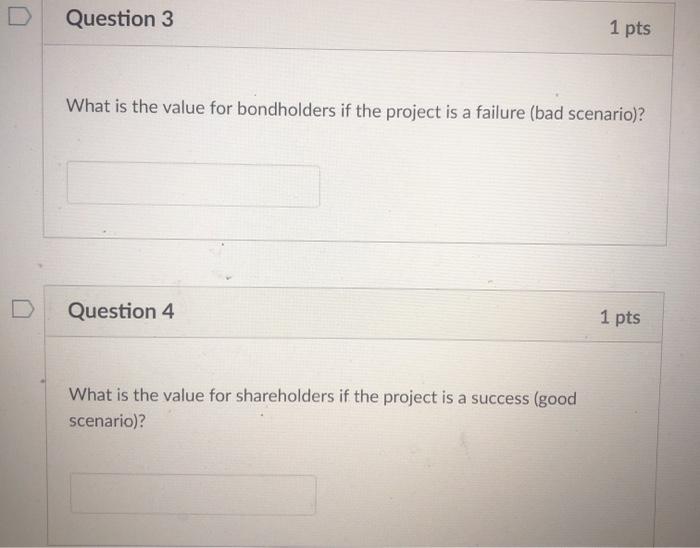

Use the following information to answer the next several questions. The Norris Company is looking to fund a new project with capital from both bondholders and shareholders. The project will cost $7,000 with 60% being financed with bonds requiring 6% interest and the remainder with shareholder investment. The company predicts there is a 60% chance the project will be a success. The cash flow to bondholders is $4,452.00 if the project ends up a success. The expected return for bondholders is 3.60% (think about what this means about their cash flow if the project is a failure), while the expected rate of return to shareholders is 18.89%. Round answers to 2 decimal places Question 1 1 pts What is the expected Cash flow to bondholders? Question 2 1 pts What is the expected cash flow to shareholders? Question 3 1 pts What is the value for bondholders if the project is a failure (bad scenario)? Question 4 1 pts What is the value for shareholders if the project is a success (good scenario) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started