please answer all the required questions.

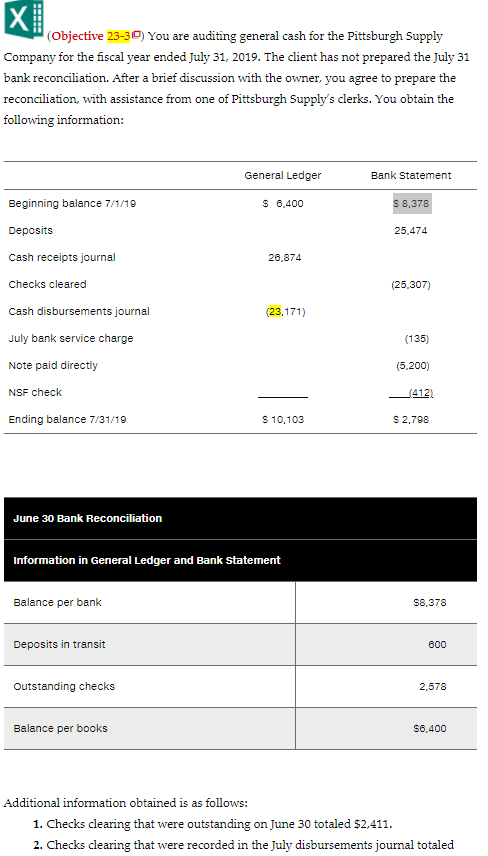

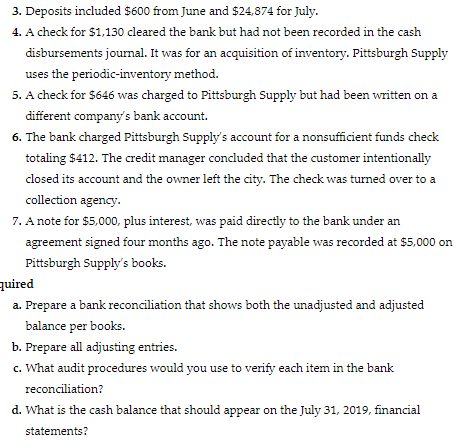

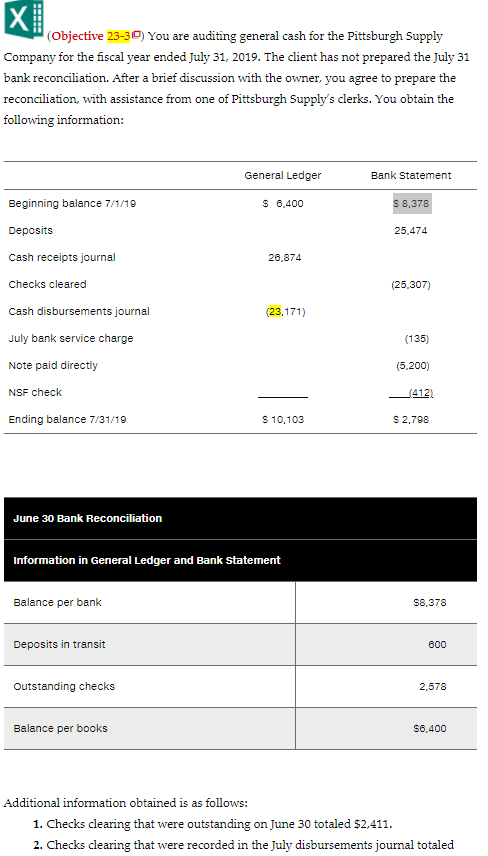

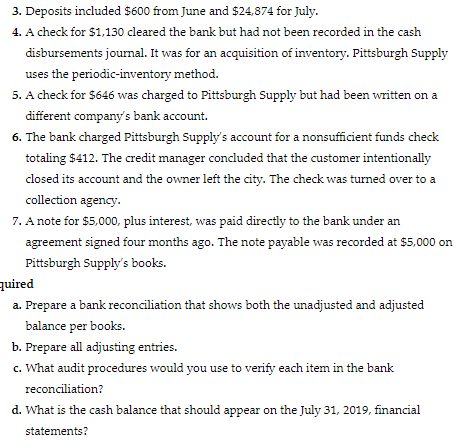

XI Objective 23-30) You are auditing general cash for the Pittsburgh Supply Company for the fiscal year ended July 31, 2019. The client has not prepared the July 31 bank reconciliation. After a brief discussion with the owner, you agree to prepare the reconciliation, with assistance from one of Pittsburgh Supply's clerks. You obtain the following information: General Ledger Bank Statement Beginning balance 7/1/19 $ 6,400 S 8,378 Deposits 25,474 26,874 (25.307) 23,171) Cash receipts journal Checks cleared Cash disbursements journal July bank service charge Note paid directly NSF check (135) (5.200) 1412 Ending balance 7/31/19 S 10.103 S 2.798 June 30 Bank Reconciliation Information in General Ledger and Bank Statement Balance per bank $8,378 Deposits in transit 600 Outstanding checks 2,578 Balance per books $6,400 Additional information obtained is as follows: 1. Checks clearing that were outstanding on June 30 totaled $2,411. 2. Checks clearing that were recorded in the July disbursements journal totaled 3. Deposits included $600 from June and $24,874 for July. 4. A check for $1,130 cleared the bank but had not been recorded in the cash disbursements journal. It was for an acquisition of inventory. Pittsburgh Supply uses the periodic-inventory method. 5. A check for $646 was charged to Pittsburgh Supply but had been written on a different company's bank account. 6. The bank charged Pittsburgh Supply's account for a nonsufficient funds check totaling $412. The credit manager concluded that the customer intentionally closed its account and the owner left the city. The check was turned over to a collection agency. 7. A note for $5,000, plus interest, was paid directly to the bank under an agreement signed four months ago. The note payable was recorded at $5,000 on Pittsburgh Supply's books. quired a. Prepare a bank reconciliation that shows both the unadjusted and adjusted balance per books. b. Prepare all adjusting entries. c. What audit procedures would you use to verify each item in the bank reconciliation? d. What is the cash balance that should appear on the July 31, 2019, financial statements? XI Objective 23-30) You are auditing general cash for the Pittsburgh Supply Company for the fiscal year ended July 31, 2019. The client has not prepared the July 31 bank reconciliation. After a brief discussion with the owner, you agree to prepare the reconciliation, with assistance from one of Pittsburgh Supply's clerks. You obtain the following information: General Ledger Bank Statement Beginning balance 7/1/19 $ 6,400 S 8,378 Deposits 25,474 26,874 (25.307) 23,171) Cash receipts journal Checks cleared Cash disbursements journal July bank service charge Note paid directly NSF check (135) (5.200) 1412 Ending balance 7/31/19 S 10.103 S 2.798 June 30 Bank Reconciliation Information in General Ledger and Bank Statement Balance per bank $8,378 Deposits in transit 600 Outstanding checks 2,578 Balance per books $6,400 Additional information obtained is as follows: 1. Checks clearing that were outstanding on June 30 totaled $2,411. 2. Checks clearing that were recorded in the July disbursements journal totaled 3. Deposits included $600 from June and $24,874 for July. 4. A check for $1,130 cleared the bank but had not been recorded in the cash disbursements journal. It was for an acquisition of inventory. Pittsburgh Supply uses the periodic-inventory method. 5. A check for $646 was charged to Pittsburgh Supply but had been written on a different company's bank account. 6. The bank charged Pittsburgh Supply's account for a nonsufficient funds check totaling $412. The credit manager concluded that the customer intentionally closed its account and the owner left the city. The check was turned over to a collection agency. 7. A note for $5,000, plus interest, was paid directly to the bank under an agreement signed four months ago. The note payable was recorded at $5,000 on Pittsburgh Supply's books. quired a. Prepare a bank reconciliation that shows both the unadjusted and adjusted balance per books. b. Prepare all adjusting entries. c. What audit procedures would you use to verify each item in the bank reconciliation? d. What is the cash balance that should appear on the July 31, 2019, financial statements