Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer and state the formulas used. Thank you so much, I appreciate your help!Number 6. and Number 8. thank you. Use Table 11.1 to

Please answer and state the formulas used. Thank you so much, I appreciate your help!Number 6. and Number 8. thank you.

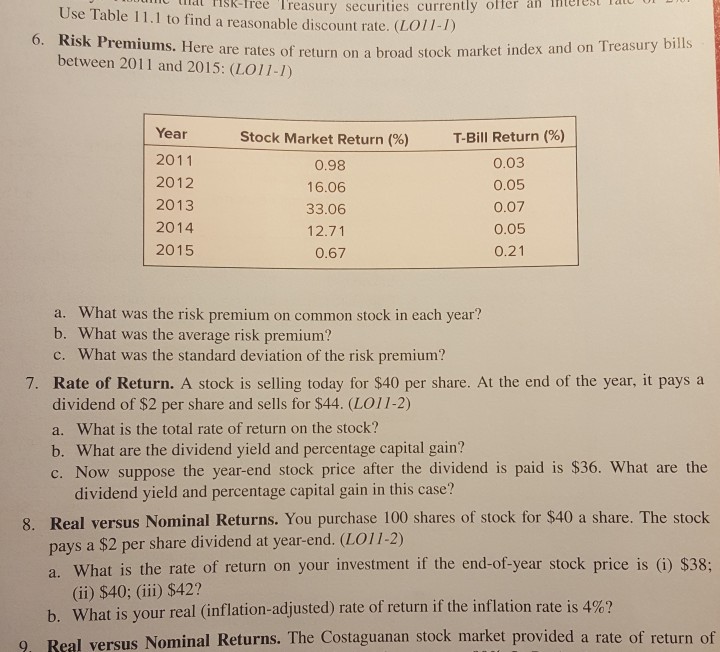

Use Table 11.1 to find a reasonable discount rate. (LO11-) that TISK-lree Treasury securities currently (iter an interest at 6. Risk Premi ums. Here are rates of return on a broad stock market index and on Treasury bills between 2011 and 2015: (LO11-1) Year 2011 2012 2013 2014 2015 Stock Market Return (%) T-Bill Return (%) 0.98 16.06 33.06 12.71 0.67 0.03 0.05 0.07 0.05 0.21 a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? 7. Rate of Return. A stock is selling today for $40 per share. At the end of the year, it pays a dividend of $2 per share and sells for $44. (LO11-2) a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain'? c. Now suppose the year-end stock price after the dividend is paid is $36. What are the dividend yield and percentage capital gain in this case? 8. Real versus Nominal Returns. You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at year-end. (LO11-2) a. What is the rate of return on your investment if the end-of-year stock price is (i) $38: (ii) $40; (iii) $42? b. What is your real (inflation-adjusted) rate of return if the inflation rate is 4%? 9, Real versus Nominal Returns. The Costaguanan stock market provided a rate of return of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started