Answered step by step

Verified Expert Solution

Question

1 Approved Answer

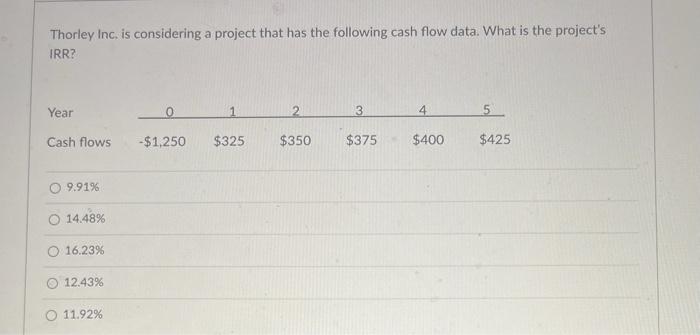

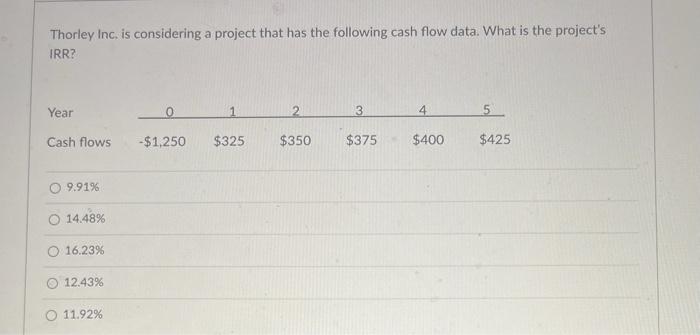

please answer all three, will upvote ASAP! Thorley Inc, is considering a project that has the following cash flow data. What is the project's IRR?

please answer all three, will upvote ASAP!

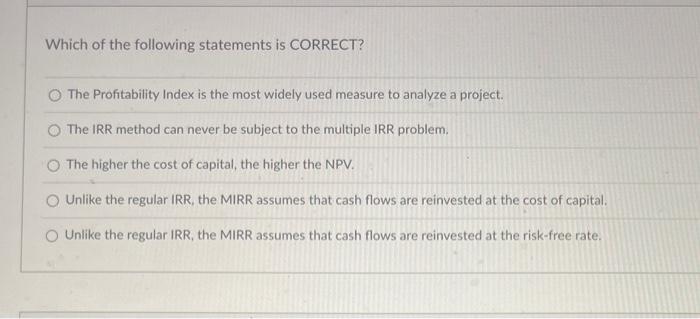

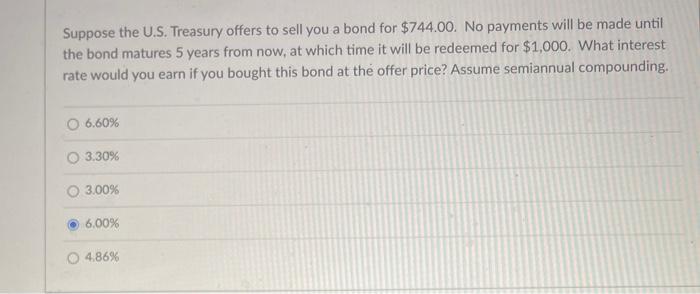

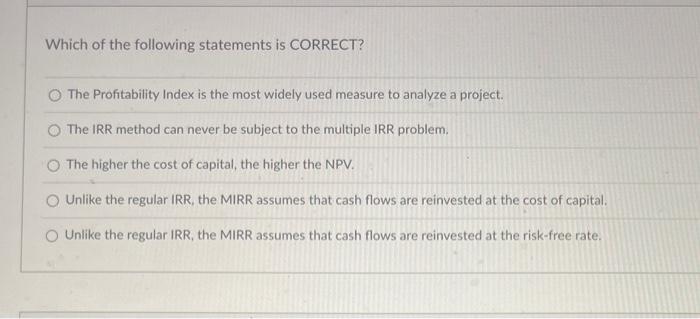

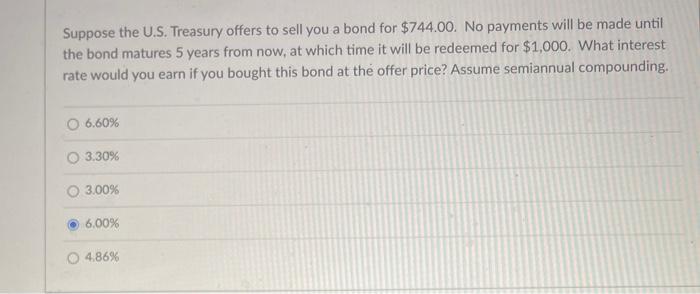

Thorley Inc, is considering a project that has the following cash flow data. What is the project's IRR? 9.91% 14.48% 16.23% 12.43% 11.92% Which of the following statements is CORRECT? The Profitability Index is the most widely used measure to analyze a project. The IRR method can never be subject to the multiple IRR problem. The higher the cost of capital, the higher the NPV. Unlike the regular IRR, the MIRR assumes that cash flows are reinvested at the cost of capital. Unlike the regular IRR, the MIRR assumes that cash flows are reinvested at the risk-free rate. Suppose the U.S. Treasury offers to sell you a bond for $744.00. No payments will be made until the bond matures 5 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond at the offer price? Assume semiannual compounding. 6.60% 3.30% 3.00% 6.00% 4.86%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started