Answered step by step

Verified Expert Solution

Question

1 Approved Answer

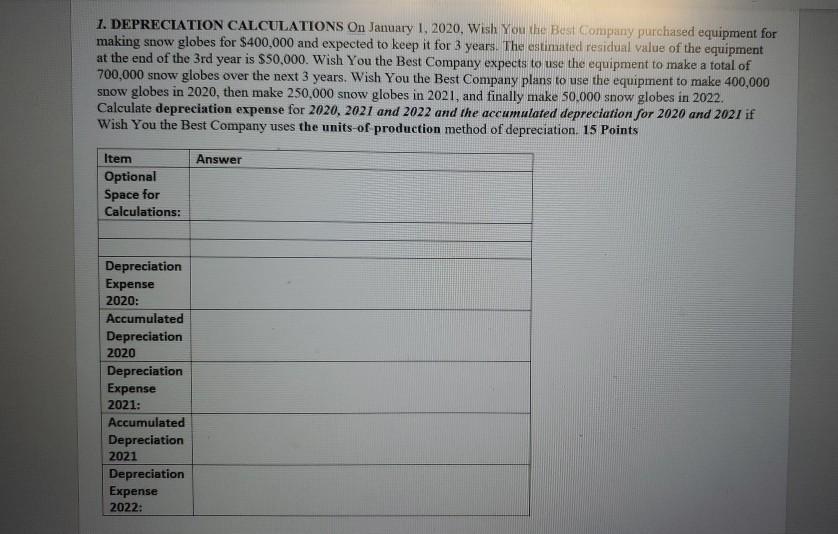

PLEASE ANSWER ALL 1. DEPRECIATION CALCULATIONS On January 1, 2020, Wish You the Best Company purchased equipment for making snow globes for $400,000 and expected

PLEASE ANSWER ALL

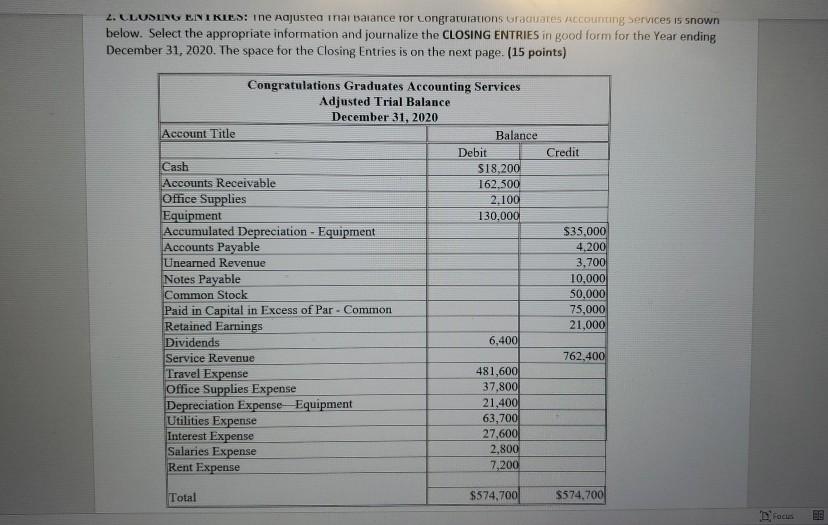

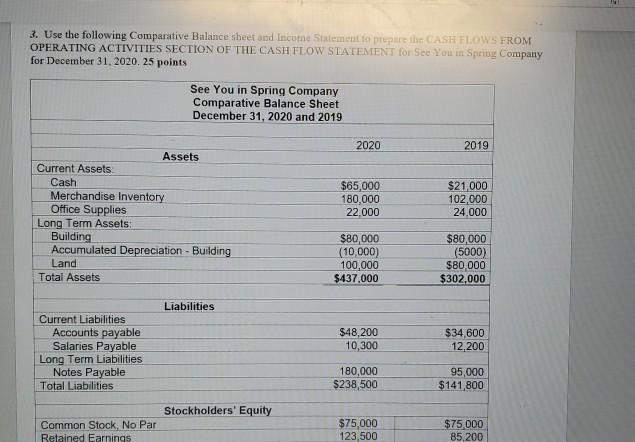

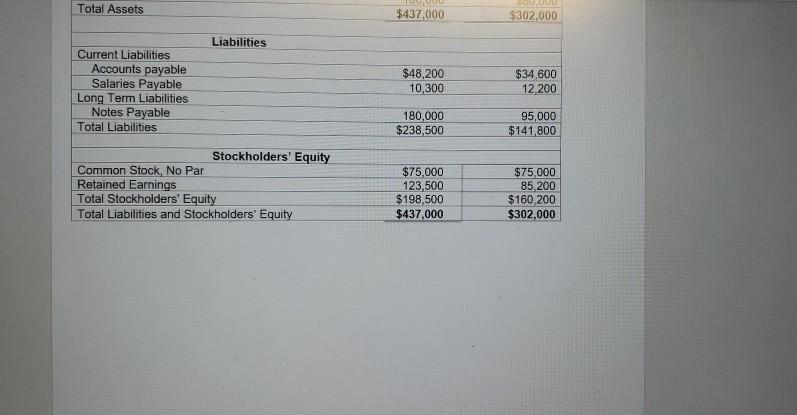

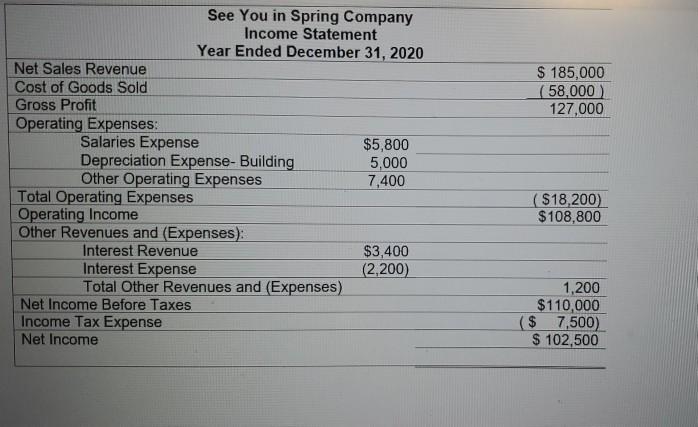

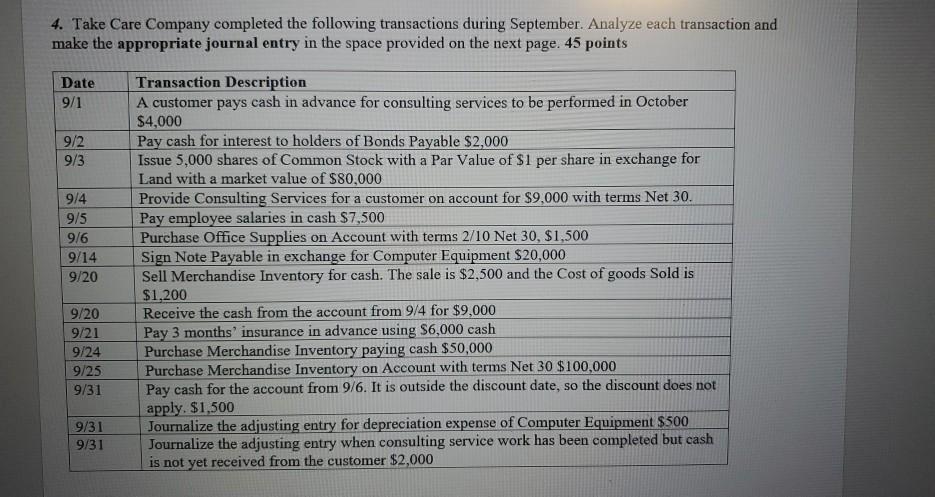

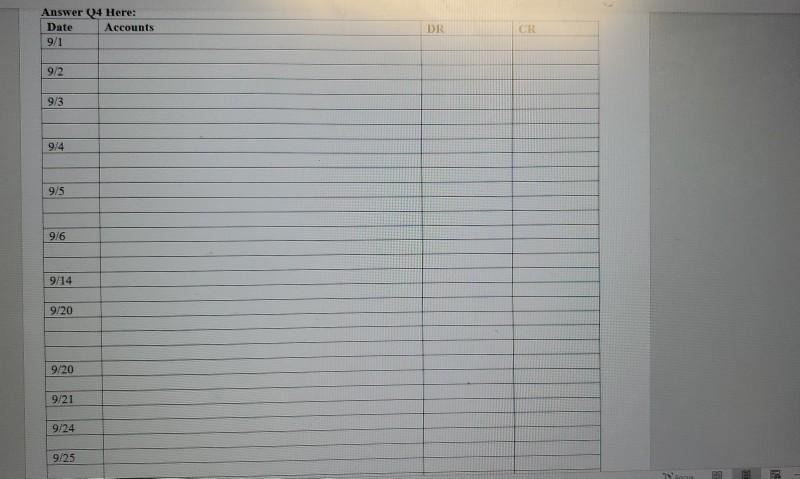

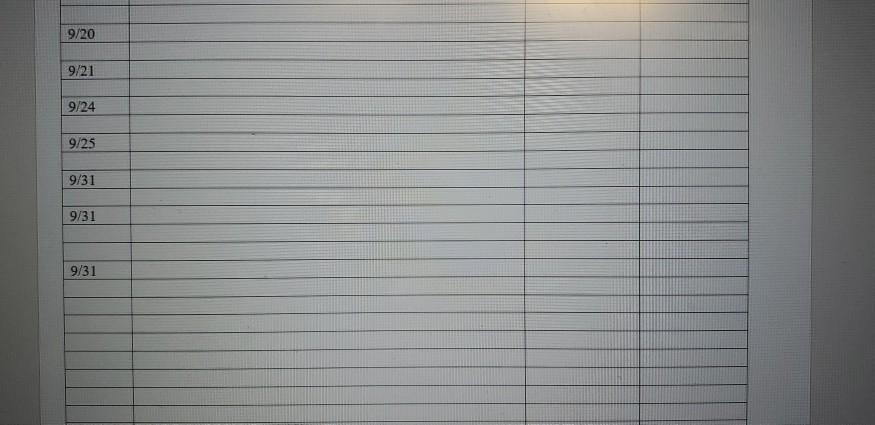

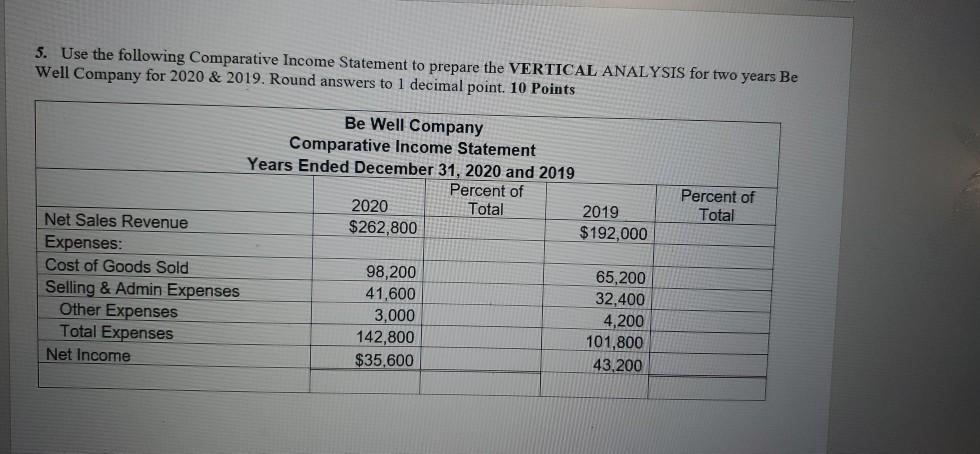

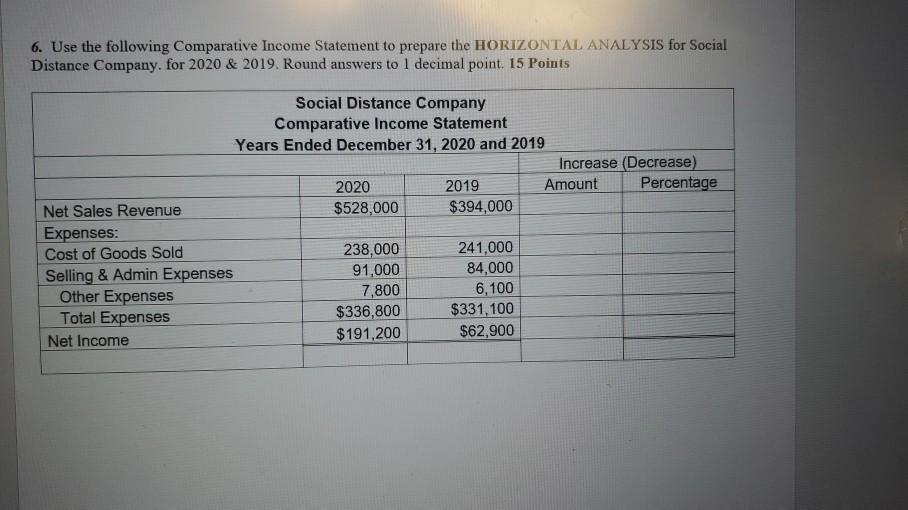

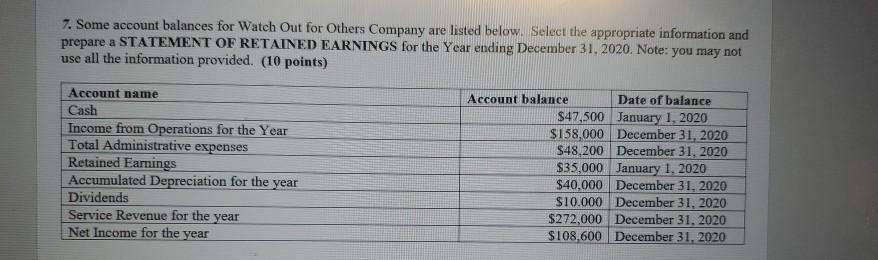

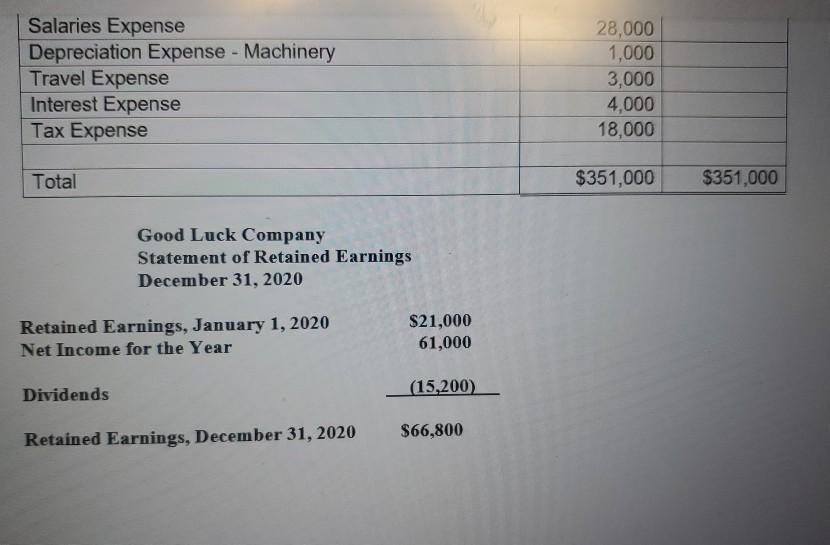

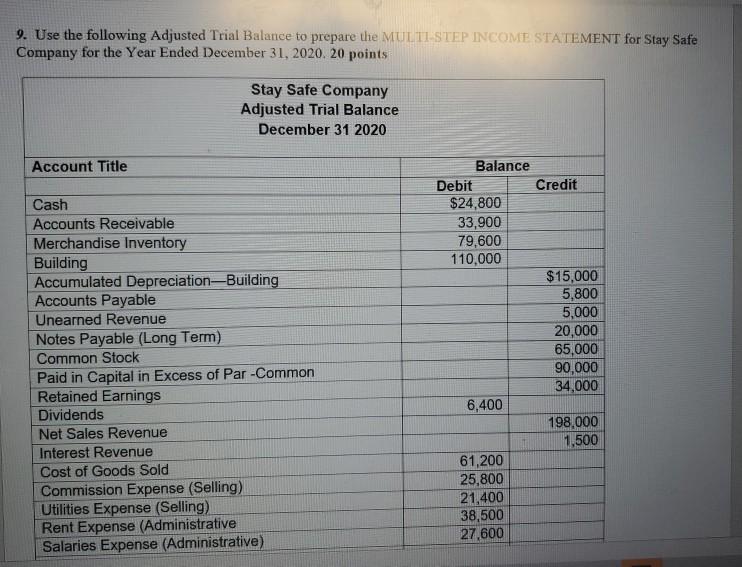

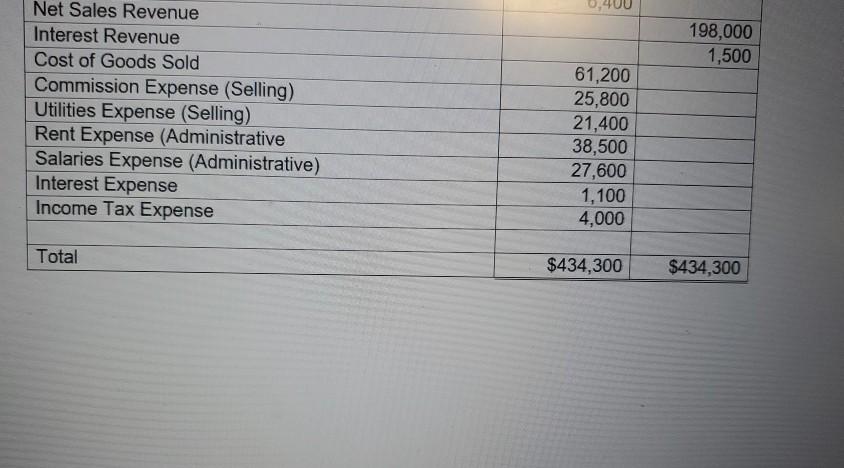

1. DEPRECIATION CALCULATIONS On January 1, 2020, Wish You the Best Company purchased equipment for making snow globes for $400,000 and expected to keep it for 3 years. The estimated residual value of the equipment at the end of the 3rd year is $50,000. Wish You the Best Company expects to use the equipment to make a total of 700,000 snow globes over the next 3 years. Wish You the Best Company plans to use the equipment to make 400,000 snow globes in 2020, then make 250,000 snow globes in 2021, and finally make 50.000 snow globes in 2022. Calculate depreciation expense for 2020, 2021 and 2022 and the accumulated depreciation for 2020 and 2021 if Wish You the Best Company uses the units of production method of depreciation. 15 Points Answer Item Optional Space for Calculations: Depreciation Expense 2020: Accumulated Depreciation 2020 Depreciation Expense 2021: Accumulated Depreciation 2021 Depreciation Expense 2022: 2. ULUSUNG EINTRIES: The Adjustea inararance for congratulations oracuares xccounting Services is snown below. Select the appropriate information and journalize the CLOSING ENTRIES in good form for the Year ending December 31, 2020. The space for the Closing Entries is on the next page. (15 points) Credit Congratulations Graduates Accounting Services Adjusted Trial Balance December 31, 2020 Account Title Balance Debit Cash S18,200 Accounts Receivable 162,500 Office Supplies 2.100 Equipment 130.000 Accumulated Depreciation - Equipment Accounts Payable Unearned Revenue Notes Payable Common Stock Paid in Capital in Excess of Par - Common Retained Earnings Dividends 6,400 Service Revenue Travel Expense 481,600 Office Supplies Expense 37.800 Depreciation Expense Equipment 21,400 Utilities Expense 63,700 Interest Expense 27,600 Salaries Expense 2,800 Rent Expense 7,200 Total $574,700 $35,000 4,200 3,700 10,000 50.000 75,000 21,000 762,400 $574,700 PE Accounts Date Dec. 31 DR. CR Dec. 31 Dec. 31 Dec. 31 3. Use the following Comparative Balance sheet and Income Statement to prepare the CASH FLOWS FROM OPERATING ACTIVITIES SECTION OF THE CASH FLOW STATEMENT for See You in Spring Company for December 31, 2020. 25 points See You in Spring Company Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Assets Current Assets Cash Merchandise Inventory Office Supplies Long Term Assets Building Accumulated Depreciation - Building Land Total Assets $65,000 180.000 22.000 $21,000 102,000 24.000 $80,000 (10,000) 100,000 $437.000 $80,000 (5000) $80 000 $302.000 Liabilities Current Liabilities Accounts payable Salaries Payable Long Term Liabilities Notes Payable Total Liabilities $48,200 10,300 $34 600 12,200 180,000 $238,500 95,000 $141,800 Stockholders' Equity Common Stock, No Par Retained Earnings $75,000 123,500 $75 000 85,200 Total Assets $437,000 $302.000 Liabilities Current Liabilities Accounts payable Salaries Payable Long Term Liabilities Notes Payable Total Liabilities $48,200 10,300 $34.600 12.200 180,000 $238,500 95,000 $141,800 Stockholders' Equity Common Stock No Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $75,000 123,500 $198,500 $437,000 $75.000 85,200 $160 200 $302,000 S 185,000 (58,000) 127,000 See You in Spring Company Income Statement Year Ended December 31, 2020 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense $5,800 Depreciation Expense- Building 5,000 Other Operating Expenses 7,400 Total Operating Expenses Operating Income Other Revenues and (Expenses): Interest Revenue $3,400 Interest Expense (2,200) Total Other Revenues and (Expenses) Net Income Before Taxes Income Tax Expense Net Income ($18,200) $108,800 1,200 $110,000 ($ 7,500) $ 102,500 See You in Spring Company Statement of Cash Flows (Operations only) Year Ended December 31, 2020 4. Take Care Company completed the following transactions during September. Analyze each transaction and make the appropriate journal entry in the space provided on the next page. 45 points Date 9/1 9/2 9/3 9/4 9/5 9/6 9/14 9/20 Transaction Description A customer pays cash in advance for consulting services to be performed in October $4,000 Pay cash for interest to holders of Bonds Payable $2,000 Issue 5,000 shares of Common Stock with a Par Value of $1 per share in exchange for Land with a market value of $80,000 Provide Consulting Services for a customer on account for $9,000 with terms Net 30. Pay employee salaries in cash $7,500 Purchase Office Supplies on Account with terms 2/10 Net 30, $1,500 Sign Note Payable in exchange for Computer Equipment $20,000 Sell Merchandise Inventory for cash. The sale is $2,500 and the Cost of goods Sold is $1,200 Receive the cash from the account from 9/4 for $9,000 Pay 3 months' insurance in advance using $6,000 cash Purchase Merchandise Inventory paying cash $50,000 Purchase Merchandise Inventory on Account with terms Net 30 $100,000 Pay cash for the account from 9/6. It is outside the discount date, so the discount does not apply. $1,500 Journalize the adjusting entry for depreciation expense of Computer Equipment $500 Journalize the adjusting entry when consulting service work has been completed but cash is not yet received from the customer $2,000 9/20 9/21 9/24 9/25 9/31 9/31 9/31 Answer Q4 Here: Date Accounts 9/1 DR CR 9/2 9/3 9/4 9/5 976 9/14 9/20 9/20 9/21 9/24 9/25 TS 920 921 9/24 925 931 9/31 931 5. Use the following Comparative Income Statement to prepare the VERTICAL ANALYSIS for two years Be Well Company for 2020 & 2019. Round answers to 1 decimal point. 10 Points Percent of Total Be Well Company Comparative Income Statement Years Ended December 31, 2020 and 2019 Percent of 2020 Total 2019 Net Sales Revenue $262,800 $192,000 Expenses: Cost of Goods Sold 98,200 65,200 Selling & Admin Expenses 41,600 32,400 Other Expenses 3,000 4,200 Total Expenses 142,800 101,800 Net Income $35,600 43,200 6. Use the following Comparative Income Statement to prepare the HORIZONTAL ANALYSIS for Social Distance Company. for 2020 & 2019. Round answers to 1 decimal point. 15 Points Social Distance Company Comparative Income Statement Years Ended December 31, 2020 and 2019 Increase (Decrease) 2020 2019 Amount Percentage Net Sales Revenue $528,000 $394,000 Expenses: Cost of Goods Sold 238,000 241,000 Selling & Admin Expenses 91,000 84,000 Other Expenses 7,800 6,100 Total Expenses $336,800 $331,100 Net Income $191,200 $62,900 7. Some account balances for Watch Out for Others Company are listed below. Select the appropriate information and prepare a STATEMENT OF RETAINED EARNINGS for the Year ending December 31, 2020. Note: you may not use all the information provided. (10 points) Account name Cash Income from Operations for the Year Total Administrative expenses Retained Earnings Accumulated Depreciation for the year Dividends Service Revenue for the year Net Income for the year Account balance Date of balance $47.500 January 1, 2020 $ 158,000 December 31, 2020 $48.200 December 31, 2020 $35,000 January 1. 2020 $40.000 December 31, 2020 $10.000 December 31, 2020 $272,000 December 31, 2020 $108.600 December 31, 2020 Watch Out for Others Corporation Retained Earnings Statement For the Year Ended December 31, 2020 8. Use the following Adjusted Trial Balance and Statement of Retained Eurings to prepare the CLASSIFIED BALANCE SHEET for Good Luck Company for December 31, 2020.30 points Good Luck Company Adjusted Trial Balance December 31, 2020 Account Title Balance Debit Credit $44,700 2,100 35,000 80,000 120,000 Cash Accounts Receivable Office Supplies Land Machinery Accumulated Depreciation - Machinery Accounts Payable Interest Payable Notes Payable (Long Term) Bonds Payable (Long Term) Common Stock Preferred Stock Retained Earnings Dividends Service Revenue Salaries Expense Depreciation Expense - Machinery Travel Expense $27,000 4,500 3,500 42.000 13,000 50,000 75,000 21,000 15,200 115.000 28,000 1,000 3,000 I. Salaries Expense Depreciation Expense - Machinery Travel Expense Interest Expense Tax Expense 28,000 1,000 3,000 4,000 18,000 Total $351,000 $351,000 Good Luck Company Statement of Retained Earnings December 31, 2020 Retained Earnings, January 1, 2020 Net Income for the Year $21,000 61,000 Dividends (15,200) $66,800 Retained Earnings, December 31, 2020 Space for Q8 Good Luck Balance Sheet December 31, 2020 Assets 9. Use the following Adjusted Trial Balance to prepare the MULTI-STEP INCOME STATEMENT for Stay Safe Company for the Year Ended December 31, 2020. 20 points Stay Safe Company Adjusted Trial Balance December 31 2020 Account Title Cash Accounts Receivable Merchandise Inventory Building Accumulated Depreciation-Building Accounts Payable Unearned Revenue Notes Payable (Long Term) Common Stock Paid in Capital in Excess of Par-Common Retained Earnings Dividends Net Sales Revenue Interest Revenue Cost of Goods Sold Commission Expense (Selling) Utilities Expense (Selling) Rent Expense (Administrative Salaries Expense (Administrative) Balance Debit Credit $24,800 33,900 79,600 110,000 $15,000 5,800 5,000 20,000 65,000 90,000 34.000 6,400 198,000 1,500 61,200 25,800 21,400 38,500 27,600 198,000 1,500 Net Sales Revenue Interest Revenue Cost of Goods Sold Commission Expense (Selling) Utilities Expense (Selling) Rent Expense (Administrative Salaries Expense (Administrative) Interest Expense Income Tax Expense 61,200 25,800 21,400 38,500 27,600 1,100 4,000 Total $434,300 $434,300 Answer Q9 here: Stay Safe Company Income Statement For the Year Ended December 31, 2020 IS 10. RECONCILIATION Use the following information to prepare a bank reconciliation for Enjoy the Break Corp December 2020. 15 Points The bank statement shows the bank collected accounts receivable in the total amount of $23,200 for Enjoy the Break Corp. and deposited the cash in the account at the bank but Enjoy the Break Corp. has not yet entered the amount in the books. Outstanding checks total $25,000. The bank statement shows the bank service charge is $1,500. The bank statement shows customer's nonsufficient funds checks total $38,000 A deposit of $12,200 is in transit. The bank balance at December 31, 2020 was $65,000. The bank statement shows the bank deposited interest earned by Enjoy the Break Corp in the amount of $2,800 The book balance is $65,700 at December 31, 2020 Enjoy the Break Corp. Bank Reconciliation December 31, 2020 BOOK BANKStep by Step Solution

There are 3 Steps involved in it

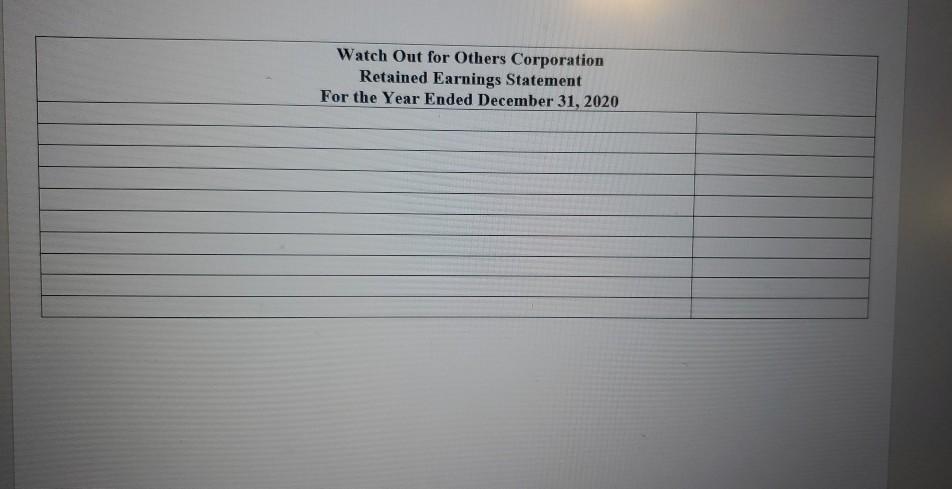

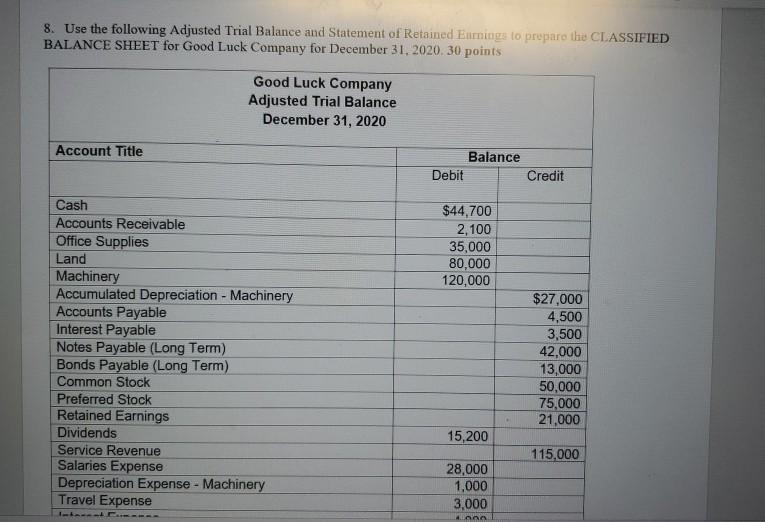

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started