Answered step by step

Verified Expert Solution

Question

1 Approved Answer

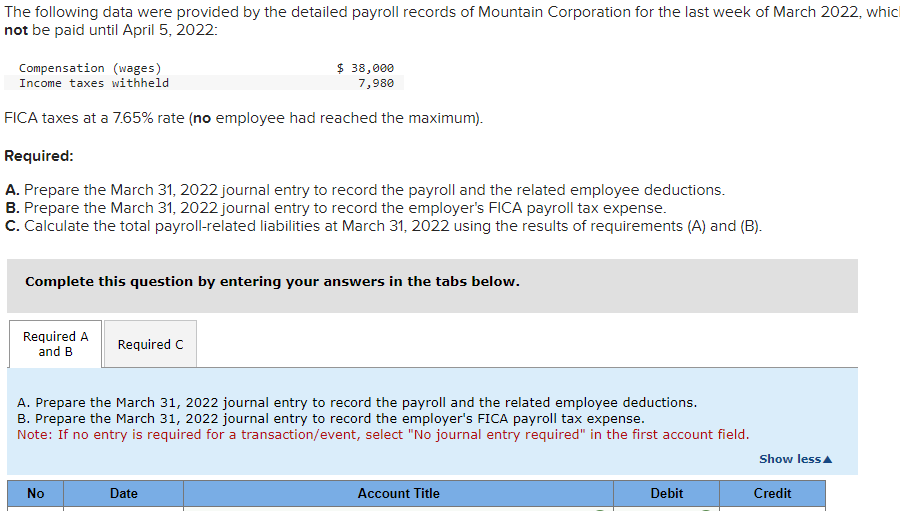

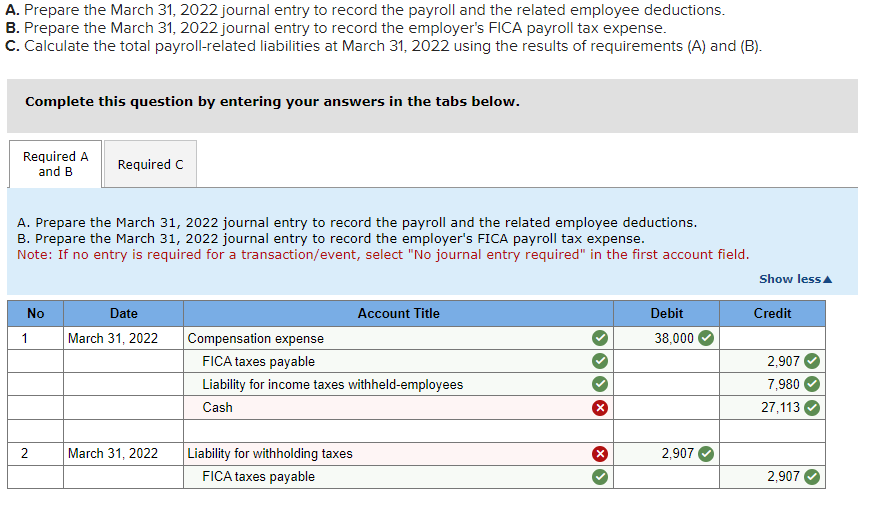

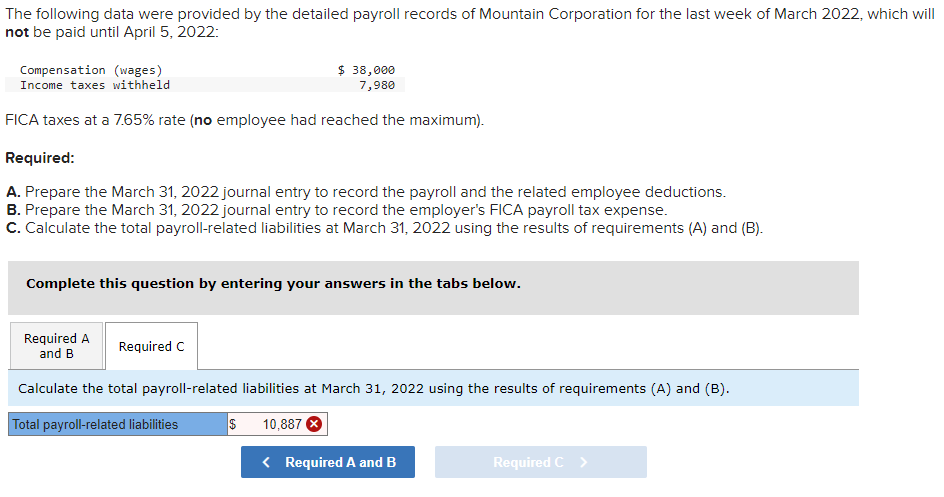

Please answer and explain part C. Thank you! FCA taxes at a 7.65% rate (no employee had reached the maximum). Required: A. Prepare the March

Please answer and explain part C. Thank you!

FCA taxes at a 7.65\% rate (no employee had reached the maximum). Required: A. Prepare the March 31, 2022 journal entry to record the payroll and the related employee deductions. B. Prepare the March 31, 2022 journal entry to record the employer's FICA payroll tax expense. C. Calculate the total payroll-related liabilities at March 31,2022 using the results of requirements (A) and (B). Complete this question by entering your answers in the tabs below. A. Prepare the March 31, 2022 journal entry to record the payroll and the related employee deductions. B. Prepare the March 31, 2022 journal entry to record the employer's FICA payroll tax expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare the March 31,2022 journal entry to record the payroll and the related employee deductions. 3. Prepare the March 31, 2022 journal entry to record the employer's FICA payroll tax expense. :. Calculate the total payroll-related liabilities at March 31, 2022 using the results of requirements (A) and (B). Complete this question by entering your answers in the tabs below. A. Prepare the March 31, 2022 journal entry to record the payroll and the related employee deductions. B. Prepare the March 31, 2022 journal entry to record the employer's FICA payroll tax expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. FICA taxes at a 7.65% rate (no employee had reached the maximum). Required: A. Prepare the March 31, 2022 journal entry to record the payroll and the related employee deductions. B. Prepare the March 31, 2022 journal entry to record the employer's FICA payroll tax expense. C. Calculate the total payroll-related liabilities at March 31, 2022 using the results of requirements (A) and (B). Complete this question by entering your answers in the tabs below. Calculate the total payroll-related liabilities at March 31,2022 using the results of requirements (A) and (B)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started