please answer as many true or false questions as possible thanks!

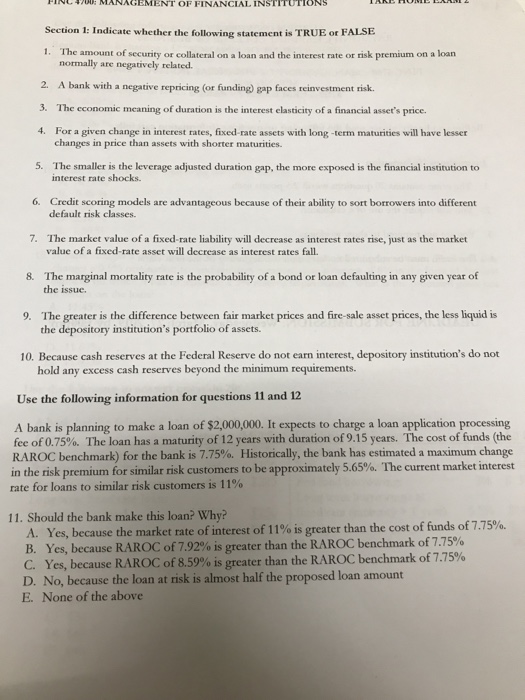

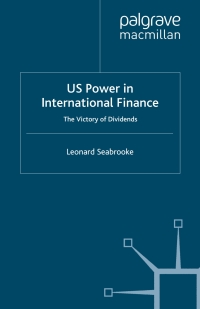

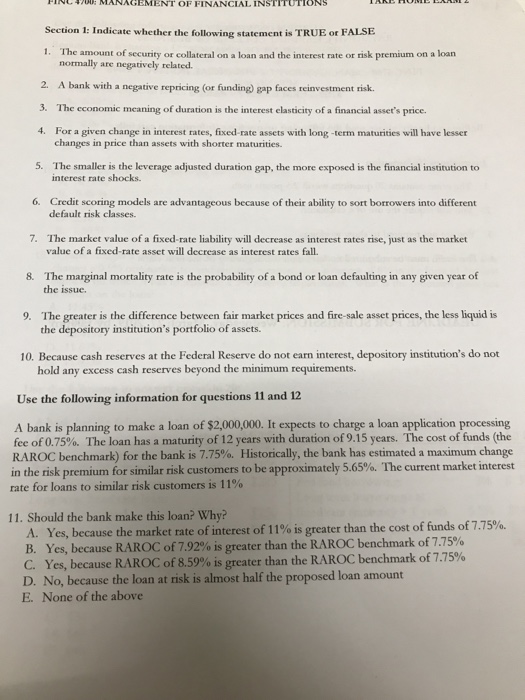

It 1 Section 1: Indicate whether the following statement is TRUE or FALSE 1. MANAGEMENT OF FINANCIAL INSrUTiONS The amount of security or collateral on a loan and the interest rate or risk premium on a loan normally are negatively related. 2. A bank with a negative repricing (or funding) gap faces reinvestment risk 3. 4. The economic meaning of duration is the interest elasticity of a financial asset's price. For a given change in interest rates, fixed rate assets with long-term maturities will have lesser changes in price than assets with shorter maturities. 5. The smaller is the leverage adjusted duration gap, the more exposed is the financial institution to interest rate shocks. 6. Credit scoring models are advantageous because of their ability to sort borrowers into different 7. The market value of a fixed-rate liability will decrease as interest rates rise, just as the market 8. The marginal mortality rate is the probability of a bond or loan defaulting in any given year of default risk classes. value of a fixed-rate asset will decrease as interest rates fall the issue The greater is the difference between fair market prices and fire-sale asset prices, the less liquid is the depository institution's portfolio of assets. 9. 10. Because cash reserves at the Federal Reserve do not earn interest, depository institution's do not hold any excess cash reserves beyond the minimum requirements. Use the following information for questions 11 and 12 A bank is planning to make a loan of $2,000,000. It expects to charge a loan application processing fee of 0.75%. The loan has a maturity of 12 years with duration of 9.15 years. The cost of funds (the RAROC benchmark) for the bank is 7.75%. Historically, the bank has estimated a maximum change in the risk premium for similar risk customers to be approximately 5.65%. The current market interest rate for loans to similar risk customers is 11% 11. Should the bank make this loan? Why? A. because the market rate of interest of 11% is greater than the cost of funds of 7.75%. Yes, Yes, because RAROC of 7.92% is greater than the RAROC benchmark of 7.75% Yes, because RAROC of 8.59% is greater than the RAROC benchmark of 7.75% B. D. No, because the loan at risk is almost half the proposed loan amount E. None of the above