Please answer as many as possible! Thank you!

Please answer as many as possible! Thank you!

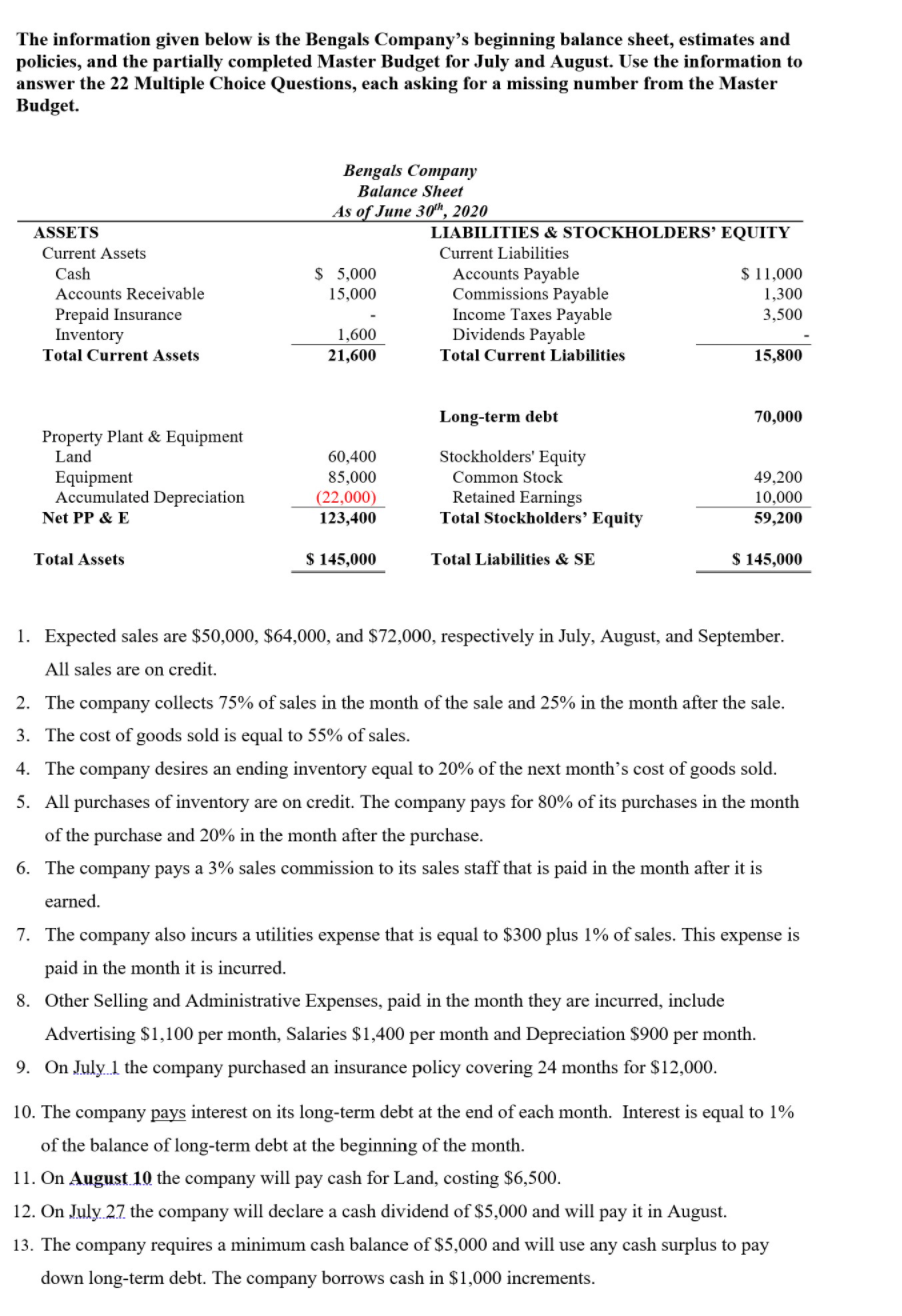

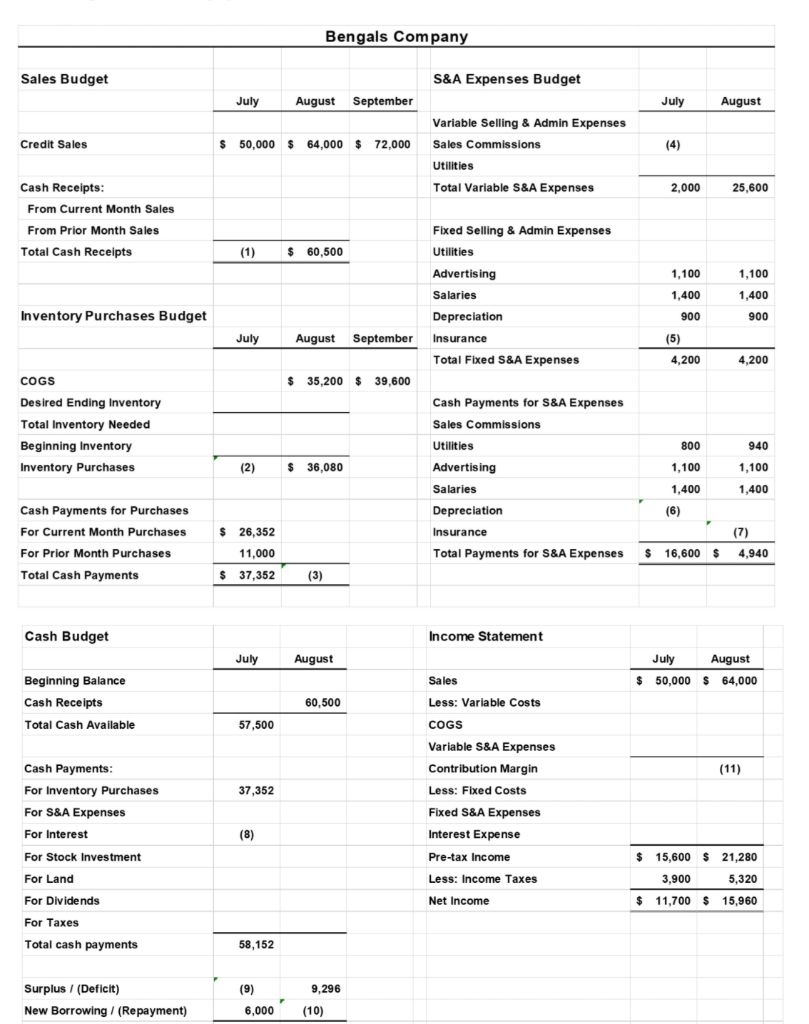

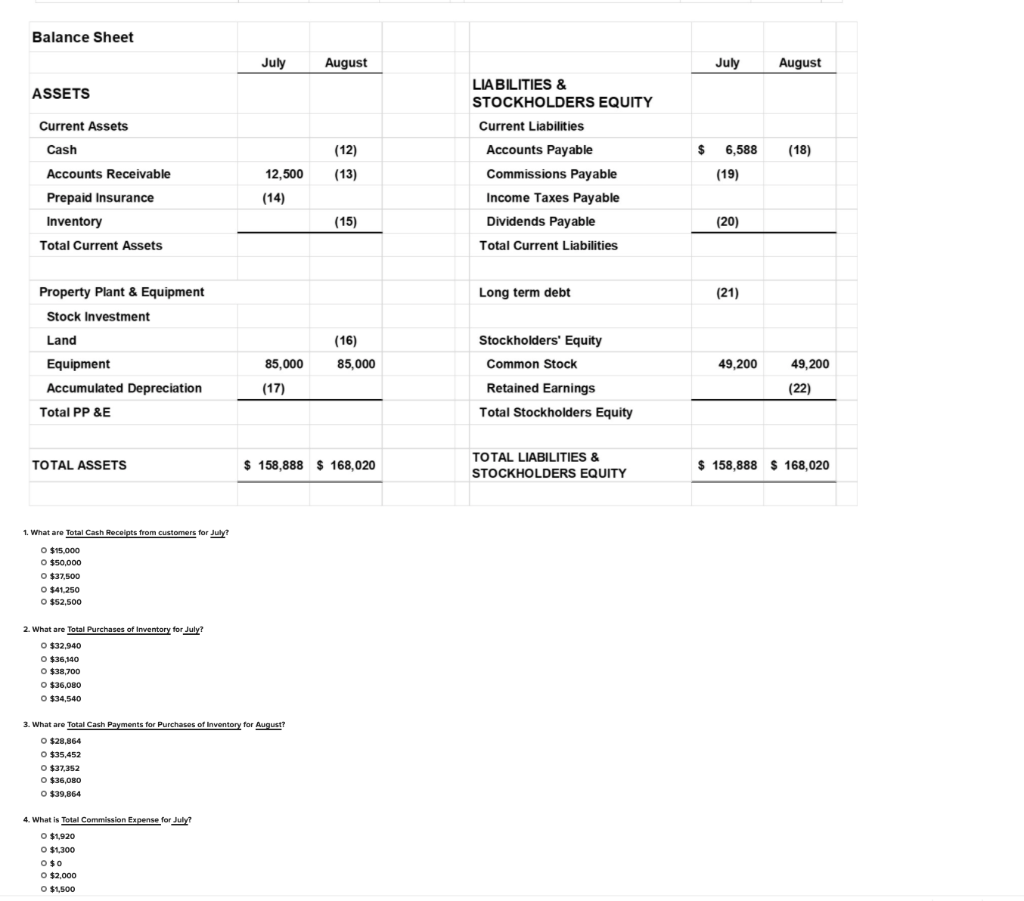

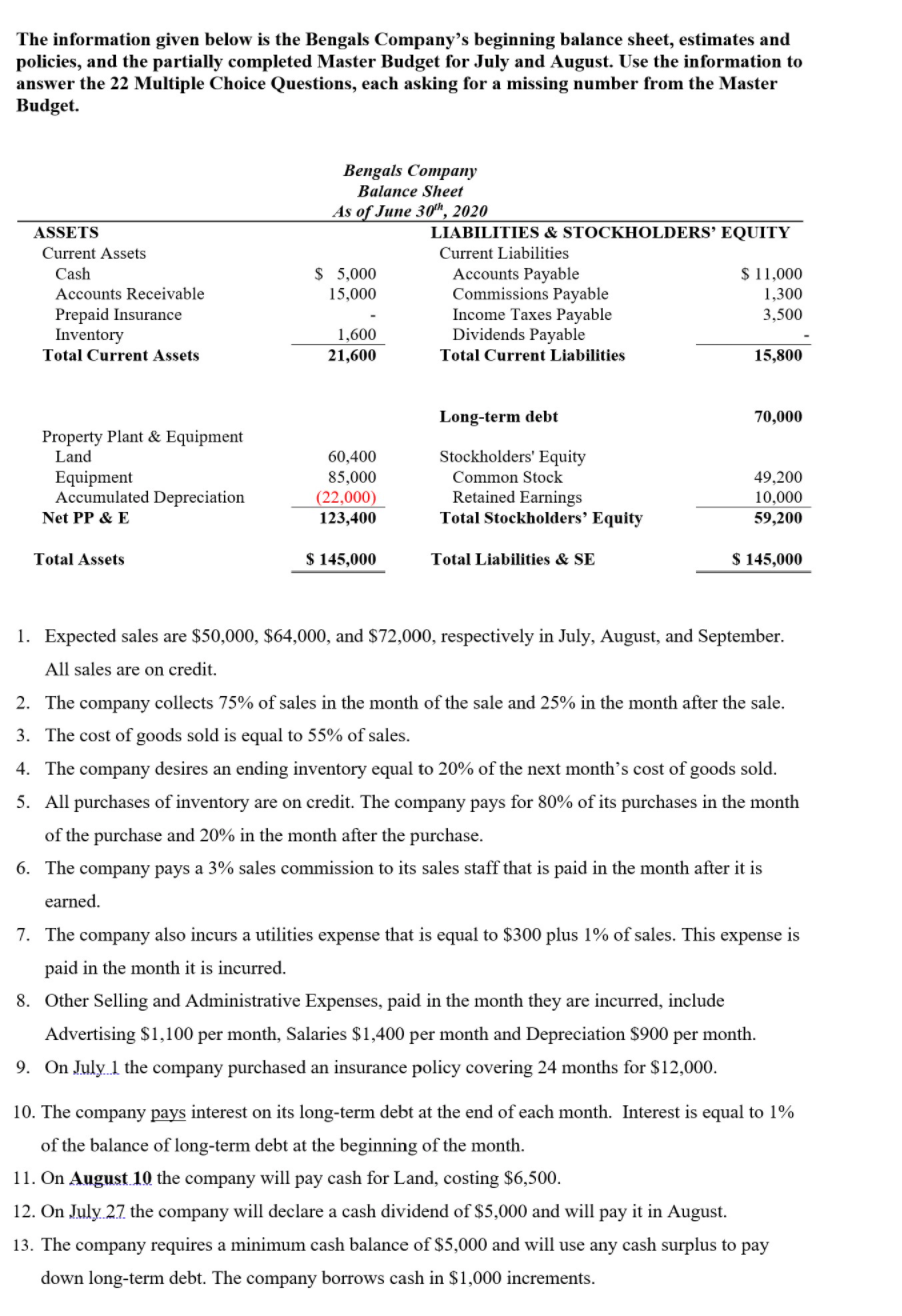

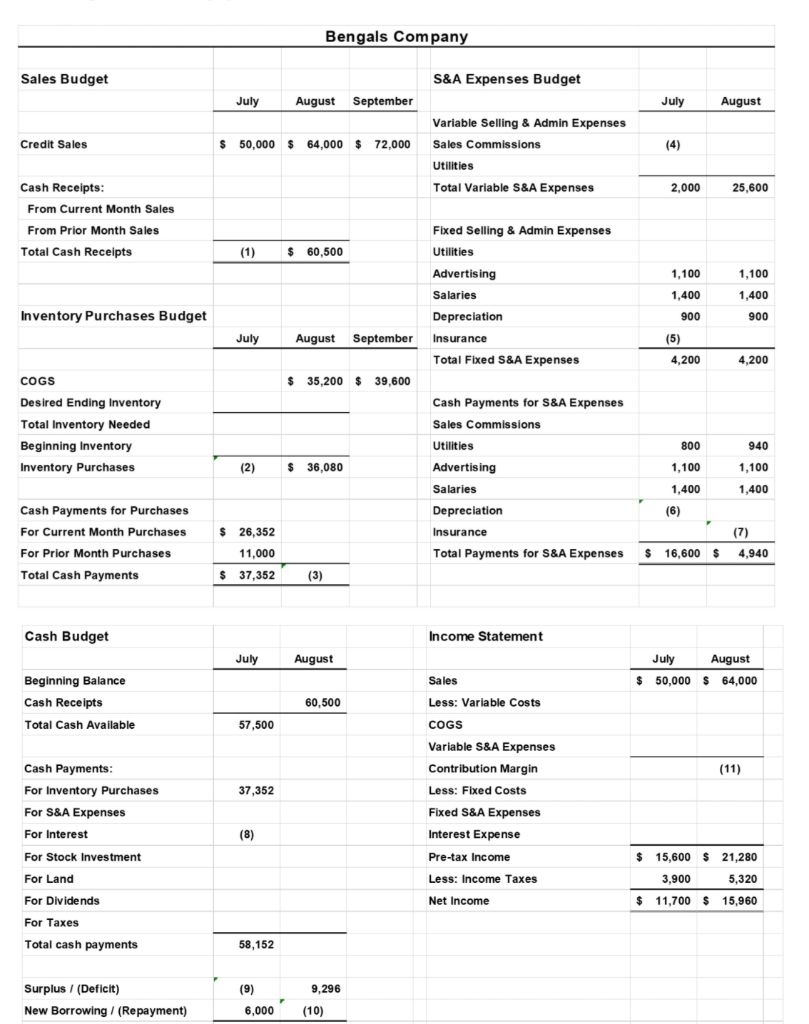

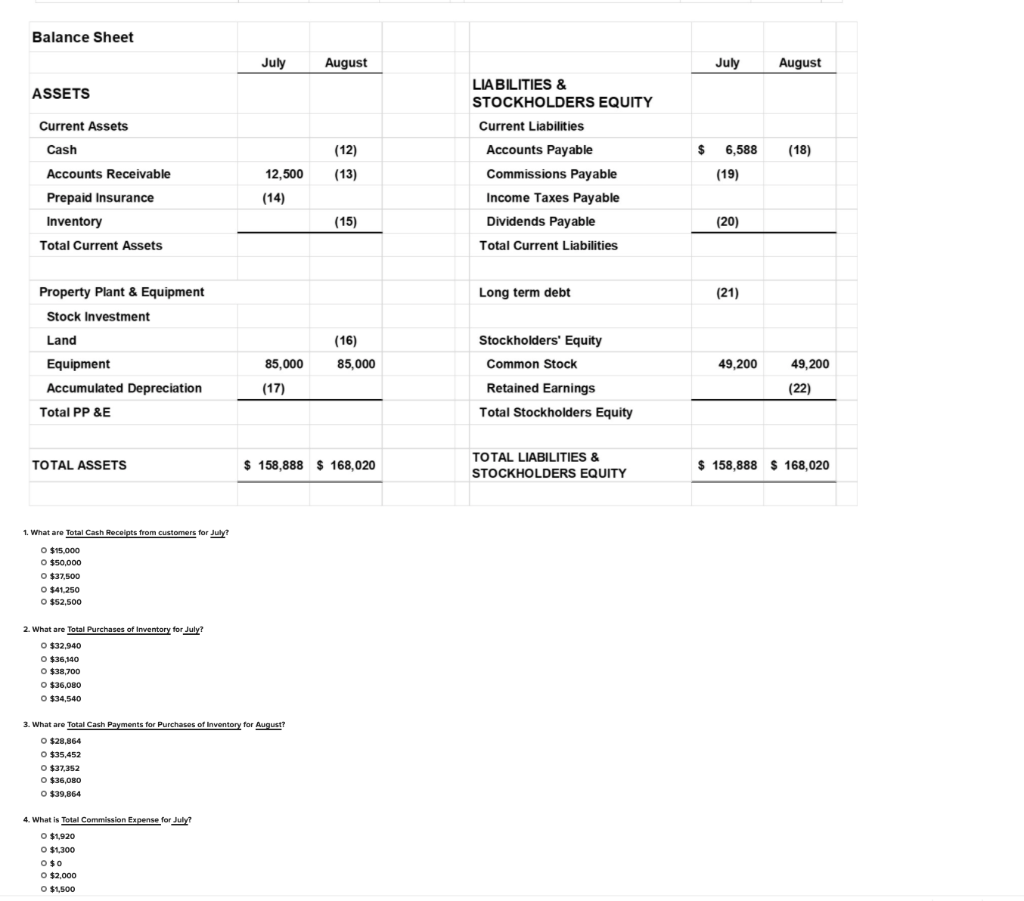

The information given below is the Bengals Company's beginning balance sheet, estimates and policies, and the partially completed Master Budget for July and August. Use the information to answer the 22 Multiple Choice Questions, each asking for a missing number from the Master Budget. ASSETS Current Assets Cash Accounts Receivable Prepaid Insurance Inventory Total Current Assets Bengals Company Balance Sheet As of June 30, 2020 LIABILITIES & STOCKHOLDERS' EQUITY Current Liabilities $ 5,000 Accounts Payable $ 11,000 15,000 Commissions Payable 1,300 Income Taxes Payable 3,500 1,600 Dividends Payable 21,600 Total Current Liabilities 15,800 Long-term debt 70,000 Property Plant & Equipment Land Equipment Accumulated Depreciation Net PP & E 60,400 85,000 (22,000) 123,400 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity 49.200 10.000 59,200 Total Assets $ 145,000 Total Liabilities & SE $ 145,000 1. Expected sales are $50,000, $64,000, and $72,000, respectively in July, August, and September. All sales are on credit. 2. The company collects 75% of sales in the month of the sale and 25% in the month after the sale. 3. The cost of goods sold is equal to 55% of sales. 4. The company desires an ending inventory equal to 20% of the next month's cost of goods sold. 5. All purchases of inventory are on credit. The company pays for 80% of its purchases in the month of the purchase and 20% in the month after the purchase. 6. The company pays a 3% sales commission to its sales staff that is paid in the month after it is earned. 7. The company also incurs a utilities expense that is equal to $300 plus 1% of sales. This expense is paid in the month it is incurred. 8. Other Selling and Administrative Expenses, paid in the month they are incurred, include Advertising $1,100 per month, Salaries $1,400 per month and Depreciation $900 per month. 9. On July 1 the company purchased an insurance policy covering 24 months for $12,000. 10. The company pays interest on its long-term debt at the end of each month. Interest is equal to 1% of the balance of long-term debt at the beginning of the month. 11. On August 10 the company will pay cash for Land, costing $6,500. 12. On July 27 the company will declare a cash dividend of $5,000 and will pay it in August. 13. The company requires a minimum cash balance of $5,000 and will use any cash surplus to pay down long-term debt. The company borrows cash in $1,000 increments. Bengals Company Sales Budget S&A Expenses Budget July August September July August Variable Selling & Admin Expenses Sales Commissions Credit Sales $ 50,000 $ 64,000 $ 72,000 (4) Utilities Total Variable S&A Expenses 2,000 25,600 Cash Receipts: From Current Month Sales From Prior Month Sales Total Cash Receipts 1,100 1,100 1,400 1,400 Inventory Purchases Budget 900 900 July (5) 4.200 4,200 COGS Desired Ending Inventory Total Inventory Needed Beginning Inventory Inventory Purchases Fixed Selling & Admin Expenses $ 60,500 Utilities Advertising Salaries Depreciation August September Insurance Total Fixed S&A Expenses $ 35,200 $ 39,600 Cash Payments for S&A Expenses Sales Commissions Utilities $ 36,080 Advertising Salaries Depreciation Insurance Total Payments for S&A Expenses (3) 800 940 1,100 (2) 1,100 Cash Payments for Purchases For Current Month Purchases For Prior Month Purchases Total Cash Payments 1,400 1,400 (6) (7) $ 16,600 $ 4,940 $ 26,352 11,000 $ 37,352 Cash Budget Income Statement July August July August $ 50,000 $ 64,000 Sales Beginning Balance Cash Receipts Total Cash Available 60,500 57,500 (11) 37,352 Cash Payments: For Inventory Purchases For S&A Expenses For Interest Less: Variable Costs COGS Variable S&A Expenses &A Contribution Margin Less: Fixed Costs Fixed S&A Expenses Interest Expense Pre-tax Income - Less: Income Taxes (8) For Stock Investment For Land $ 15,600 $ 21,280 3,900 5,320 $ 11,700 $ 15,960 Net Income For Dividends For Taxes Total cash payments 58,152 9,296 Surplus/ (Deficit) New Borrowing / (Repayment) (9) 6,000 (10) Balance Sheet July August July August ASSETS LIABILITIES & STOCKHOLDERS EQUITY Current Liabilities Current Assets Cash (18) (12) (13) $ 6,588 (19) Accounts Receivable 12,500 (14) Prepaid Insurance Inventory Total Current Assets Accounts Payable Commissions Payable Income Taxes Payable Dividends Payable Total Current Liabilities (15) (20) Long term debt (21) Stockholders' Equity Property Plant & Equipment Stock Investment Land Equipment Accumulated Depreciation Total PP &E (16) 85,000 85,000 Common Stock 49,200 49,200 (17) (22) Retained Earnings Total Stockholders Equity TOTAL ASSETS $ 158,888 $ 168,020 TOTAL LIABILITIES & STOCKHOLDERS EQUITY $ 158,888 $ 168,020 What are Total Cash Receipts from customers for July? O $15.000 O $50,000 O $37,500 O $41.250 O $52,500 2. What are Total Purchases of Inventory for July? O $32,940 O $36,140 O $38,700 $36,080 O $34,540 3. What are Total Cash Payments for Purchases of Inventory for August? O $28,864 O $35,452 O $ O $37,352 O $35,000 O $39,864 4. What is Total Commission Expense for July O $1,920 O $1.300 O $0 O $2,000 O $1,500 5. What is Total Insurance Expense for July? OSO O $1,500 O $500 O $12,000 O $1,000 6. What is the Total Cash Payment for Depreciation Expense for July? O$o O $ 22.000 O $21,100 O $1,800 o $ 900 7. What is Total Cash Payment for Insurance Expense for August? O $ 1.500 O $1,000 O$o O $12,000 O $500 8. What is Total Interest Expense for July O $700 O $1,400 O $7000 O $2.100 O $0 9. What is Total Cash Surplus Deficit) for July? O $5,348 O $9.296 O $652 O $17,152) $1652) 10. What is Total Net Borrowing (Repayment) for August? O $ (4.296) o $4,296 O $0 O $19.296) O $6,000 11. What is the Contribution Margin for August? O $21,280 O $26.249 O $64.000 O $61,440 O $20,500 12. What is the balance of Cash on August 31, 20207 O $5,348 O $9.296 O $5,000 O $0 O $76,000 12. What is the balance of Cash on August 31, 2020? O $5,348 O $9,296 O $5,000 O $0 O $76,000 13. What is the balance of Accounts Receivable on August 31, 2020? O $28,500 $ $15,000 O $12,500 O $18,000 O $16,000 14. What is the balance of Prepaid Insurance on July 31, 2020? O $11,000 o $ 500 O $12,000 O $0 O $ $11,500 15. What is the balance of Inventory on August 31, 2020? o $ O $36,080 O $ 7,920 O $35,452 o $7,040 O $1,600 16. What is the balance of Land on August 31, 2020? O $0 O $128,100 O $6,500 O $ 66,900 O $ 60,400 17. What is the balance of Accumulated Depreciation, as reflected on the Balance Sheet, on July 31, 2020? O $(23,800) O $( 900) $) o $(21,100) o $(22,900) O $( 1,800) 18. What is the balance of Accounts Payable on August 31, 2020? O $11,000 O $ 7,216 0 $ 6,588 O $13,804 0 $ $ 7,920 19. What is the balance of Commissions Payable on July 31, 20207 O $1,500 $ O $1,300 o $o o $2,800 o $1,920 20. What is the balance of Dividends Payable on July 31, 2020? O $10,000 o $5,000 o $5,320 O $3,900 O $0 21. What is the balance of Long-Term Debt on July 31, 2020? O $71,704 $ o $5,348 O $70,000 O $76,000 o$ 6,000 22. What is the balance of Retained Earnings on August 31, 2020? O $10,000 o O $32,660 O $22,660 O $37,660 O $16,700

Please answer as many as possible! Thank you!

Please answer as many as possible! Thank you!