Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all What is the expected rate of return for the preferred stock based on the following information? Assume that the stock is priced

please answer all

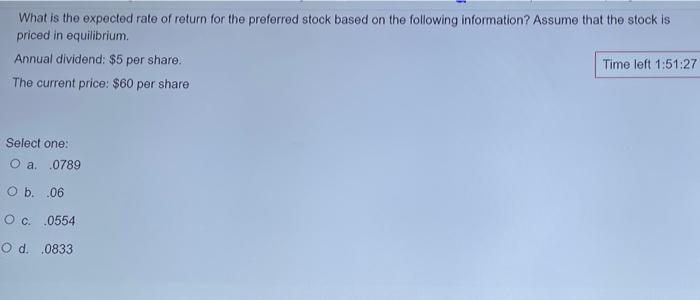

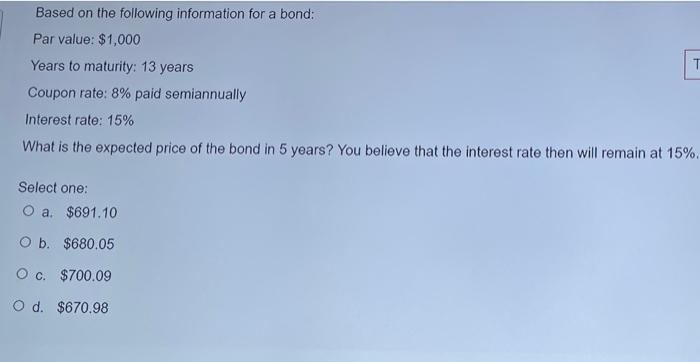

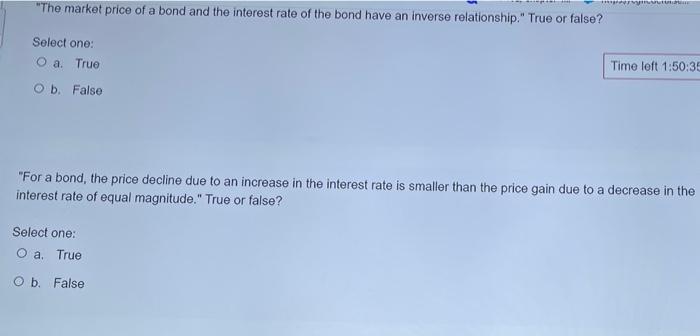

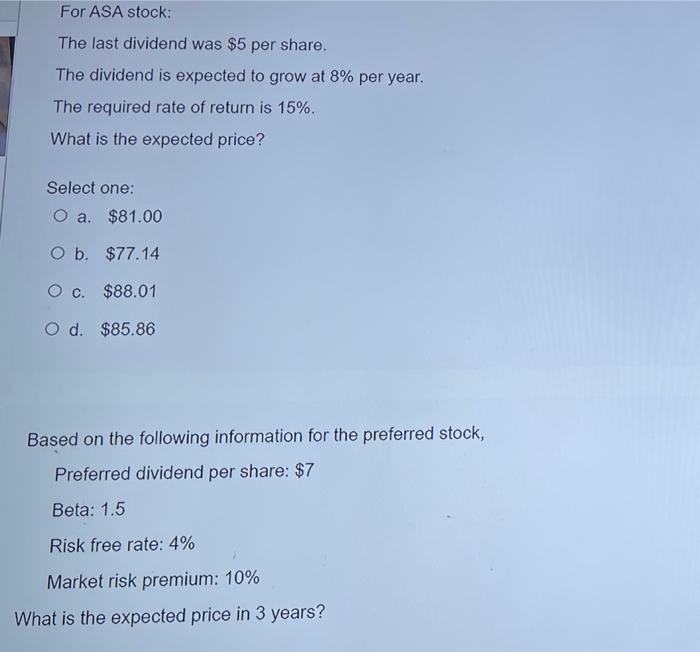

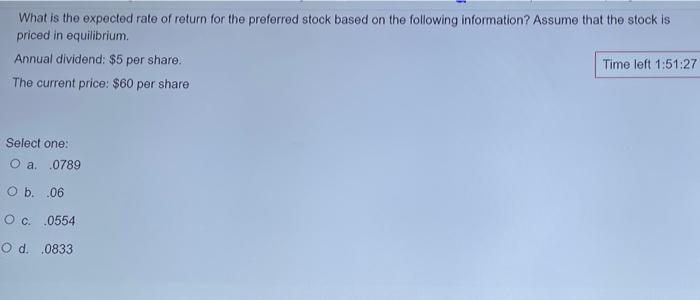

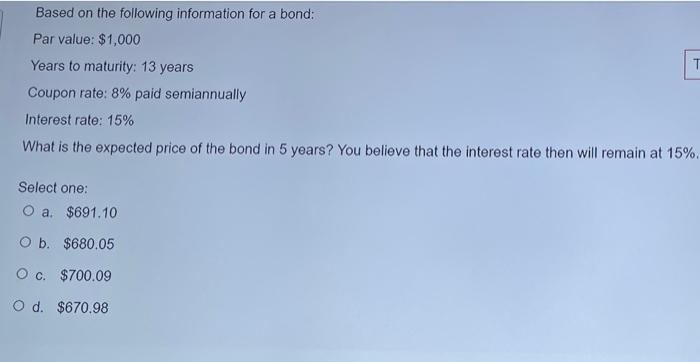

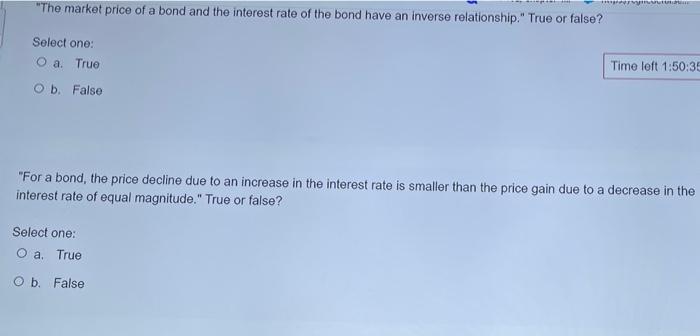

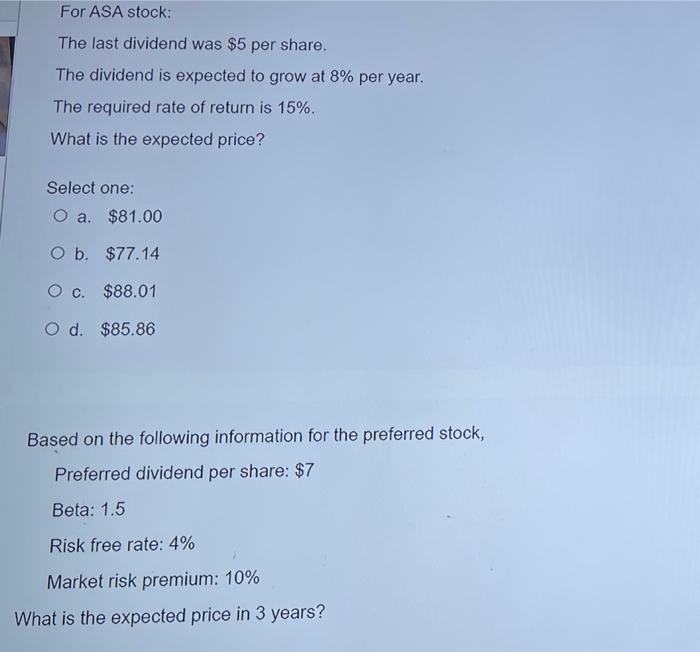

What is the expected rate of return for the preferred stock based on the following information? Assume that the stock is priced in equilibrium Annual dividend: $5 per share. Time left 1:51:27 The current price: $60 per share Select one: O a. .0789 Ob. .06 O c. .0554 O d. .0833 Based on the following information for a bond: Par value: $1,000 T Years to maturity: 13 years Coupon rate: 8% paid semiannually Interest rate: 15% What is the expected price of the bond in 5 years? You believe that the interest rate then will remain at 15%. Select one: O a. $691.10 O b. $680.05 O c. $700.09 O d. $670.98 "The market price of a bond and the interest rate of the bond have an inverse relationship." True or false? Select one: O a. True Time left 1:50:38 O b. False "For a bond, the price decline due to an increase in the interest rate is smaller than the price gain due to a decrease in the interest rate of equal magnitude." True or false? Select one: O a. True Ob False For ASA stock: The last dividend was $5 per share. The dividend is expected to grow at 8% per year. The required rate of return is 15%. What is the expected price? Select one: O a. $81.00 O b. $77.14 O c. $88.01 O d. $85.86 Based on the following information for the preferred stock, Preferred dividend per share: $7 Beta: 1.5 Risk free rate: 4% Market risk premium: 10% What is the expected price in 3 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started