please answer all will rate!

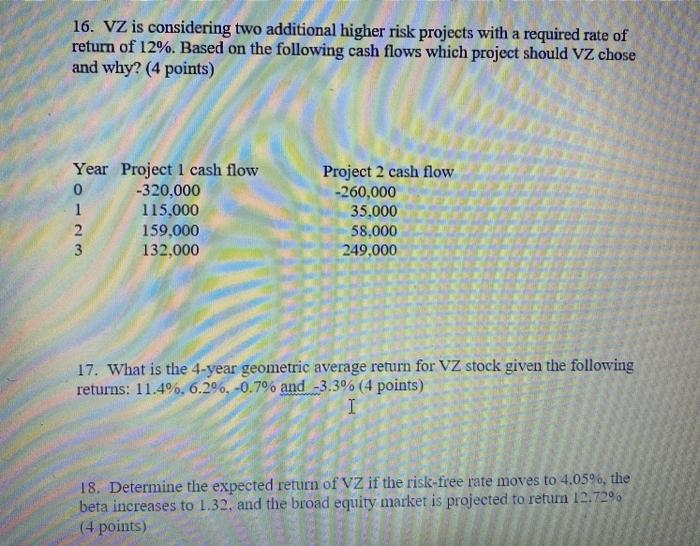

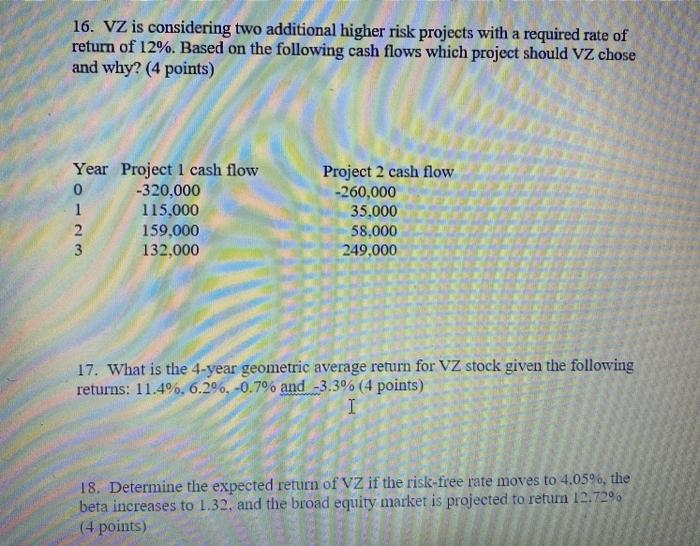

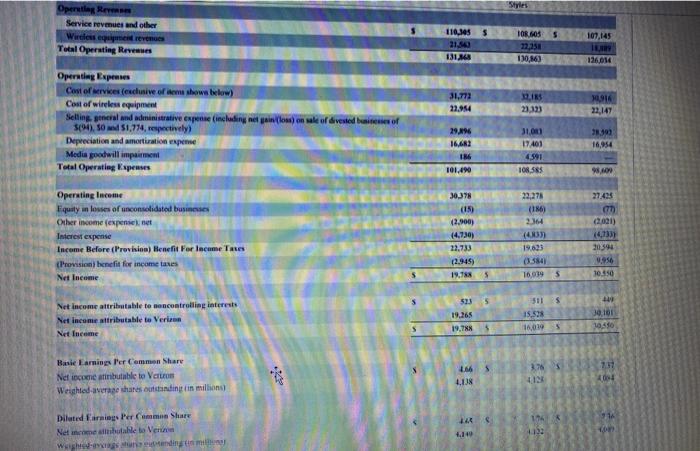

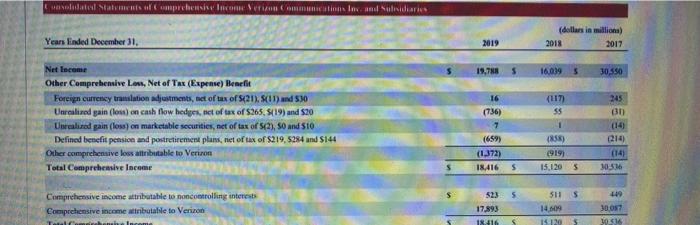

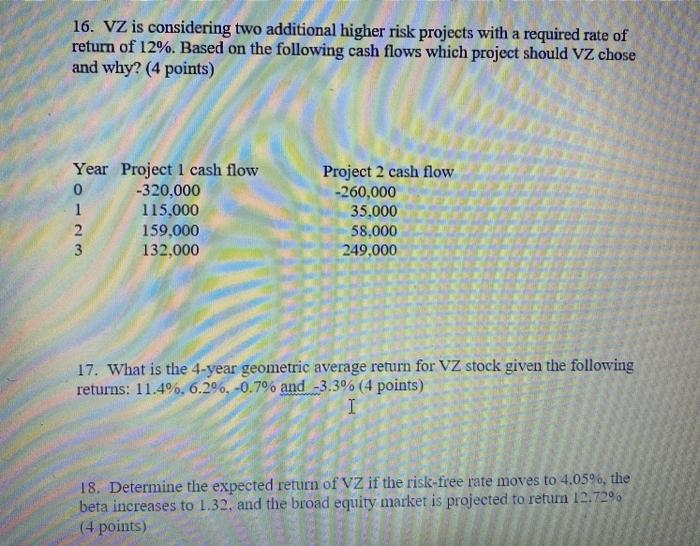

16. VZ is considering two additional higher risk projects with a required rate of return of 12%. Based on the following cash flows which project should vz chose and why? (4 points) NO Year Project 1 cash flow -320,000 115,000 159.000 3 132,000 Project 2 cash flow -260,000 35.000 58,000 249,000 17. What is the 4-year geometric average return for VZ stock given the following returns: 11.4%. 6.2%, -0.7% and -3.3% (4 points) I 18. Determine the expected return of VZ if the risk-free rate moves to 4.05%, the beta increases to 1.32, and the broad equity market is projected to return 12.72% (4 points) Operater Rere Service revmues and other Wielen equipment revenues Total Operating Reviews $ s 110,345 21.840 131 TOR. SO 22,258 110,16) 107,145 1. 126.01 31,772 23.964 IRS 23.123 10,916 22,147 Operating Express Cost of rices exclusive of shown below) Cost of wireless equip Selling general and administrative expense (including met inloon ak of divested bees of 394), 51,714, respectively Depreciation and amortization experte Media goodwill impairment Total Operating Kiprases 29.296 16.62 38.390 16,954 31.01 17.40) 6591 108585 101.490 98.00 22,278 (16) Operating Income Equity in losses of unconsolidated businesses Other income expense Interest expense Income Before(Provision) Henefit For Income Taxes (Provision benefit for income taxes Net Income 30.378 (15) (2.900) (4730) 12,733 2.945 19.78 5 (4) 19.623 0.021) (4,7337 20394 1.956 10.450 16,019 5 533 5 5 30.101 Net Income attributable to encontrolling interest Net income attributable to Verin Net Income 19.265 15.58 16.019 19.78 5 5 10.550 5 Basie Earnings Per Common Share Nef income tributable to Vetrom Wrighted average shares outstanding in million 16 4,138 3.75 IN 40 91 Diluted Earnings Per Cams Share Net Income table to Venom www.tending tim 17 4.123 4,149 Lotul a pression on Inc. and Sundaries Years Linded December 31, (dollars in million) 2018 2017 2019 19,78 5 16.039 5 30.550 245 16 (736) Net Income Other Comprehensive Loss, Net of Tax (Expense) Benefit Foreign currency translation adjustments, met of tax of (21), 11) and 530 Unrealized gain (los) on cash flow hedges, set of tax of S265, $119) and $20 Umalized gain (loss) on marketable securities, net of tax of S(2), 50 and 510 Defined benefit pension and postretirement plans, net of tax of $219,5284 and 5144 Other comprehensive loss attributable to Veriron Total Comprehensive Income ) 55 1 on (1.372) 18.416 19191 15.120 (214) (14) 20516 5 5 523 5 5 Comprehensive income attributable to no controlling interest Comprehensive income wirbutalile to Verizon 17.893 18 110 511 14. | 3007 O 16 TI S