PLEASE ANSWER

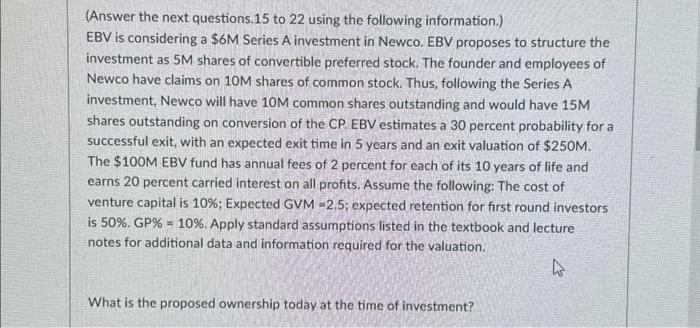

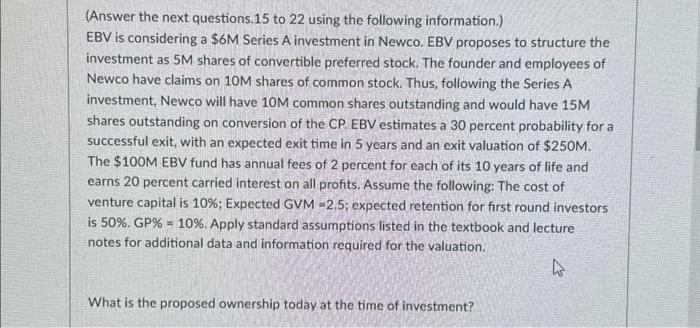

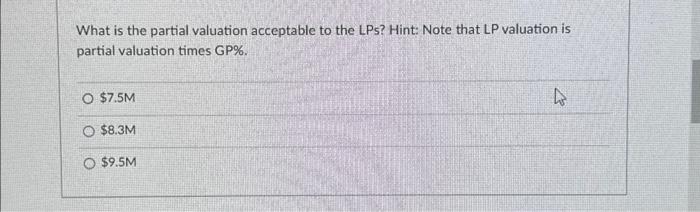

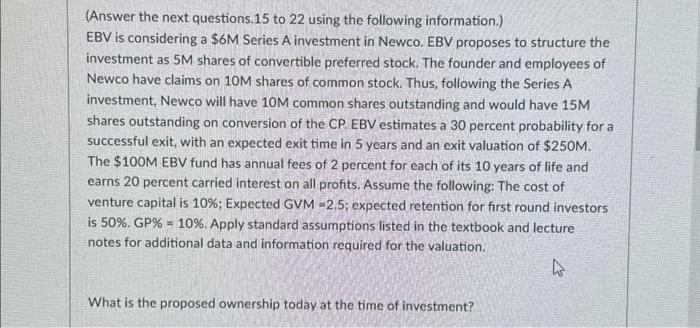

(Answer the next questions.15 to 22 using the following information.) EBV is considering a \$6M Series A investment in Newco. EBV proposes to structure the investment as 5M shares of convertible preferred stock. The founder and employees of Newco have claims on 10M shares of common stock. Thus, following the Series A investment, Newco will have 10M common shares outstanding and would have 15M shares outstanding on conversion of the CP. EBV estimates a 30 percent probability for a successful exit, with an expected exit time in 5 years and an exit valuation of $250M. The $100M EBV fund has annual fees of 2 percent for each of its 10 years of life and earns 20 percent carried interest on all profits. Assume the following: The cost of venture capital is 10%; Expected GVM =2.5; expected retention for first round investors is 50%.GP%=10%. Apply standard assumptions listed in the textbook and lecture notes for additional data and information required for the valuation. What is the proposed ownership today at the time of investment? What is the partial valuation acceptable to the LPs? Hint: Note that LP valuation is partial valuation times GP\%. $7.5M $8.3M $9.5M (Answer the next questions.15 to 22 using the following information.) EBV is considering a \$6M Series A investment in Newco. EBV proposes to structure the investment as 5M shares of convertible preferred stock. The founder and employees of Newco have claims on 10M shares of common stock. Thus, following the Series A investment, Newco will have 10M common shares outstanding and would have 15M shares outstanding on conversion of the CP. EBV estimates a 30 percent probability for a successful exit, with an expected exit time in 5 years and an exit valuation of $250M. The $100M EBV fund has annual fees of 2 percent for each of its 10 years of life and earns 20 percent carried interest on all profits. Assume the following: The cost of venture capital is 10%; Expected GVM =2.5; expected retention for first round investors is 50%.GP%=10%. Apply standard assumptions listed in the textbook and lecture notes for additional data and information required for the valuation. What is the proposed ownership today at the time of investment? What is the partial valuation acceptable to the LPs? Hint: Note that LP valuation is partial valuation times GP\%. $7.5M $8.3M $9.5M