Please answer all three. Thank you.

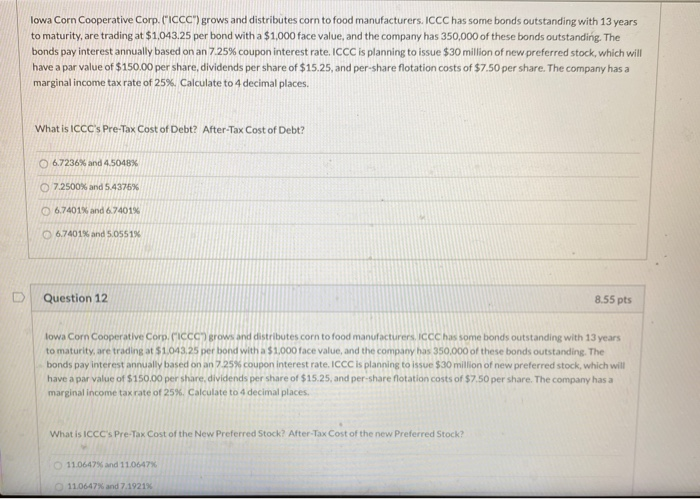

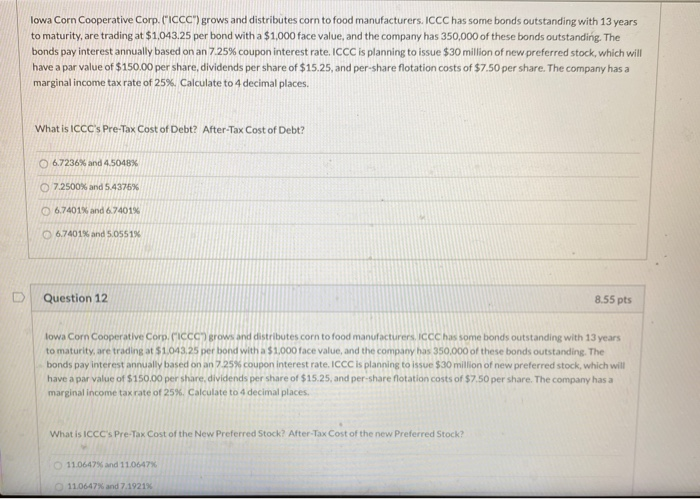

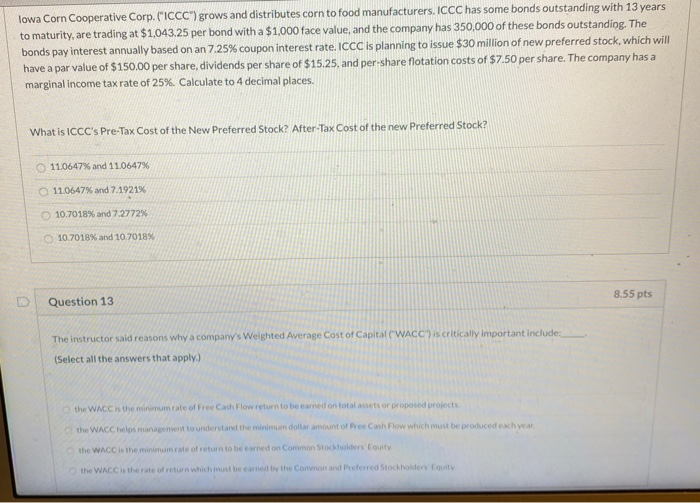

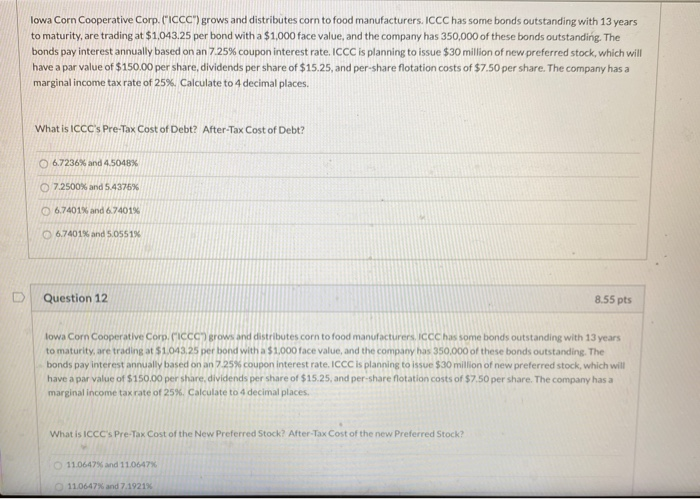

lowa Corn Cooperative Corp. ("ICCC") grows and distributes corn to food manufacturers. ICCC has some bonds outstanding with 13 years to maturity, are trading at $1,043.25 per bond with a $1,000 face value, and the company has 350,000 of these bonds outstanding. The bonds pay interest annually based on an 7 25% coupon interest rate ICCC is planning to issue $30 million of new preferred stock, which will have a par value of $150.00 per share, dividends per share of $15.25, and per-share flotation costs of $7.50 per share. The company has a marginal income tax rate of 25%. Calculate to 4 decimal places. What is ICCC's Pre-Tax Cost of Debt? After-Tax Cost of Debt? 6.7236% and 4.5048% 7.2500% and 5.4376% 6.7401% and 6.7401% 6.7401% and 5.0551% Question 12 8.55 pts lowa Corn Cooperative Corp. (CCC grows and distributes corn to food manufacturers, ICCC has some bonds outstanding with 13 years to maturity, are trading at $1.043.25 per bond with a $1,000 face value, and the company has 350,000 of these bonds outstanding. The bonds pay interest annually based on an 7.25% coupon interest rate, ICCC is planning to issue $30 million of new preferred stock, which will have a par value of $150.00 per share, dividends per share of $15.25, and per-share flotation costs of $7.50 per share. The company has a marginal income tax rate of 25% Calculate to a decimal places. What is Icec's Pre-Tax Cost of the New Preferred Stock? After-Tax Cost of the new Preferred Stock? 11.0647% and 11.0647% 11.0647 and 7.1921% lowa Corn Cooperative Corp. ("ICCC") grows and distributes corn to food manufacturers. ICCC has some bonds outstanding with 13 years to maturity, are trading at $1,043.25 per bond with a $1,000 face value, and the company has 350,000 of these bonds outstanding. The bonds pay interest annually based on an 7.25% coupon interest rate. ICCC is planning to issue $30 million of new preferred stock, which will have a par value of $150.00 per share, dividends per share of $15.25, and per-share flotation costs of $7.50 per share. The company has a marginal income tax rate of 25%. Calculate to 4 decimal places. What is ICCC's Pre-Tax Cost of the New Preferred Stock? After-Tax Cost of the new Preferred Stock? 11.0647% and 11.0647% 11.0647% and 7.1921% 10.7018% and 7.2772% 10.7018% and 10.7018% 8.55 pts Question 13 The instructor said reasons why a company's Weighted Average Cost of Capital (WACC) is critically important include: (Select all the answers that apply.) the WACC is the minimum rate of Free Cash Flow return to be earned on total assets or proposed projects the WACC hel management to understand the minimum dolor amount of Free Cash Flow which must be produced each year. the WACC is the minimum rate of return to be cared on Common Stockholders uity the WACC is the rate of return which must be earned by the Common and Preferred Stockholders Equity