Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer as many as possible thanks! Question 3 (1 point) The date is April 24, 2022. If you enter into a short straddle using

Please answer as many as possible thanks!

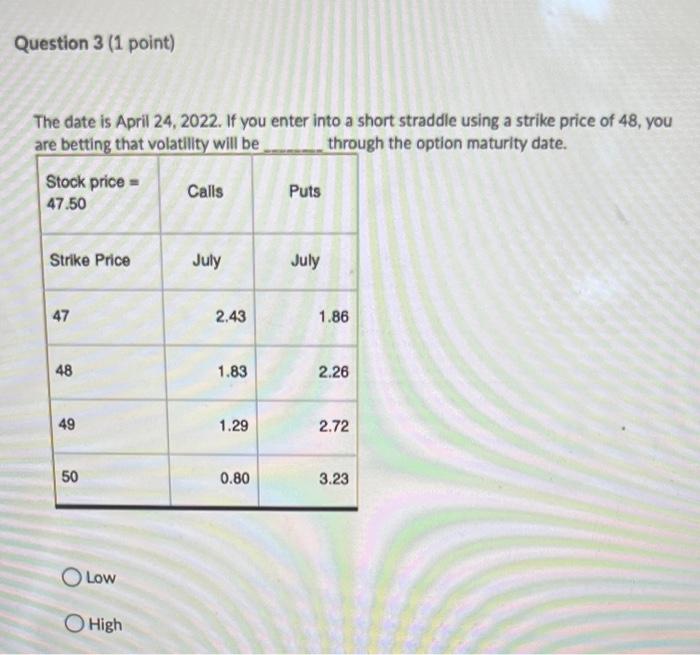

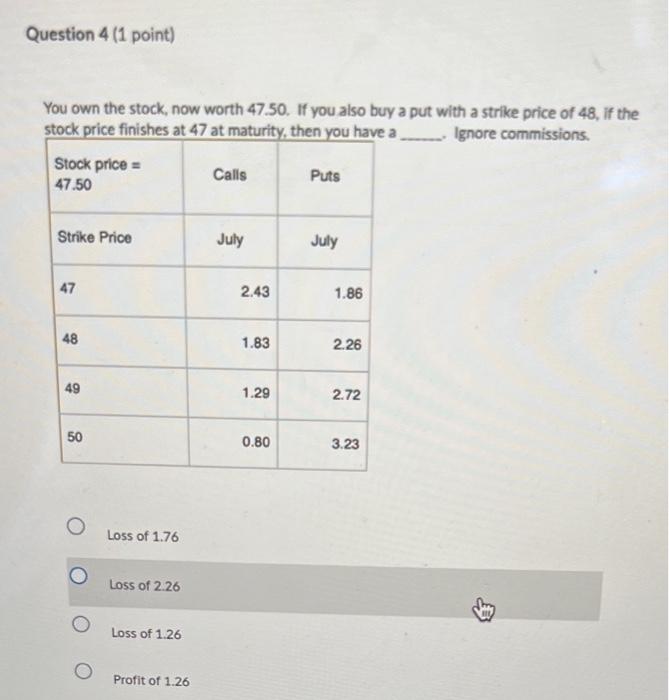

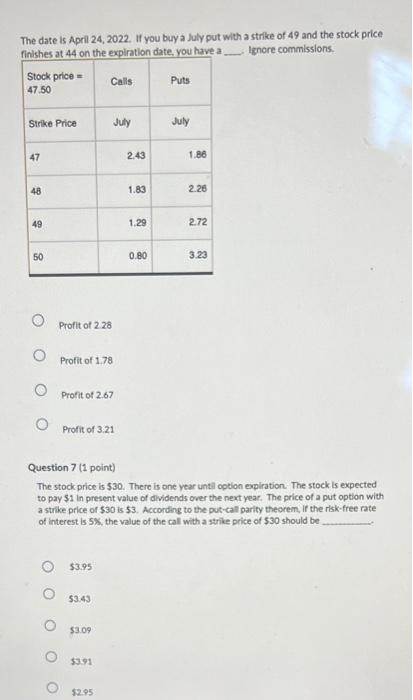

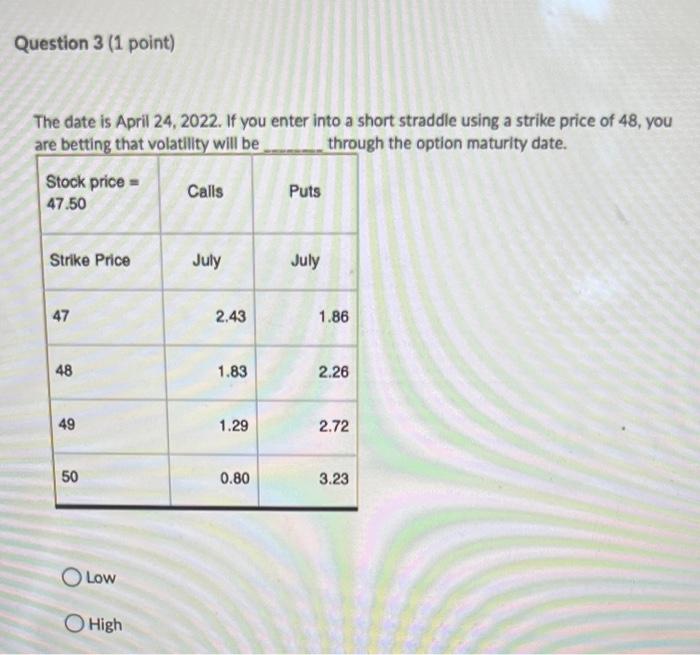

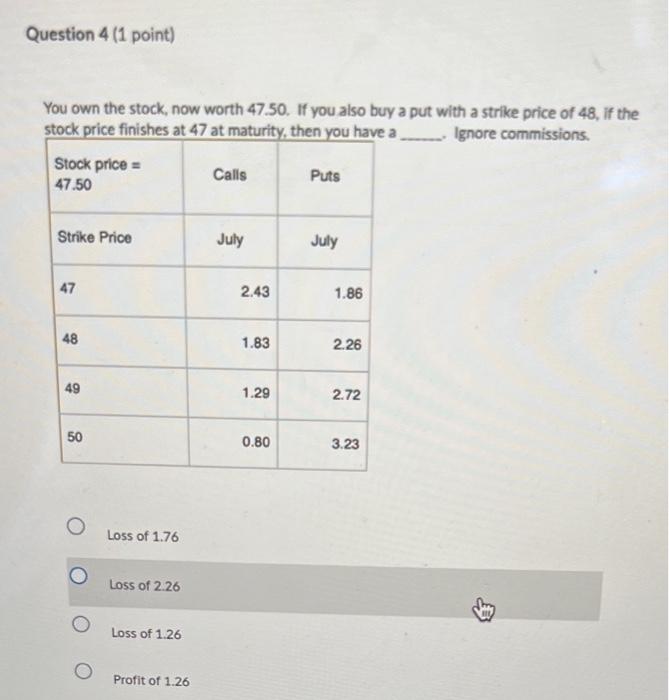

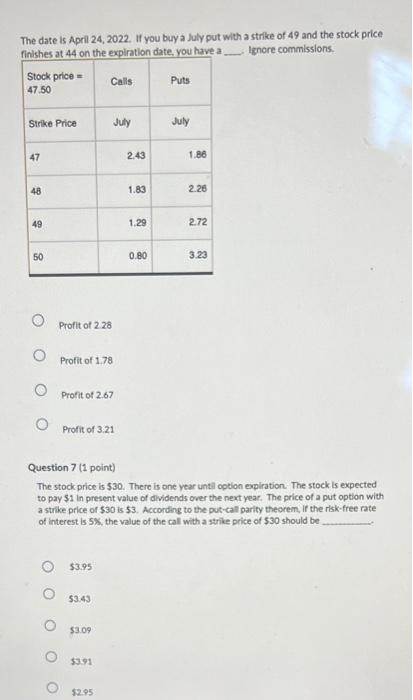

Question 3 (1 point) The date is April 24, 2022. If you enter into a short straddle using a strike price of 48, you are betting that volatility will be through the option maturity date. Stock price - 47.50 Calls Puts Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 Low O High Question 4 (1 point) You own the stock, now worth 47.50. If you also buy a put with a strike price of 48, If the stock price finishes at 47 at maturity, then you have a ____ Ignore commissions. Stock price = Calls 47.50 Puts Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 O Loss of 1.76 Loss of 2.26 Loss of 1.26 Profit of 1.26 The date is April 24, 2022. If you buy a July put with a strike of 49 and the stock price finishes at 44 on the expiration date, you have a Ignore commissions Stock price - Calls Puts 47.50 Strike Price July July 47 2.43 1.86 48 1.83 2.26 49 1.29 2.72 50 0.80 3.23 Profit of 228 O Profit of 1.78 Profit of 2.67 O Profit of 3.21 Question 7 (1 point) The stock price is $30. There is one year until option expiration. The stock is expected to pay $1 in present value of dividends over the next year. The price of a put option with a strike price of $30 is $3. According to the pur-call parity theorem, if the risk-free rate of interest is 5%, the value of the call with a strike price of $30 should be $3.95 $3.43 $3.09 $391 52.95

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started