Answered step by step

Verified Expert Solution

Question

1 Approved Answer

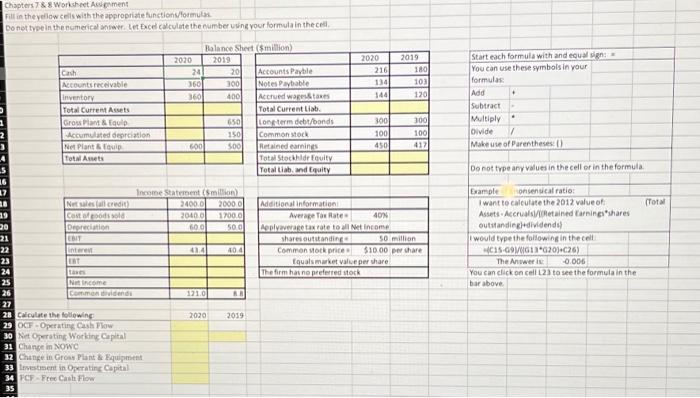

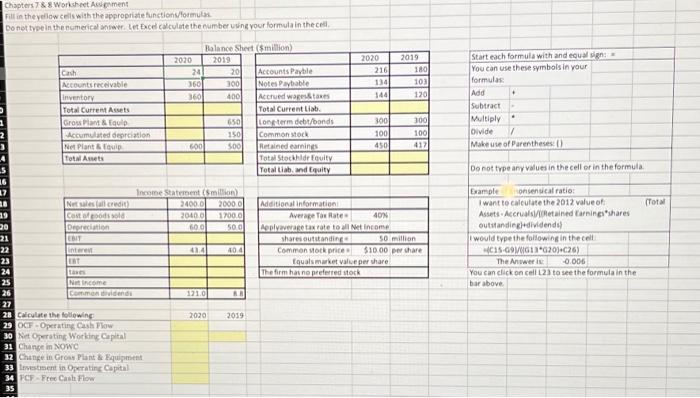

please answer and fill OUT the YELLOW BOXES Chapter 7 & 8 Worksheet Aument Fill in the yellow cells with the appropriate function/form Do not

please answer and fill OUT the YELLOW BOXES

Chapter 7 & 8 Worksheet Aument Fill in the yellow cells with the appropriate function/form Do not type in the numerical et Excel calculate the number in your formula in the cell Start each formula with and equal You can use these symbols in your formulas 360 360 Add Subtract Multiply Divide 1 Make use of Parentheses (3) 10g Do not type any values in the cell or in the formula (Total Balance Sheet (5million) 2020 2019 2020 2019 Cash 24 201 Accounts Paytle 216 180 Accounts receivable 300 Notes Payable 130 103 Inventory 400 Accrued waste 144 120 Total Current Assets Total Current Liab Gros & Equip 650 Long term debt/bonds 300 300 Accumulated desiatlon 150 Common och 100 Net Plant ou 600 500 Retained earnings 450 417 Toti Anet Total Stockhler County 5 Total tiband Equity 16 17 Income Statement million Notales (all credit) 24000 2000 01 Additional information 19 Cassola 20400 17000 Average Rates 40N 20 Detection 600 500 Aeolvavacottate to all Net Income 21 EBIT shares outstanding 50 million 22 44 404 Common stock price $10.00 per share 23 RT Equals market value per share 24 tas The firm has no preferred stock 25 Nincome 26 Commen tidende 121.0 BA 27 28 Calculate the following 2020 2019 29 OCF - Operating Cash Flow 30 Net Operating Working Capital 31 Change in NOWO 32 Change in Gros Plant & Equment 33 levestment in Operating Capital 34 FCF Free Cash Flow 35 Example onsensical ratio I want to calculate the 2012 value of Assets Accruals/Retained Earnings shares outstanding dividende I would type the following in the cell 15.GOVIGTIG20)+C26) The Answers -0.006 You can click on cell L23 to see the formula in the bar above 6 Liquidity Ratios 7 Current Ratio 38 Quick Ratio 39 Asset Mgmt. Ratios 40 Inventory Turnover (use Sales) 41 Average Collection Period (days) 42 Fixed Asset Turnover 43 Total Asset Turnover 44 Capital Intensity 45 Debt Mgmt. and Coverage Ratios 46 Debt Ratio 47 Debt to Equity Ratio 48 Times Interest Earned 49 Profitability Ratios 50 Profit Margin 51 Basic Earnings Power 52 ROA 53 ROE 54 Dividend Payout ratio 55 EPS 56 Market Value Ratios 57 P/E 58 Market to Book 59 60 61

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started