Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer and show steps rimon Industries bonds have 6 years left to maturity. Interest is poid annoally, and the bonds have a $1,000 par

please answer and show steps

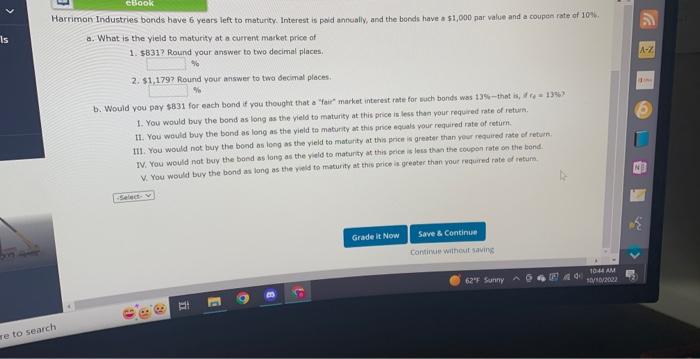

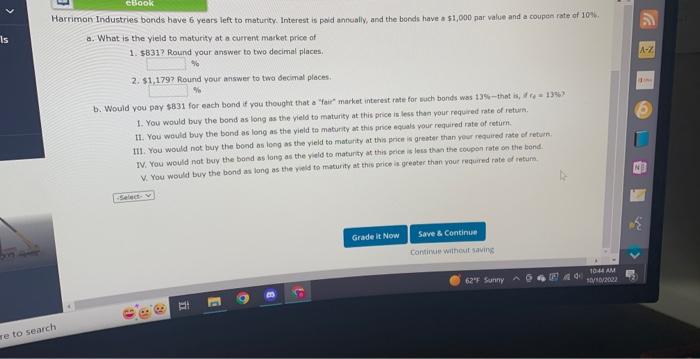

rimon Industries bonds have 6 years left to maturity. Interest is poid annoally, and the bonds have a $1,000 par value and a coupen rate of 10% a. What is the yield to maturity at a current maket price of 1. \$831? Rounid your answer to two decimal places: 2. \$1,179? Round your answer to two decimal places. \% b. Would you pay \$831 for each bond if you thought that a Yair market interest rate fot euch bonds wos 13% that is, 4 fe =13%6? 1. You would buy the bond as long as the yrels to maturity at this price is less than vour requred rate of letum. 11. You would buy the bond as long as the yield ta maturity at this price equals your required rate of ceturn. III. You would not buy the bond as long as the vield to moturty at this price is greater than year required rate of return. IV. You would not bay the bond as long as the veld to maturity at this peice is less then the coupon rate on the bend. V. You would buy the bond as long as the weld ta maturity at this price is greoter than your required rate of retume

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started