Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer answer alk of them clearly. i dont neel all steos just formulas and answers. thank you dont answers too late Allied Plastics borrows

please answer answer alk of them clearly. i dont neel all steos just formulas and answers. thank you

dont answers too late

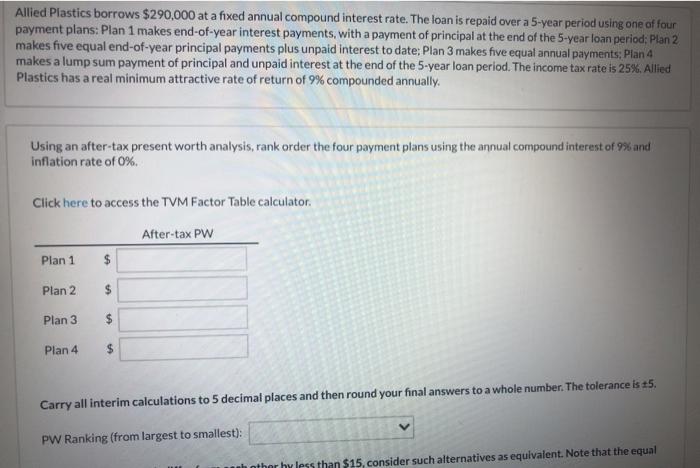

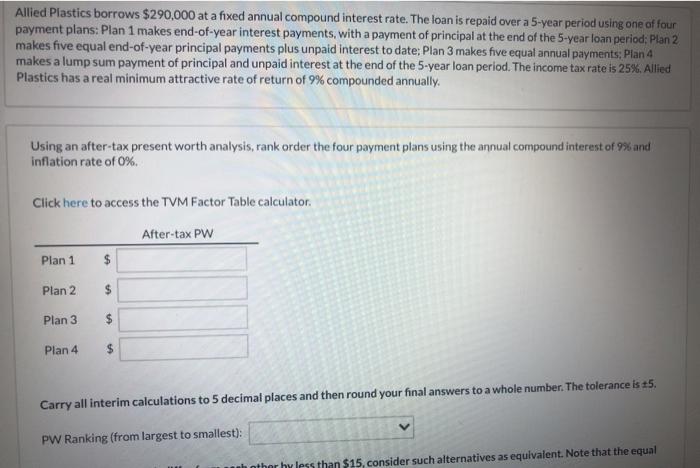

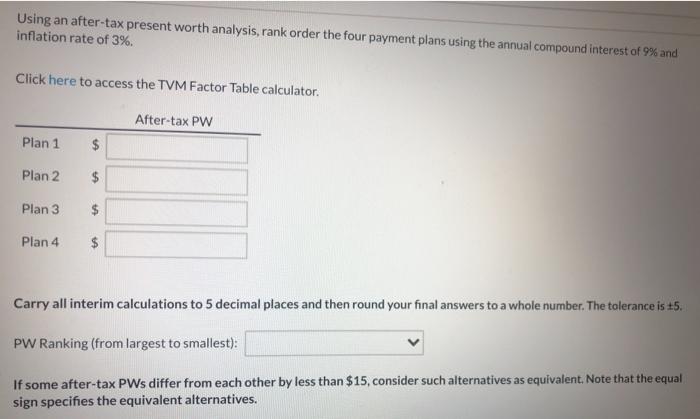

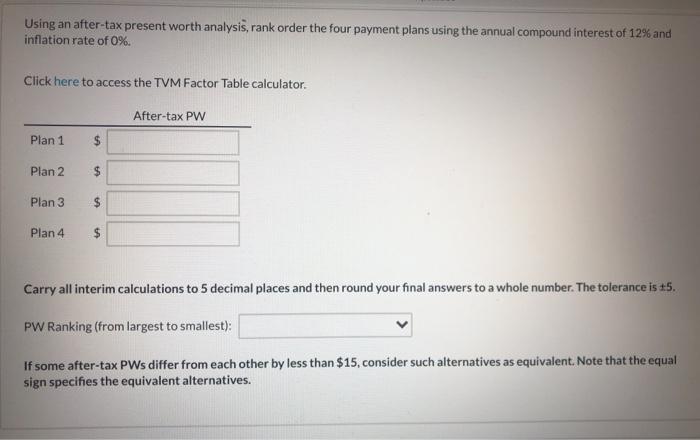

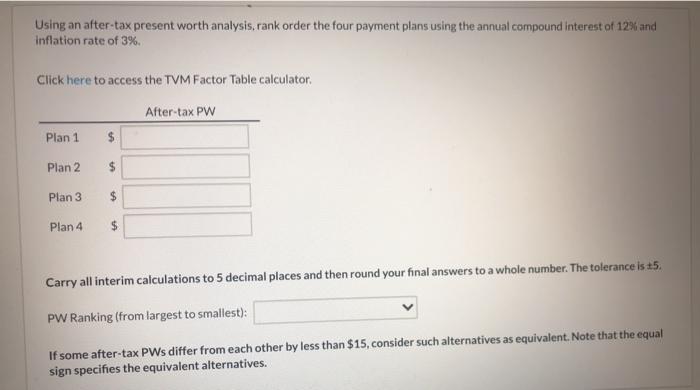

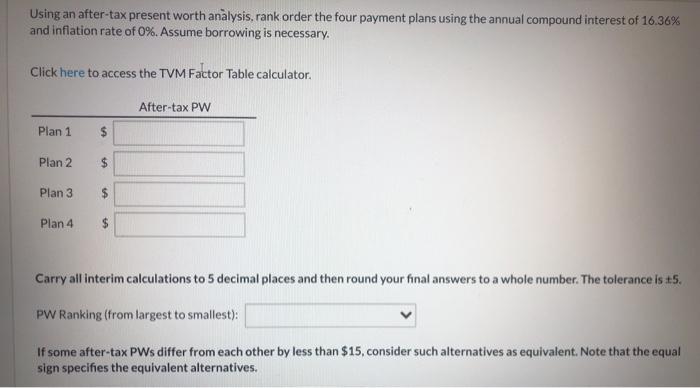

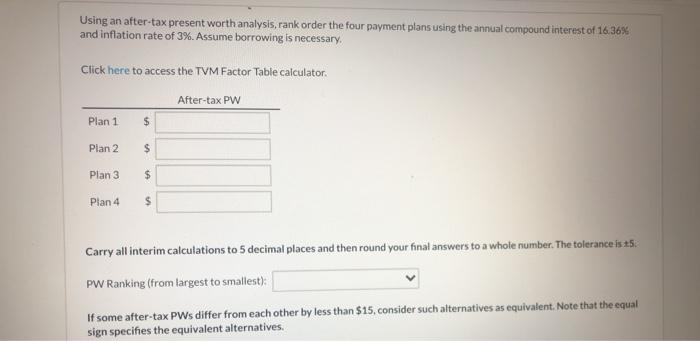

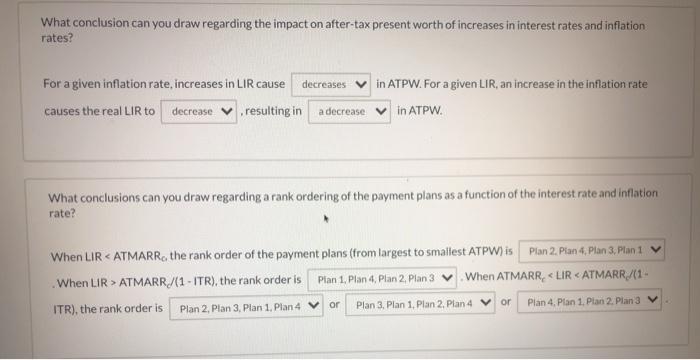

Allied Plastics borrows $290,000 at a fixed annual compound interest rate. The loan is repaid over a 5-year period using one of four payment plans: Plan 1 makes end-of-year interest payments, with a payment of principal at the end of the 5-year loan period: Plan 2 makes five equal end-of-year principal payments plus unpaid interest to date: Plan 3 makes five equal annual payments: Plan 4 makes a lump sum payment of principal and unpaid interest at the end of the 5-year loan period. The income tax rate is 25%. Allied Plastics has a real minimum attractive rate of return of 9% compounded annually. Using an after-tax present worth analysis, rank order the four payment plans using the annual compound interest of 9% and inflation rate of 0% Click here to access the TVM Factor Table calculator. After-tax PW Plan 1 $ Plan 2 Plan 3 $ Plan 4 $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5. PW Ranking (from largest to smallest): inthor hy less than $15, consider such alternatives as equivalent. Note that the equal Using an after-tax present worth analysis, rank order the four payment plans using the annual compound interest of 9% and inflation rate of 3%. Click here to access the TVM Factor Table calculator. After-tax PW Plan 1 $ $ Plan 2 $ Plan 3 $ $ Plan 4 $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is 45. PW Ranking (from largest to smallest): If some after-tax PWs differ from each other by less than $15, consider such alternatives as equivalent. Note that the equal sign specifies the equivalent alternatives. Using an after-tax present worth analysis, rank order the four payment plans using the annual compound interest of 12% and inflation rate of 0% Click here to access the TVM Factor Table calculator. After-tax PW Plan 1 Plan 2 $ Plan 3 $ Plan 4 $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is 45. PW Ranking (from largest to smallest): If some after-tax PWs differ from each other by less than $15, consider such alternatives as equivalent. Note that the equal sign specifies the equivalent alternatives. Using an after-tax present worth analysis, rank order the four payment plans using the annual compound interest of 12% and inflation rate of 3%. Click here to access the TVM Factor Table calculator After-tax PW Plan 1 $ Plan 2 Plan 3 $ $ Plan 4 Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is 15. PW Ranking (from largest to smallest): If some after-tax PWs differ from each other by less than $15, consider such alternatives as equivalent. Note that the equal sign specifies the equivalent alternatives. Using an after-tax present worth analysis, rank order the four payment plans using the annual compound interest of 16.36% and inflation rate of 0%. Assume borrowing is necessary. Click here to access the TVM Factor Table calculator. After-tax PW Plan 1 $ $ Plan 2 Plan 3 $ Plan 4 $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is t5. PW Ranking (from largest to smallest): If some after-tax PWs differ from each other by less than $15, consider such alternatives as equivalent. Note that the equal sign specifies the equivalent alternatives. Using an after-tax present worth analysis, rank order the four payment plans using the annual compound interest of 16.36% and inflation rate of 3%. Assume borrowing is necessary. Click here to access the TVM Factor Table calculator After-tax PW Plan 1 $ Plan 2 $ Plan 3 $ Plan 4 $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is 25. PW Ranking (from largest to smallest): If some after-tax PWs differ from each other by less than $15, consider such alternatives as equivalent. Note that the equal sign specifies the equivalent alternatives. What conclusion can you draw regarding the impact on after-tax present worth of increases in interest rates and inflation rates? For a given inflation rate, increases in LIR cause decreases causes the real LIR to decrease resulting in a decrease in ATPW.For a given LIR, an increase in the Inflation rate in ATPW. What conclusions can you draw regarding a rank ordering of the payment plans as a function of the interest rate and inflation rate? When LIR ATMARR/(1 - ITR), the rank order is Plan 1. Plan 4, Plan 2. Plan 3 When ATMARR, Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started