PLEASE ANSWER ALL THE REQUIREMENTS AND SHOW ALL WORK FOR THUMBS UP! THANK YOU!

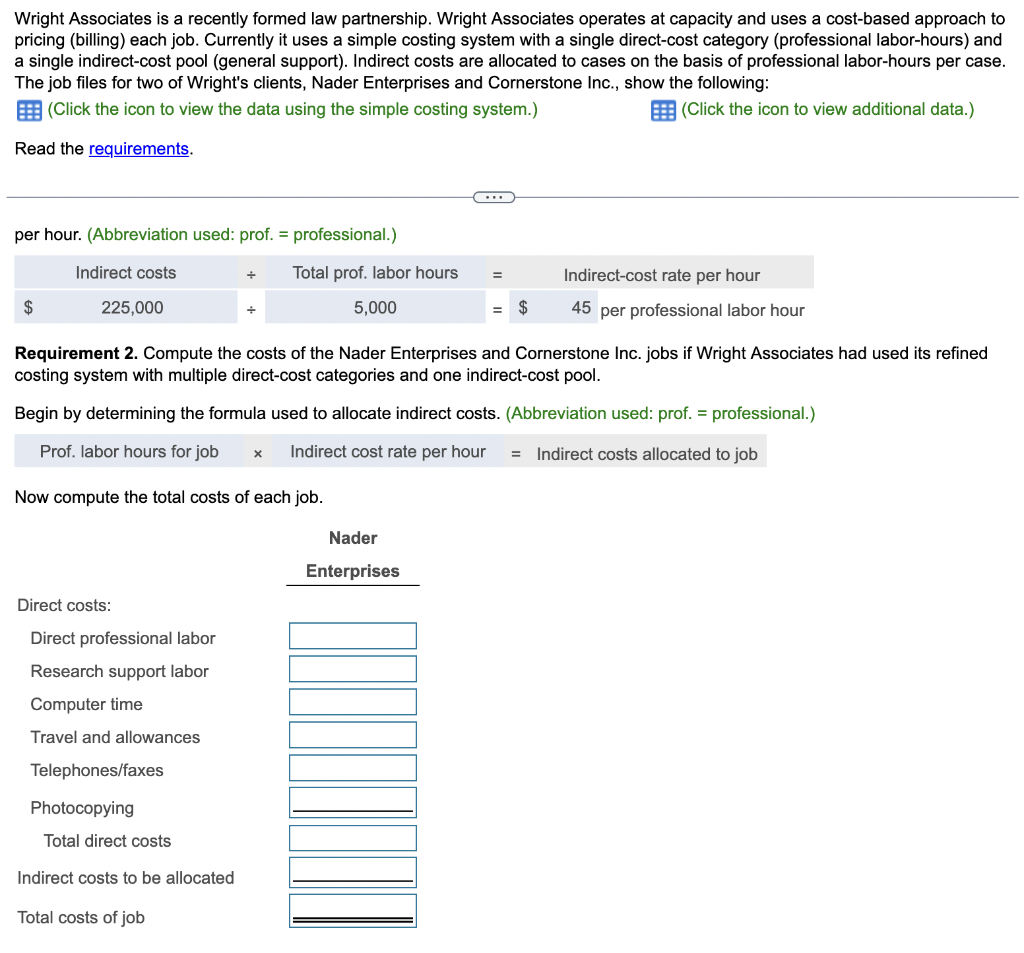

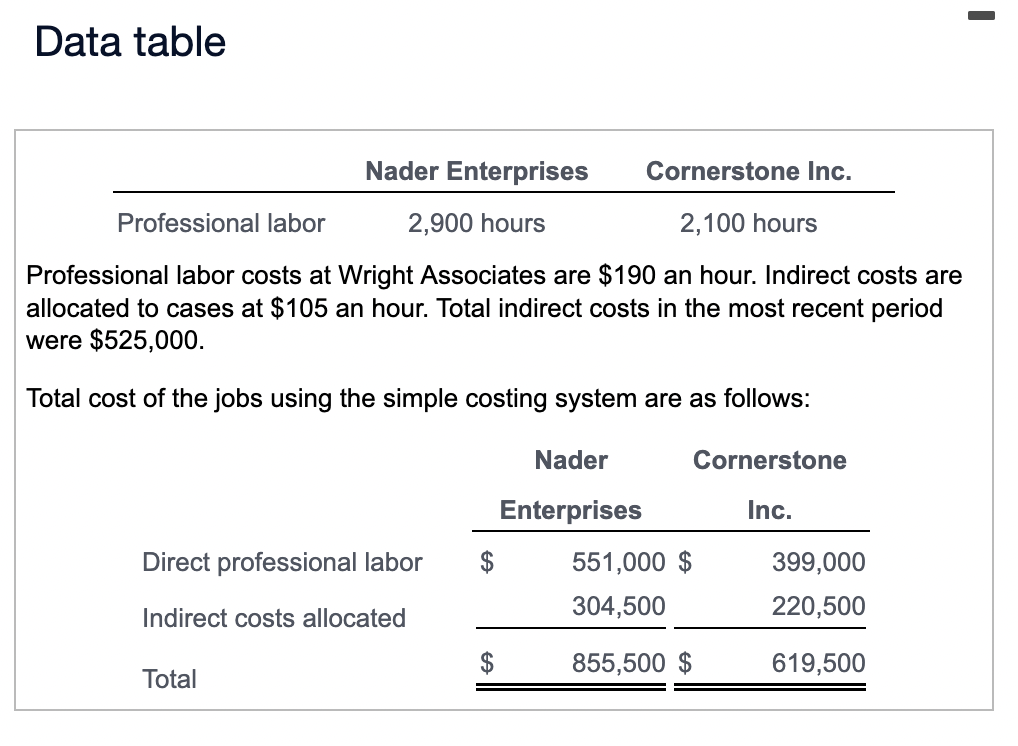

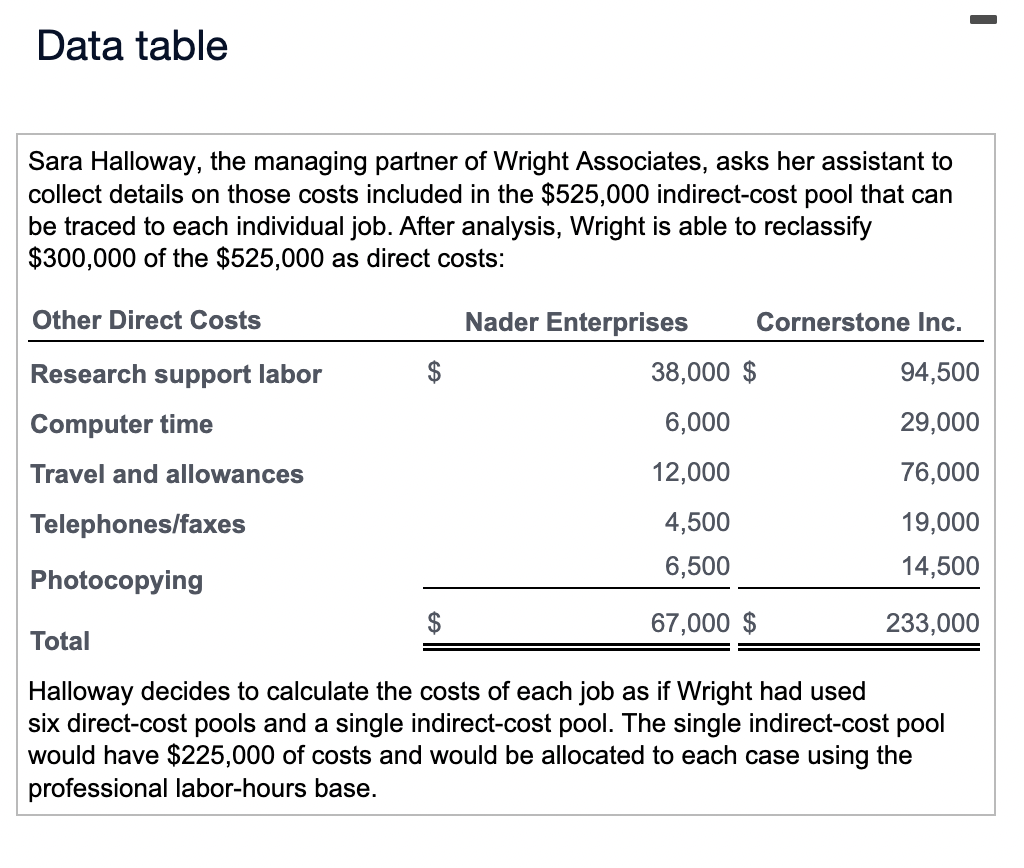

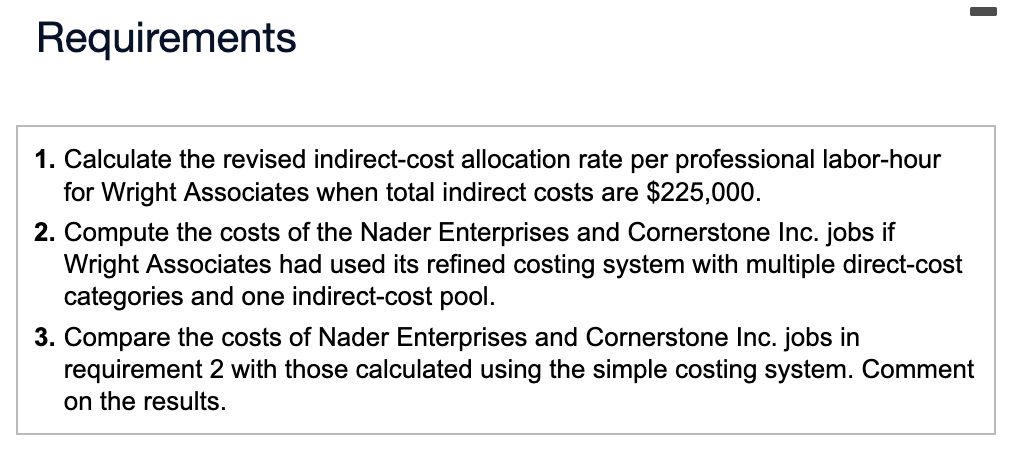

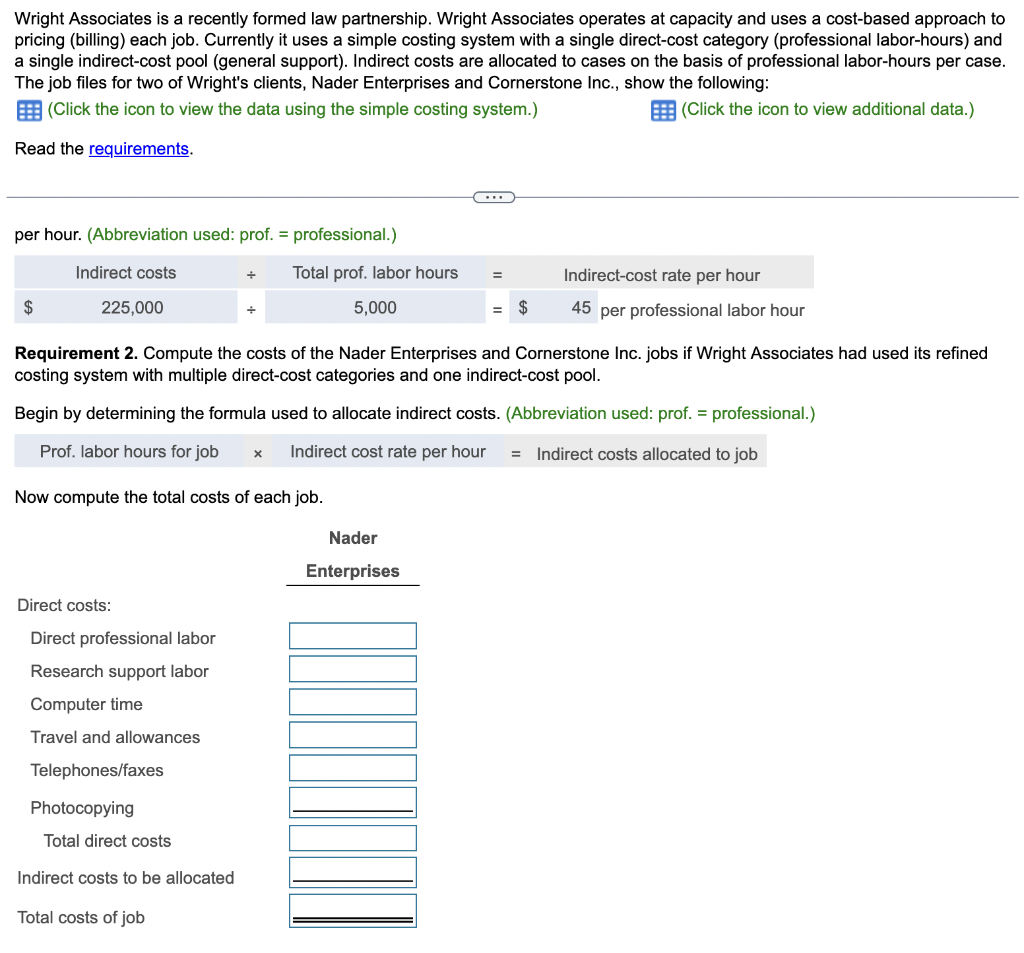

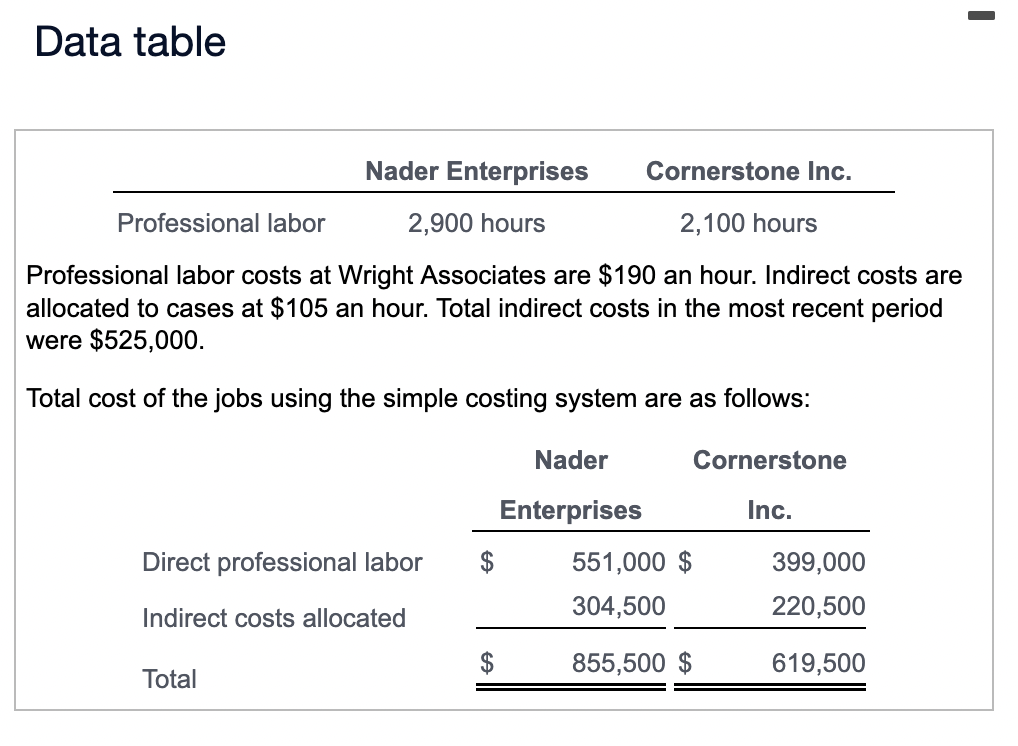

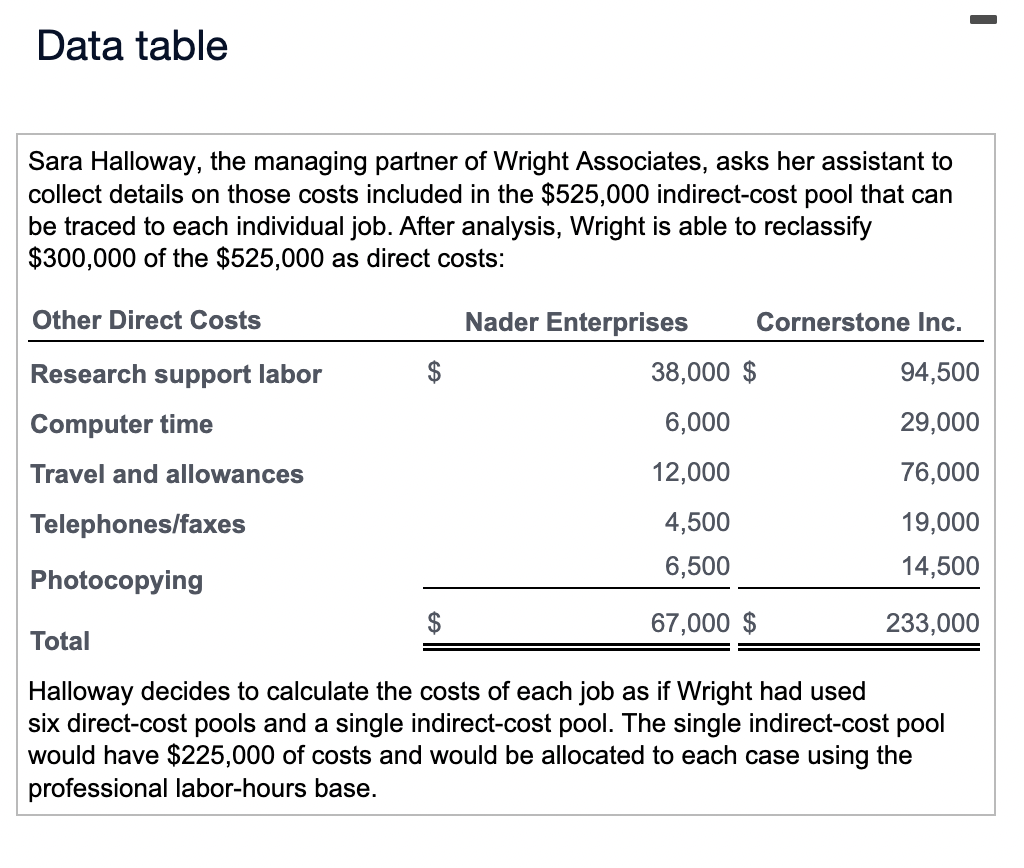

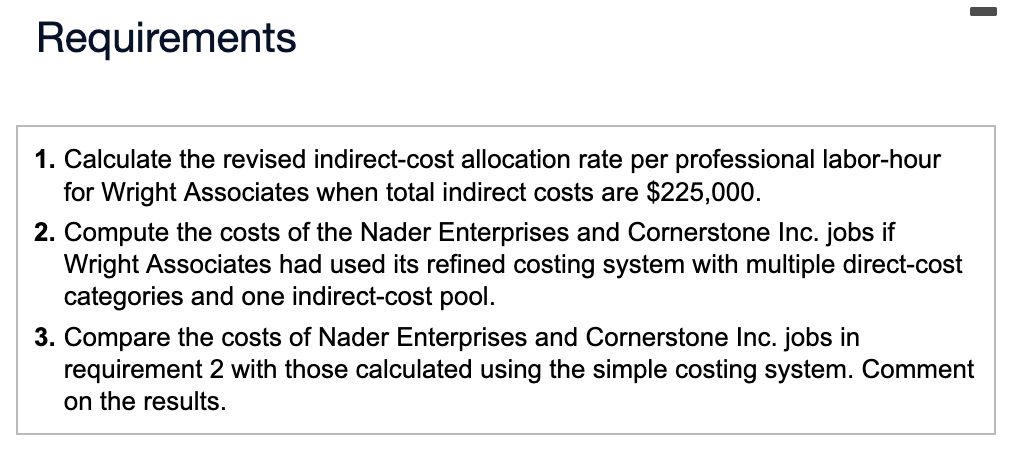

Wright Associates is a recently formed law partnership. Wright Associates operates at capacity and uses a cost-based approach to pricing (billing) each job. Currently it uses a simple costing system with a single direct-cost category (professional labor-hours) and a single indirect-cost pool (general support). Indirect costs are allocated to cases on the basis of professional labor-hours per case. The job files for two of Wright's clients, Nader Enterprises and Cornerstone Inc., show the following: (Click the icon to view the data using the simple costing system.) Click the icon to view additional data.) Read the requirements. per hour. (Abbreviation used: prof. = professional. Requirement 2. Compute the costs of the Nader Enterprises and Cornerstone Inc. jobs if Wright Associates had used its refined costing system with multiple direct-cost categories and one indirect-cost pool. Begin by determining the formula used to allocate indirect costs. (Abbreviation used: prof. = professional.) Prof. labor hours for job Indirect cost rate per hour = Indirect costs allocated to job Now compute the total costs of each job. Data table Professional labor costs at Wright Associates are $190 an hour. Indirect costs are allocated to cases at $105 an hour. Total indirect costs in the most recent period were $525,000. Total cost of the jobs using the simple costing system are as follows: Data table Sara Halloway, the managing partner of Wright Associates, asks her assistant to collect details on those costs included in the $525,000 indirect-cost pool that can be traced to each individual job. After analysis, Wright is able to reclassify $300,000 of the $525,000 as direct costs: Halloway decides to calculate the costs of each job as if Wright had used six direct-cost pools and a single indirect-cost pool. The single indirect-cost pool would have $225,000 of costs and would be allocated to each case using the professional labor-hours base. Requirements 1. Calculate the revised indirect-cost allocation rate per professional labor-hour for Wright Associates when total indirect costs are $225,000. 2. Compute the costs of the Nader Enterprises and Cornerstone Inc. jobs if Wright Associates had used its refined costing system with multiple direct-cost categories and one indirect-cost pool. 3. Compare the costs of Nader Enterprises and Cornerstone Inc. jobs in requirement 2 with those calculated using the simple costing system. Comment on the results