Answered step by step

Verified Expert Solution

Question

1 Approved Answer

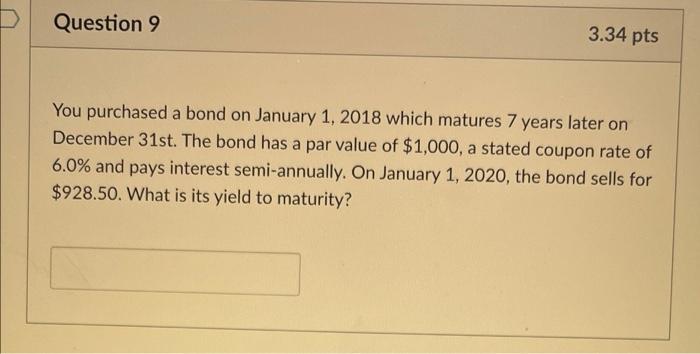

please answer alll Question 9 3.34 pts a You purchased a bond on January 1, 2018 which matures 7 years later on December 31st. The

please answer alll

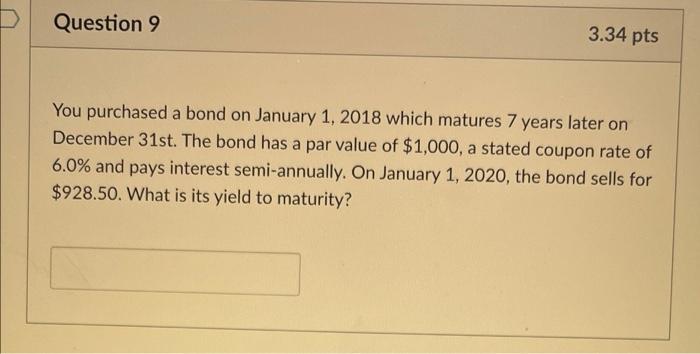

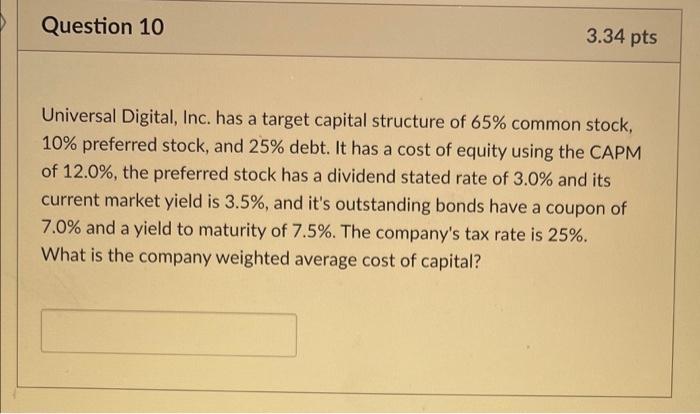

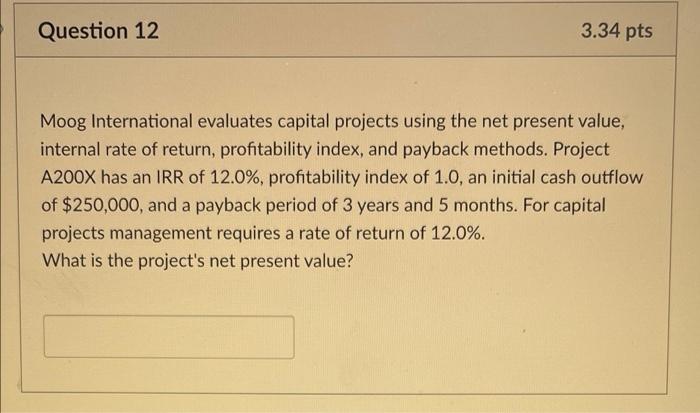

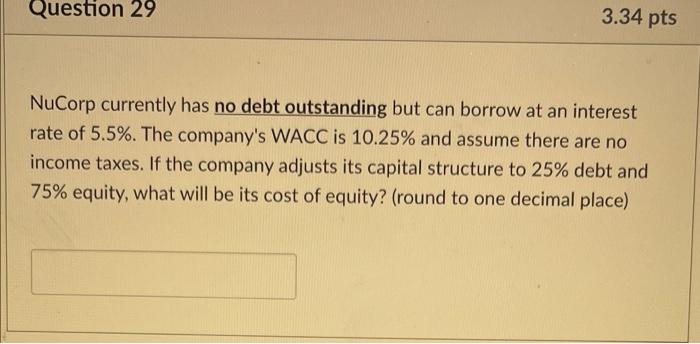

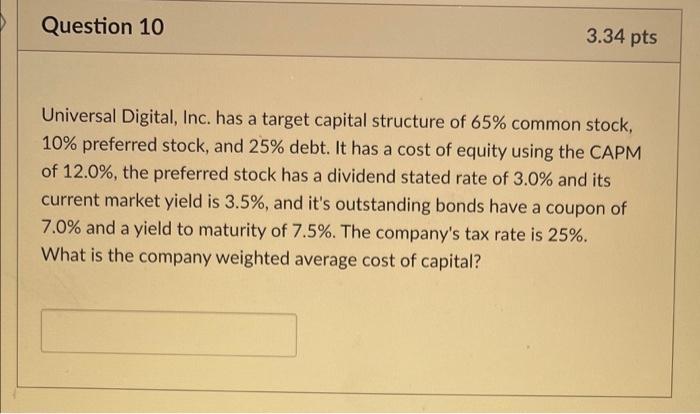

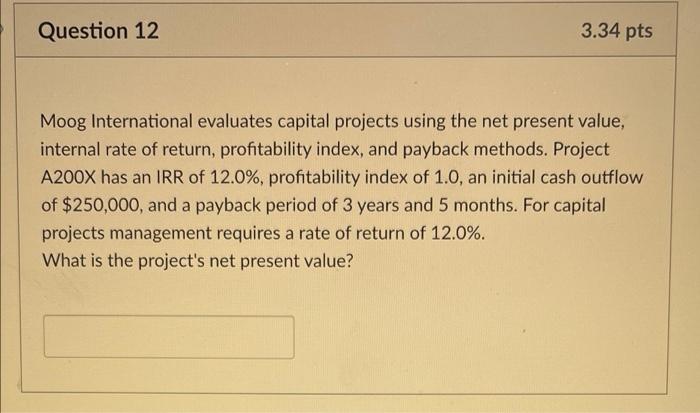

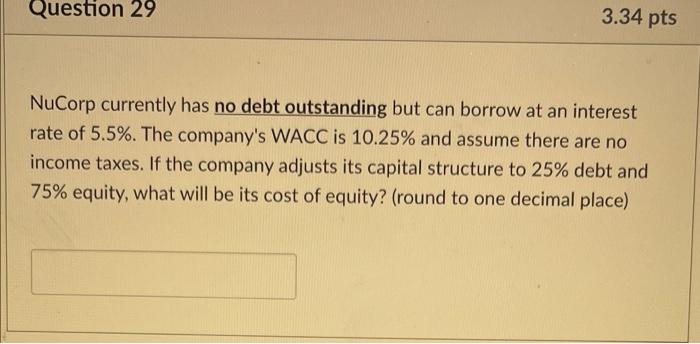

Question 9 3.34 pts a You purchased a bond on January 1, 2018 which matures 7 years later on December 31st. The bond has a par value of $1,000, a stated coupon rate of 6.0% and pays interest semi-annually. On January 1, 2020, the bond sells for $928.50. What is its yield to maturity? Question 10 3.34 pts Universal Digital, Inc. has a target capital structure of 65% common stock, 10% preferred stock, and 25% debt. It has a cost of equity using the CAPM of 12.0%, the preferred stock has a dividend stated rate of 3.0% and its current market yield is 3.5%, and it's outstanding bonds have a coupon of 7.0% and a yield to maturity of 7.5%. The company's tax rate is 25%. What is the company weighted average cost of capital? Question 12 3.34 pts Moog International evaluates capital projects using the net present value, internal rate of return, profitability index, and payback methods. Project A200X has an IRR of 12.0%, profitability index of 1.0, an initial cash outflow of $250,000, and a payback period of 3 years and 5 months. For capital projects management requires a rate of return of 12.0%. What is the project's net present value? Question 29 3.34 pts NuCorp currently has no debt outstanding but can borrow at an interest rate of 5.5%. The company's WACC is 10.25% and assume there are no income taxes. If the company adjusts its capital structure to 25% debt and 75% equity, what will be its cost of equity? (round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started