Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer any/all parts of the question. I will upvote! Question 3: The management team of Highquality Co. is thinking about replacing an old texture

Please answer any/all parts of the question. I will upvote!

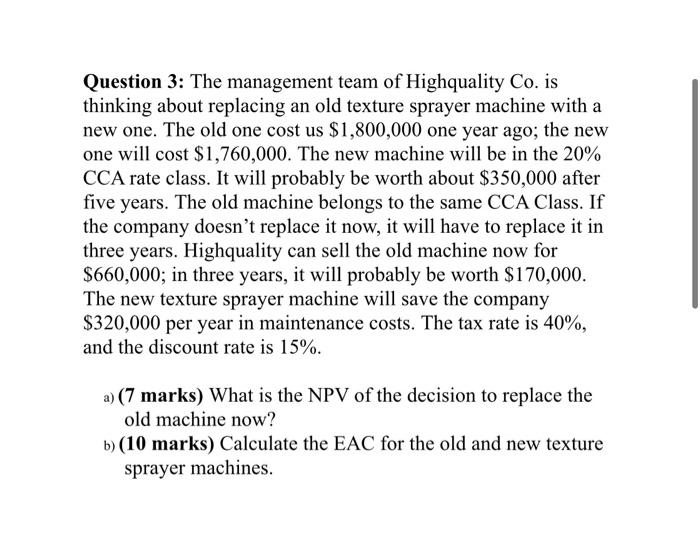

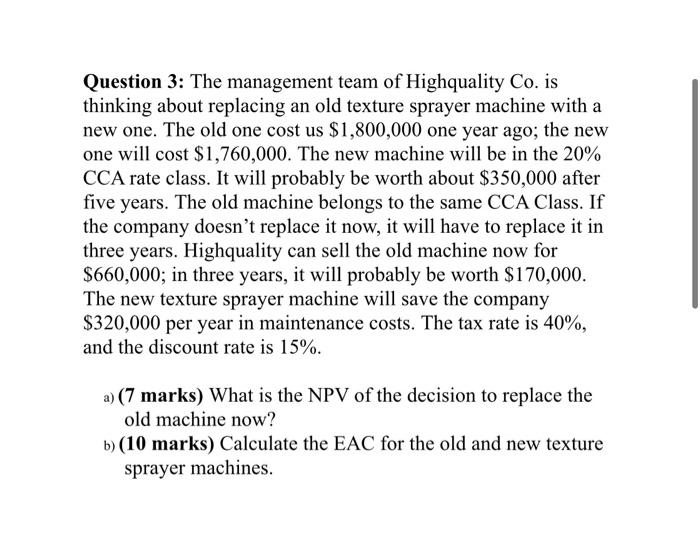

Question 3: The management team of Highquality Co. is thinking about replacing an old texture sprayer machine with a new one. The old one cost us $1,800,000 one year ago; the new one will cost $1,760,000. The new machine will be in the 20% CCA rate class. It will probably be worth about $350,000 after five years. The old machine belongs to the same CCA Class. If the company doesn't replace it now, it will have to replace it in three years. Highquality can sell the old machine now for $660,000; in three years, it will probably be worth $170,000. The new texture sprayer machine will save the company $320,000 per year in maintenance costs. The tax rate is 40%, and the discount rate is 15%. a) (7 marks) What is the NPV of the decision to replace the old machine now? b) (10 marks) Calculate the EAC for the old and new texture sprayer machines

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started