Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all, will leave a good teview #1. Zeinu Construction enters into a contract with a customer to build a warehouse for $800,000 on

Please answer all, will leave a good teview

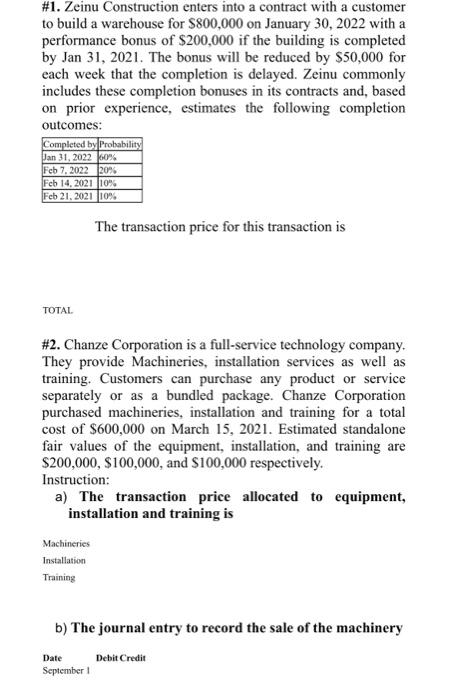

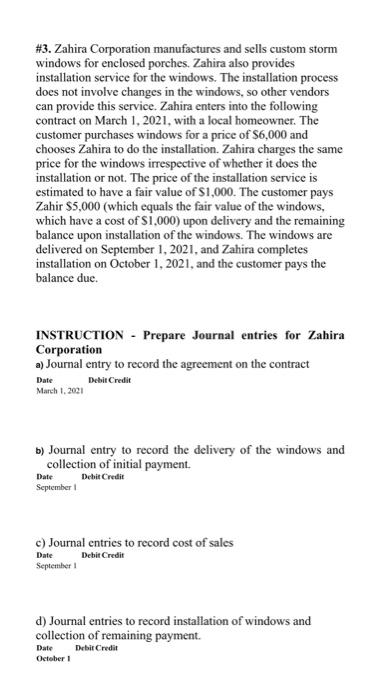

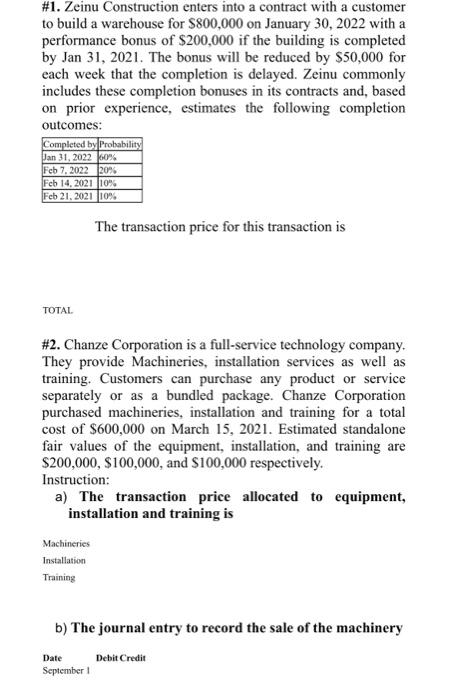

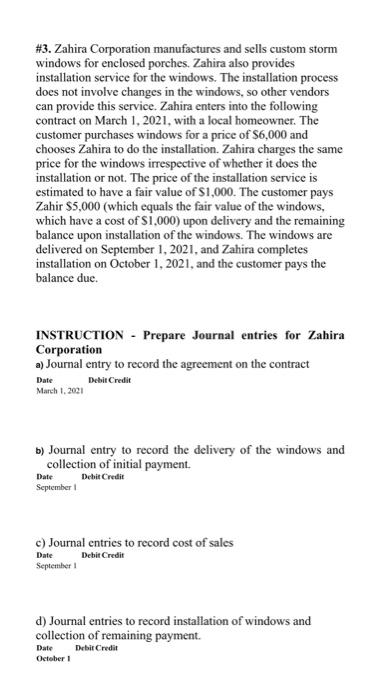

#1. Zeinu Construction enters into a contract with a customer to build a warehouse for $800,000 on January 30, 2022 with a performance bonus of $200,000 if the building is completed by Jan 31, 2021. The bonus will be reduced by $50,000 for each week that the completion is delayed. Zeinu commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability Jan 31, 2022 60% Feb 7, 2022 20% Feb 14, 2021 10% Feb 21.2021 10% The transaction price for this transaction is TOTAL #2. Chanze Corporation is a full-service technology company. They provide Machineries, installation services as well as training. Customers can purchase any product or service separately or as a bundled package. Chanze Corporation purchased machineries, installation and training for a total cost of $600,000 on March 15, 2021. Estimated standalone fair values of the equipment, installation, and training are $200,000, $100,000, and $100,000 respectively. Instruction: a) The transaction price allocated to equipment, installation and training is Machineries Installation Training b) The journal entry to record the sale of the machinery Debit Credit Date September #3. Zahira Corporation manufactures and sells custom storm windows for enclosed porches. Zahira also provides installation service for the windows. The installation process does not involve changes in the windows, so other vendors can provide this service. Zahira enters into the following contract on March 1, 2021, with a local homeowner. The customer purchases windows for a price of S6,000 and chooses Zahira to do the installation. Zahira charges the same price for the windows irrespective of whether it does the installation or not. The price of the installation service is estimated to have a fair value of $1,000. The customer pays Zahir $5,000 (which equals the fair value of the windows, which have a cost of $1.000) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2021, and Zahira completes installation on October 1, 2021, and the customer pays the balance due. INSTRUCTION - Prepare Journal entries for Zahira Corporation a) Journal entry to record the agreement on the contract Date Debit Credit March 1, 2021 b) Journal entry to record the delivery of the windows and collection of initial payment. Date Debit Credit September c) Journal entries to record cost of sales Debit Credit Date September d) Journal entries to record installation of windows and collection of remaining payment. Debit Credit Date October

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started