Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all will give you like 9. Imagine you can take one of two loans to finance your real estate purchase. Both loans have

Please answer all will give you like

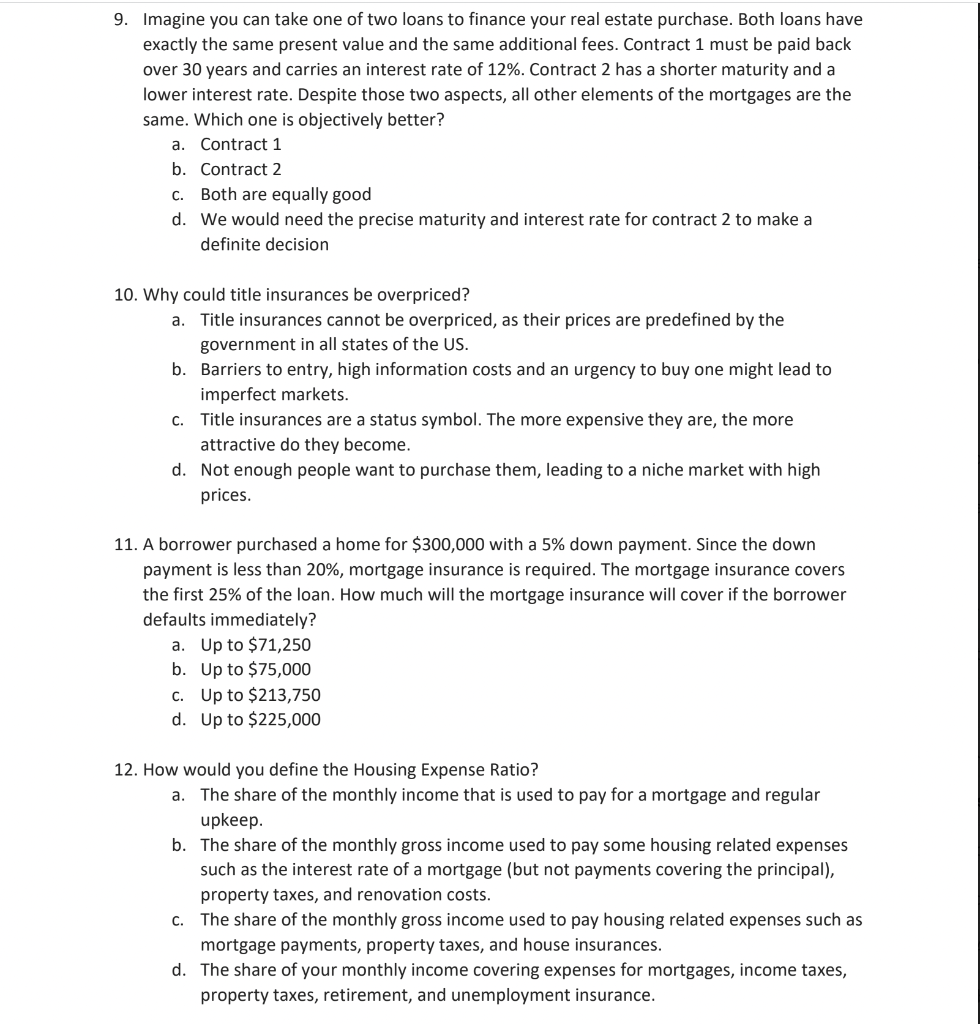

9. Imagine you can take one of two loans to finance your real estate purchase. Both loans have exactly the same present value and the same additional fees. Contract 1 must be paid back over 30 years and carries an interest rate of 12%. Contract 2 has a shorter maturity and a lower interest rate. Despite those two aspects, all other elements of the mortgages are the same. Which one is objectively better? a. Contract 1 b. Contract 2 c. Both are equally good d. We would need the precise maturity and interest rate for contract 2 to make a definite decision 10. Why could title insurances be overpriced? a. Title insurances cannot be overpriced, as their prices are predefined by the government in all states of the US. b. Barriers to entry, high information costs and an urgency to buy one might lead to imperfect markets. c. Title insurances are a status symbol. The more expensive they are, the more attractive do they become. d. Not enough people want to purchase them, leading to a niche market with high prices. 11. A borrower purchased a home for $300,000 with a 5% down payment. Since the down payment is less than 20%, mortgage insurance is required. The mortgage insurance covers the first 25% of the loan. How much will the mortgage insurance will cover if the borrower defaults immediately? a. Up to $71,250 b. Up to $75,000 c. Up to $213,750 d. Up to $225,000 12. How would you define the Housing Expense Ratio? a. The share of the monthly income that is used to pay for a mortgage and regular upkeep. b. The share of the monthly gross income used to pay some housing related expenses such as the interest rate of a mortgage (but not payments covering the principal), property taxes, and renovation costs. c. The share of the monthly gross income used to pay housing related expenses such as mortgage payments, property taxes, and house insurances. d. The share of your monthly income covering expenses for mortgages, income taxes, property taxes, retirement, and unemployment insuranceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started