Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all You are considering buying a loan from a local bank with the following features: Loan principal: $10,000 Term: 5 years Stated rate:

please answer all

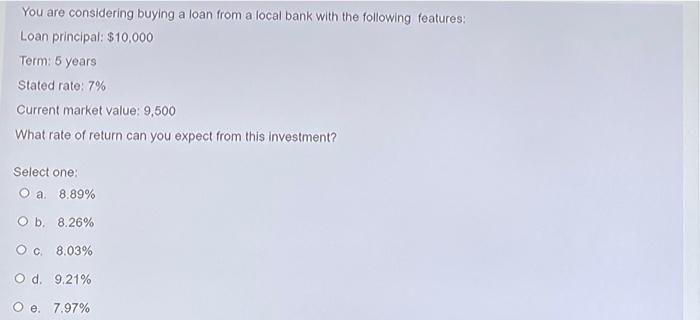

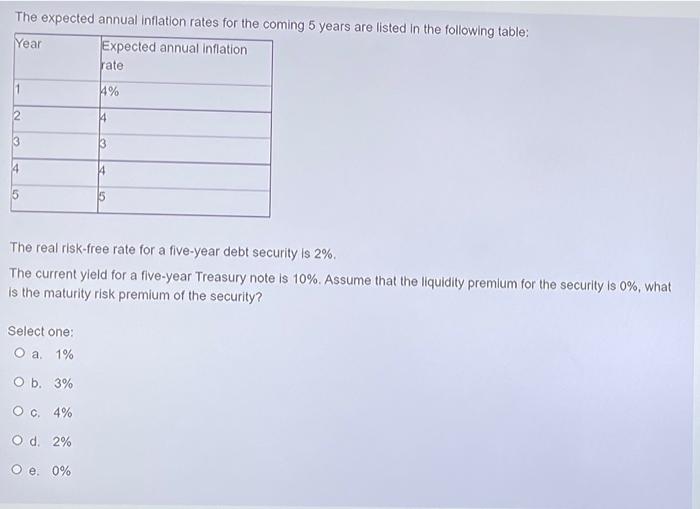

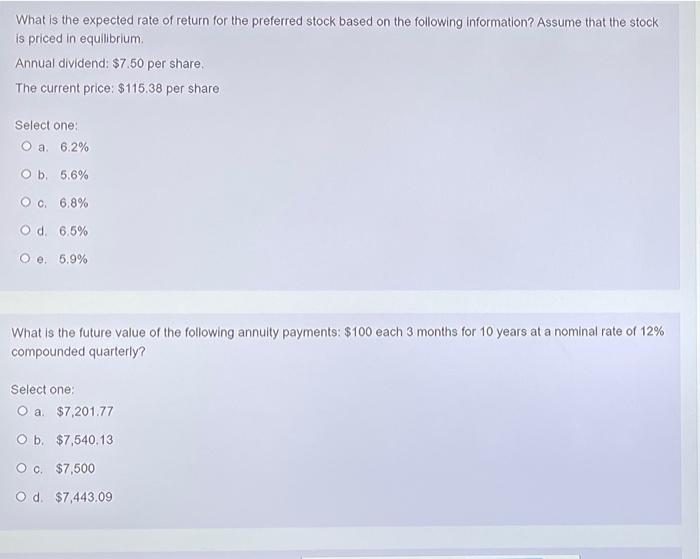

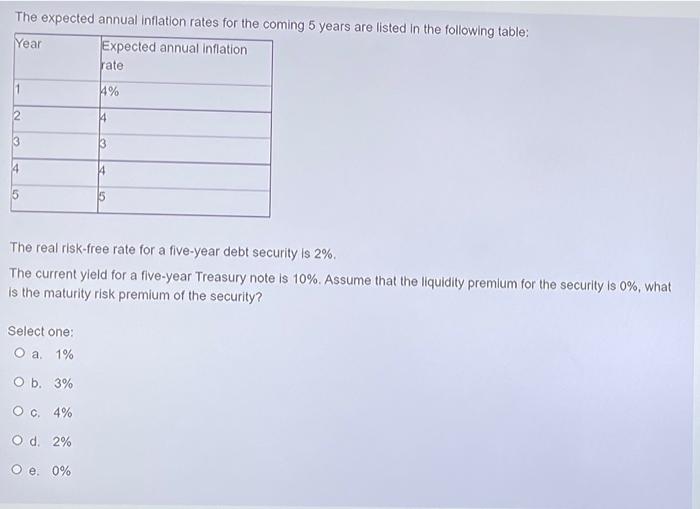

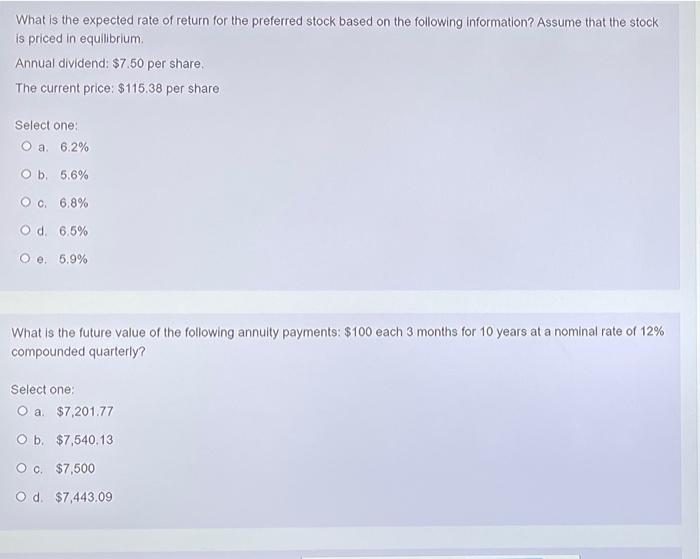

You are considering buying a loan from a local bank with the following features: Loan principal: $10,000 Term: 5 years Stated rate: 7% Current market value: 9,500 What rate of return can you expect from this Investment? Select one: O a. 8,89% Ob. 8.26% Oc8.03% O d. 9.21% O e 7.97% The expected annual Inflation rates for the coming 5 years are listed in the following table: Year Expected annual inflation rate 1 4% 2 4 3 3 4 14 The real risk-free rate for a five-year debt security is 2%. The current yield for a five-year Treasury note is 10%. Assume that the liquidity premium for the security is 0%, what is the maturity risk premium of the security? Select one: O a 1% Ob. 3% Oc 4% O d. 2% Oe. 0% What is the expected rate of return for the preferred stock based on the following information? Assume that the stock is priced in equilibrium Annual dividend: $7.50 per share. The current price: $115.38 per share Select one: O a 6.2% Ob 5.6% Oo 6.8% Od 6.5% Oe: 5.9% What is the future value of the following annuity payments: $100 each 3 months for 10 years at a nominal rate of 12% compounded quarterly? Select one: O a $7,201.77 Ob. $7,540.13 Oc. $7,500 Od $7.443.09

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started