Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL THREE QUESTIONS! Use the following scenario to answer questions 10 through 13. Rowdy died on January 1, 2023 after a rattlesnake bit

PLEASE ANSWER ALL THREE QUESTIONS!

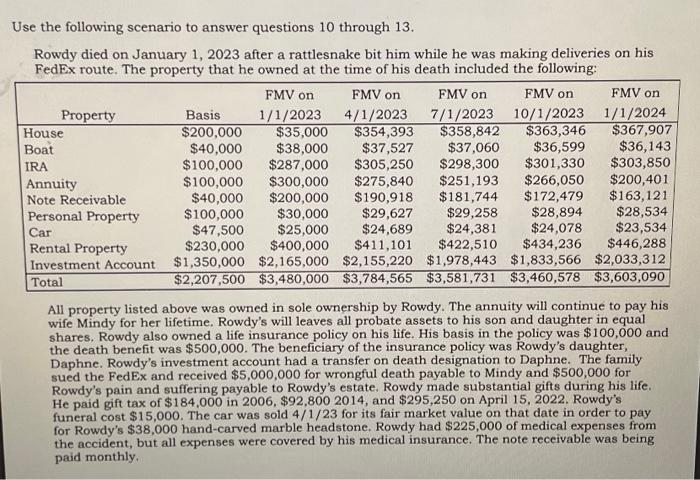

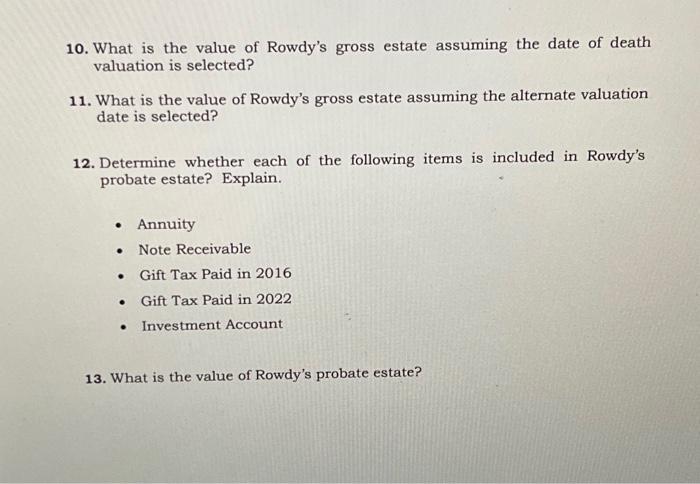

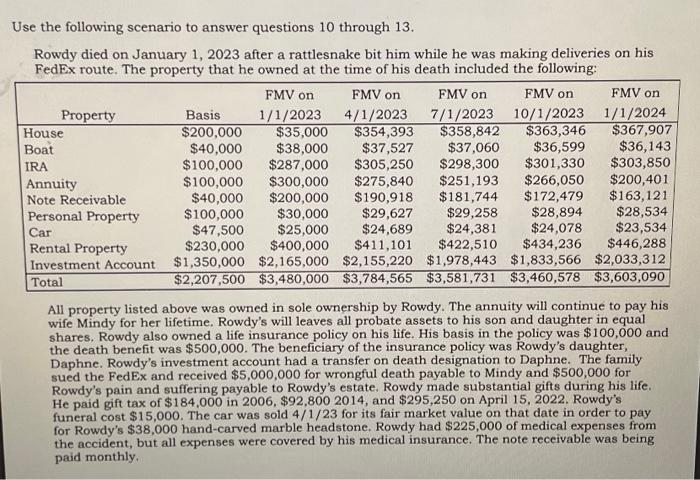

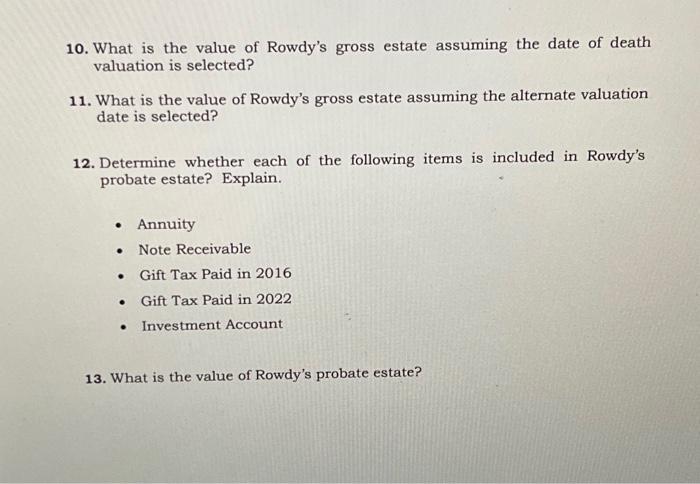

Use the following scenario to answer questions 10 through 13. Rowdy died on January 1, 2023 after a rattlesnake bit him while he was making deliveries on his FedEx route. The property that he owned at the time of his death included the following: All property listed above was owned in sole ownership by Rowdy. The annuity will continue to pay his wife Mindy for her lifetime. Rowdy's will leaves all probate assets to his son and daughter in equal shares. Rowdy also owned a life insurance policy on his life. His basis in the policy was $100,000 and the death benefit was $500,000. The beneficiary of the insurance policy was Rowdy's daughter, Daphne. Rowdy's investment account had a transfer on death designation to Daphne. The family sued the FedEx and received $5,000,000 for wrongful death payable to Mindy and $500,000 for Rowdy's pain and suffering payable to Rowdy's estate. Rowdy made substantial gifts during his life. He paid gift tax of $184,000 in 2006, $92,8002014, and $295,250 on April 15, 2022. Rowdy's funeral cost $15,000. The car was sold 4/1/23 for its fair market value on that date in order to pay for Rowdy's $38,000 hand-carved marble headstone. Rowdy had $225,000 of medical expenses from the accident, but all expenses were covered by his medical insurance. The note receivable was being paid monthly. 10. What is the value of Rowdy's gross estate assuming the date of death valuation is selected? 11. What is the value of Rowdy's gross estate assuming the alternate valuation date is selected? 12. Determine whether each of the following items is included in Rowdy's probate estate? Explain. - Annuity - Note Receivable - Gift Tax Paid in 2016 - Gift Tax Paid in 2022 - Investment Account 13. What is the value of Rowdy's probate estate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started