Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer as many parts as you can are assigned to ual parts in proportion to the information included in the correct answer for a

please answer as many parts as you can

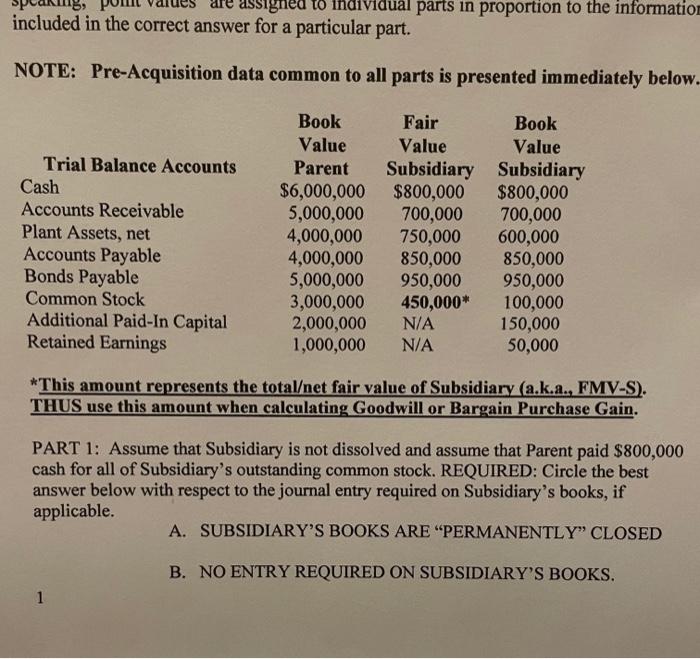

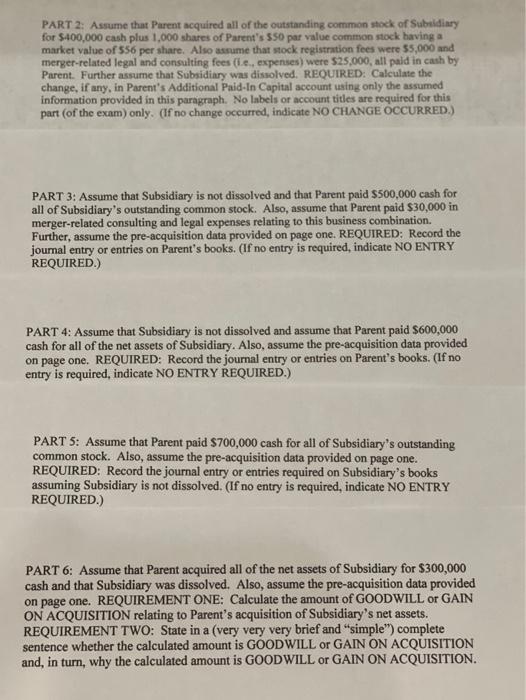

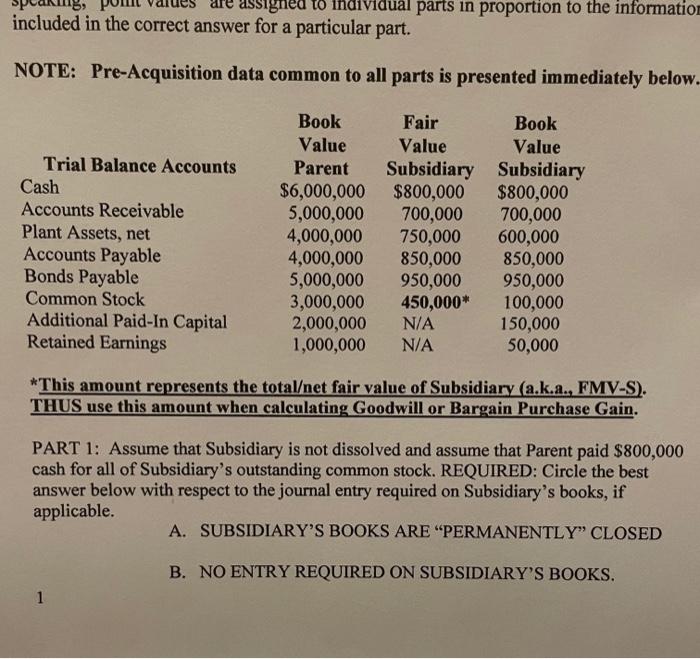

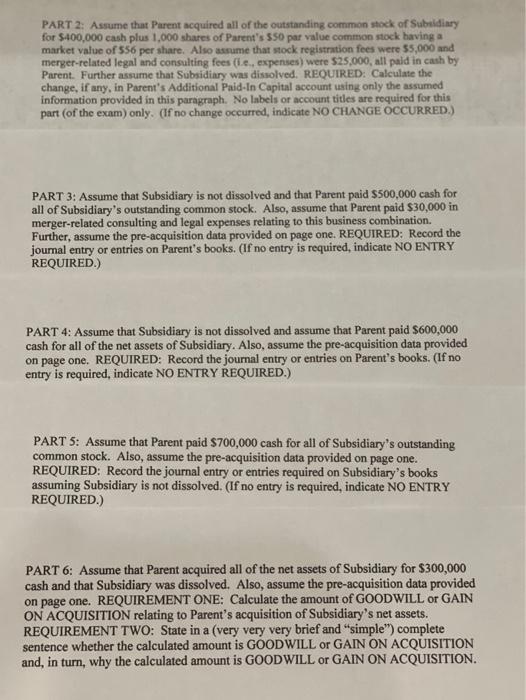

are assigned to ual parts in proportion to the information included in the correct answer for a particular part. NOTE: Pre-Acquisition data common to all parts is presented immediately below. Trial Balance Accounts Cash Accounts Receivable Plant Assets, net Accounts Payable Bonds Payable Common Stock Additional Paid-In Capital Retained Earnings Book Value Parent $6,000,000 5,000,000 4,000,000 4,000,000 5,000,000 3,000,000 2,000,000 1,000,000 Fair Book Value Value Subsidiary Subsidiary $800,000 $800,000 700.000 700,000 750,000 600,000 850,000 850,000 950,000 950,000 450,000* 100,000 N/A 150,000 N/A 50,000 *This amount represents the totalet fair value of Subsidiary (a.k.a., FMV-S). THUS use this amount when calculating Goodwill or Bargain Purchase Gain. PART 1: Assume that Subsidiary is not dissolved and assume that Parent paid $800,000 cash for all of Subsidiary's outstanding common stock. REQUIRED: Circle the best answer below with respect to the journal entry required on Subsidiary's books, if applicable. A. SUBSIDIARY'S BOOKS ARE "PERMANENTLY" CLOSED B. NO ENTRY REQUIRED ON SUBSIDIARY'S BOOKS. PART 2: Assume that Parent acquired all of the outstanding common stock of Subsidiary for $400,000 cash plus 1,000 shares of Parent's 550 par value common stock having a market value of 556 per share. Also assume that stock registration fees were 55,000 and merger-related legal and consulting fees (ie, expenses) were $25,000, all pald in cash by Parent. Further assume that Subsidiary was dissolved. REQUIRED: Calculate the change, if any, in Parent's Additional Paid In Capital account using only the assumed information provided in this paragraph. No labels or account titles are required for this part of the exam) only. (If no change occurred, indicate NO CHANGE OCCURRED.) PART 3: Assume that Subsidiary is not dissolved and that Parent paid $500,000 cash for all of Subsidiary's outstanding common stock. Also, assume that Parent paid $30,000 in merger-related consulting and legal expenses relating to this business combination Further, assume the pre-acquisition data provided on page one. REQUIRED: Record the journal entry or entries on Parent's books. (If no entry is required, indicate NO ENTRY REQUIRED.) PART 4: Assume that Subsidiary is not dissolved and assume that Parent paid $600,000 cash for all of the net assets of Subsidiary. Also, assume the pre-acquisition data provided on page one. REQUIRED: Record the journal entry or entries on Parent's books. (If no entry is required, indicate NO ENTRY REQUIRED.) PART 5: Assume that Parent paid $700,000 cash for all of Subsidiary's outstanding common stock. Also, assume the pre-acquisition data provided on page one. REQUIRED: Record the journal entry or entries required on Subsidiary's books assuming Subsidiary is not dissolved. (If no entry is required, indicate NO ENTRY REQUIRED.) PART 6: Assume that Parent acquired all of the net assets of Subsidiary for $300,000 cash and that Subsidiary was dissolved. Also, assume the pre-acquisition data provided on page one. REQUIREMENT ONE: Calculate the amount of GOODWILL or GAIN ON ACQUISITION relating to Parent's acquisition of Subsidiary's net assets. REQUIREMENT TWO: State in a very very very brief and "simple") complete sentence whether the calculated amount is GOODWILL or GAIN ON ACQUISITION and, in turn, why the calculated amount is GOODWILL or GAIN ON ACQUISITION. are assigned to ual parts in proportion to the information included in the correct answer for a particular part. NOTE: Pre-Acquisition data common to all parts is presented immediately below. Trial Balance Accounts Cash Accounts Receivable Plant Assets, net Accounts Payable Bonds Payable Common Stock Additional Paid-In Capital Retained Earnings Book Value Parent $6,000,000 5,000,000 4,000,000 4,000,000 5,000,000 3,000,000 2,000,000 1,000,000 Fair Book Value Value Subsidiary Subsidiary $800,000 $800,000 700.000 700,000 750,000 600,000 850,000 850,000 950,000 950,000 450,000* 100,000 N/A 150,000 N/A 50,000 *This amount represents the totalet fair value of Subsidiary (a.k.a., FMV-S). THUS use this amount when calculating Goodwill or Bargain Purchase Gain. PART 1: Assume that Subsidiary is not dissolved and assume that Parent paid $800,000 cash for all of Subsidiary's outstanding common stock. REQUIRED: Circle the best answer below with respect to the journal entry required on Subsidiary's books, if applicable. A. SUBSIDIARY'S BOOKS ARE "PERMANENTLY" CLOSED B. NO ENTRY REQUIRED ON SUBSIDIARY'S BOOKS. PART 2: Assume that Parent acquired all of the outstanding common stock of Subsidiary for $400,000 cash plus 1,000 shares of Parent's 550 par value common stock having a market value of 556 per share. Also assume that stock registration fees were 55,000 and merger-related legal and consulting fees (ie, expenses) were $25,000, all pald in cash by Parent. Further assume that Subsidiary was dissolved. REQUIRED: Calculate the change, if any, in Parent's Additional Paid In Capital account using only the assumed information provided in this paragraph. No labels or account titles are required for this part of the exam) only. (If no change occurred, indicate NO CHANGE OCCURRED.) PART 3: Assume that Subsidiary is not dissolved and that Parent paid $500,000 cash for all of Subsidiary's outstanding common stock. Also, assume that Parent paid $30,000 in merger-related consulting and legal expenses relating to this business combination Further, assume the pre-acquisition data provided on page one. REQUIRED: Record the journal entry or entries on Parent's books. (If no entry is required, indicate NO ENTRY REQUIRED.) PART 4: Assume that Subsidiary is not dissolved and assume that Parent paid $600,000 cash for all of the net assets of Subsidiary. Also, assume the pre-acquisition data provided on page one. REQUIRED: Record the journal entry or entries on Parent's books. (If no entry is required, indicate NO ENTRY REQUIRED.) PART 5: Assume that Parent paid $700,000 cash for all of Subsidiary's outstanding common stock. Also, assume the pre-acquisition data provided on page one. REQUIRED: Record the journal entry or entries required on Subsidiary's books assuming Subsidiary is not dissolved. (If no entry is required, indicate NO ENTRY REQUIRED.) PART 6: Assume that Parent acquired all of the net assets of Subsidiary for $300,000 cash and that Subsidiary was dissolved. Also, assume the pre-acquisition data provided on page one. REQUIREMENT ONE: Calculate the amount of GOODWILL or GAIN ON ACQUISITION relating to Parent's acquisition of Subsidiary's net assets. REQUIREMENT TWO: State in a very very very brief and "simple") complete sentence whether the calculated amount is GOODWILL or GAIN ON ACQUISITION and, in turn, why the calculated amount is GOODWILL or GAIN ON ACQUISITION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started