Answered step by step

Verified Expert Solution

Question

1 Approved Answer

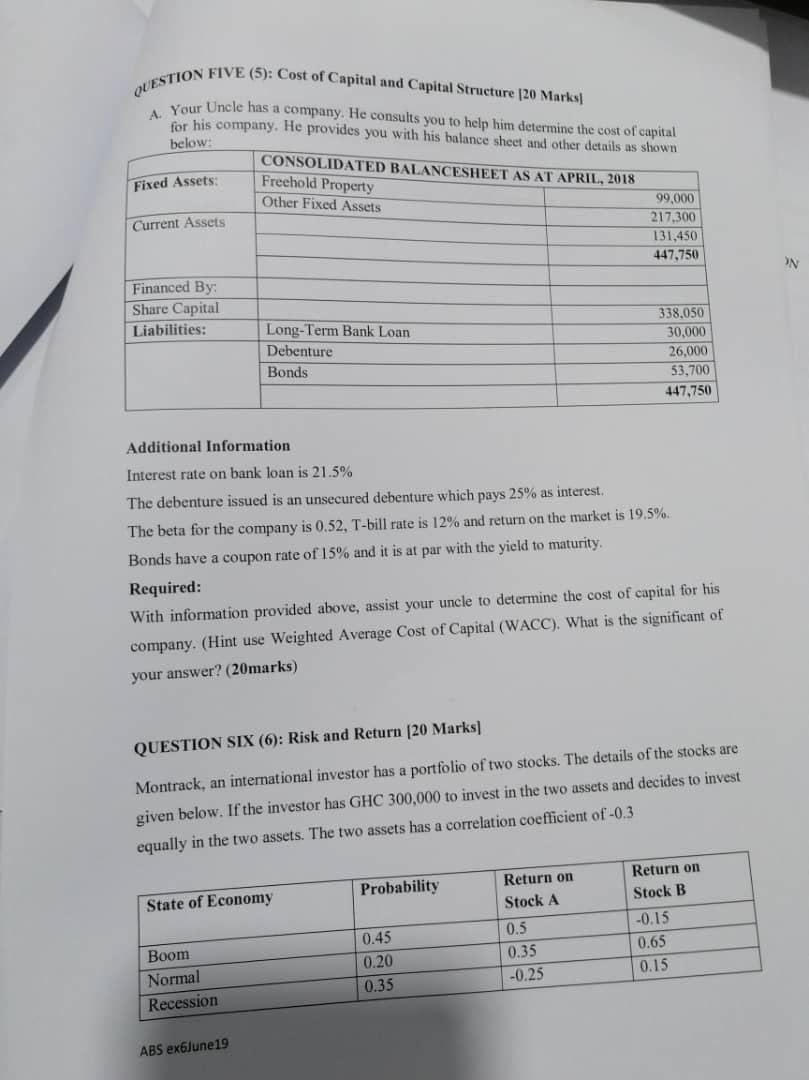

Please assist me with Question 6 QUESTION FIVE (5): Cost of Capital and Capital Structure 120 Marks A. Your Uncle has a company. He consults

Please assist me with Question 6

QUESTION FIVE (5): Cost of Capital and Capital Structure 120 Marks A. Your Uncle has a company. He consults you to help him determine the cost of capital . below: Fixed Assets CONSOLIDATED BALANCESHEET AS AT APRIL, 2018 Freehold Property Other Fixed Assets Current Assets 99,000 217,300 131,450 447,750 ON Financed By: Share Capital Liabilities: Long-Term Bank Loan Debenture 338.050 30.000 26.000 53,700 447,750 Bonds Additional Information Interest rate on bank loan is 21.5% The debenture issued is an unsecured debenture which pays 25% as interest. The beta for the company is 0.52, T-bill rate is 12% and return on the market is 19.5%. Bonds have a coupon rate of 15% and it is at par with the yield to maturity, Required: With information provided above, assist your uncle to determine the cost of capital for his company. (Hint use Weighted Average Cost of Capital (WACC). What is the significant of your answer? (20marks) QUESTION SIX (6): Risk and Return (20 Marks] Montrack, an international investor has a portfolio of two stocks. The details of the stocks are given below. If the investor has GHC 300,000 to invest in the two assets and decides to invest equally in the two assets. The two assets has a correlation coefficient of -0.3 Return on Probability Return on Stock B State of Economy Stock A -0.15 0.5 0.65 0.35 0.45 0.20 0.35 Boom Normal Recession 0.15 -0.25 ABS ex6June 19 Required: Calculate the return and risk on the individual stocks. 18marks b. Calculate the portfolio return and risk. (4marks] What does the portfolio risk and the individual asset risk tell you? [4marks) d. What does the Capital Asset Pricing Model (CAPM) say about investor return? c. [4marks] PA QUESTION FIVE (5): Cost of Capital and Capital Structure 120 Marks A. Your Uncle has a company. He consults you to help him determine the cost of capital . below: Fixed Assets CONSOLIDATED BALANCESHEET AS AT APRIL, 2018 Freehold Property Other Fixed Assets Current Assets 99,000 217,300 131,450 447,750 ON Financed By: Share Capital Liabilities: Long-Term Bank Loan Debenture 338.050 30.000 26.000 53,700 447,750 Bonds Additional Information Interest rate on bank loan is 21.5% The debenture issued is an unsecured debenture which pays 25% as interest. The beta for the company is 0.52, T-bill rate is 12% and return on the market is 19.5%. Bonds have a coupon rate of 15% and it is at par with the yield to maturity, Required: With information provided above, assist your uncle to determine the cost of capital for his company. (Hint use Weighted Average Cost of Capital (WACC). What is the significant of your answer? (20marks) QUESTION SIX (6): Risk and Return (20 Marks] Montrack, an international investor has a portfolio of two stocks. The details of the stocks are given below. If the investor has GHC 300,000 to invest in the two assets and decides to invest equally in the two assets. The two assets has a correlation coefficient of -0.3 Return on Probability Return on Stock B State of Economy Stock A -0.15 0.5 0.65 0.35 0.45 0.20 0.35 Boom Normal Recession 0.15 -0.25 ABS ex6June 19 Required: Calculate the return and risk on the individual stocks. 18marks b. Calculate the portfolio return and risk. (4marks] What does the portfolio risk and the individual asset risk tell you? [4marks) d. What does the Capital Asset Pricing Model (CAPM) say about investor return? c. [4marks] PAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started