Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all the steps. Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended.

Please answer all the steps.

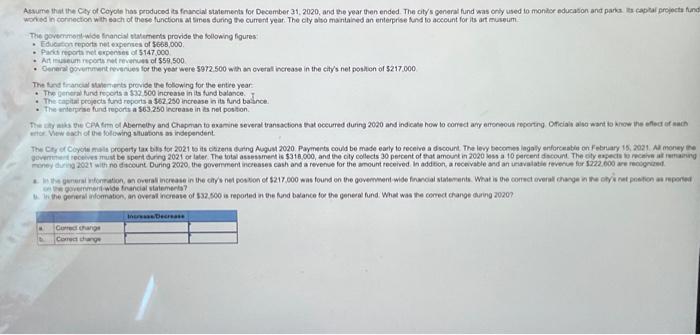

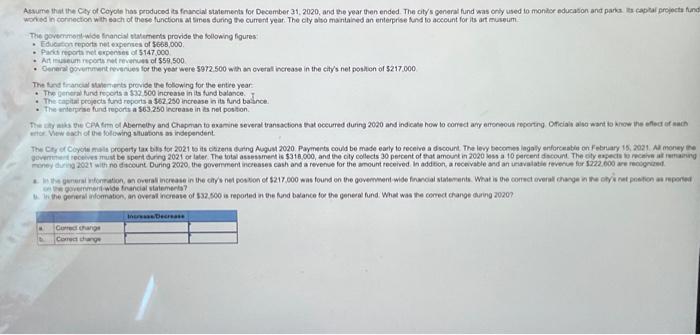

Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city's general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: - Education reports net expenses of $668,000. - Parks reports net expenses of $147,000. - Art museum reports net revenues of $59,500. - General government revenues for the year were $972,500 with an overall increase in the city's net position of $217,000. The fund financial statements provide the following for the entire year: - The general fund reports a $32,500 increase in its fund balance. - The capital projects fund reports a $62,250 increase in its fund balance. - The enterprise fund reports a $63,250 increase in its net position. The city asiss the CPA firm of Abernethy and Chapman to examine several transactions that occurred during 2020 and indicate how to correct any erroneou, reporting. Officials also want to know the effect of each error. View each of the following situations as independent. The City of Coyot malis property tax bills for 2021 to its citizens during August 2020 . Payments could be made early to receive a discount. The lev becomes legally enforceable on February 15, 2021. All money the government receives must be spent during 2021 or leter. The tot assessment is $318,000, and the city coliects 30 percent of that amount in 2020 less a 10 percent discount. The city expects to receive all remaining money during 2021 with no discount. During 2020 , the government increases cash and a revenue for the amount received in addition, a recelvable and an unavailable revenue for $222,600 are recognized. e. In the general information, an overall increase in the city's net position of $27.00 dwas found on the government-wide financial statements. What is the correct overall change in the city's net position as reported on the govemment-wide financial statements? b. In the general information, an overall increase of $32,500 is reported in the fund balance for the general fund. What was the correct change during 2020 ? The goverment wide Inancial nakements provide the lollowing figures - Educition reports net expersies of $658,000. - Pada mporta net expenate of $147,000 The tund tranciar ataveruerts provide ine folowing for the entre year: - The generwi furd fogers a 132.500 increase in its tund balance. - The capiai propacts tund roporis a 562250 increase in its fund basince. - The enterprise fund reportis a 863,250 increase in ts net postion. enc. View tach of the following stuations as indecendent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started