Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer as quickly as possible, I will thumbs up instantly If Fantastic: Sam's uses the LIFO Inventory Costing method, what is the gross profit

please answer as quickly as possible, I will thumbs up instantly

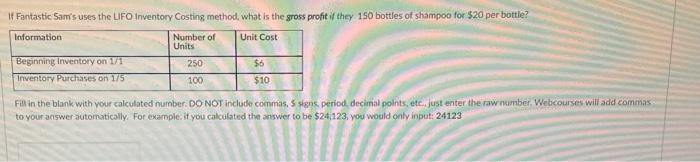

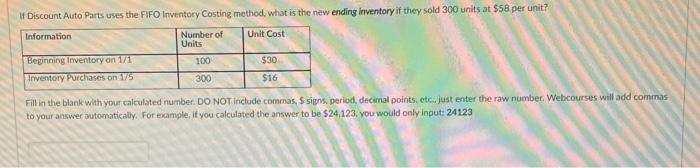

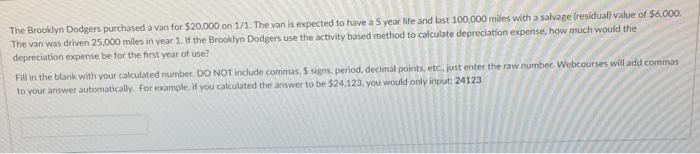

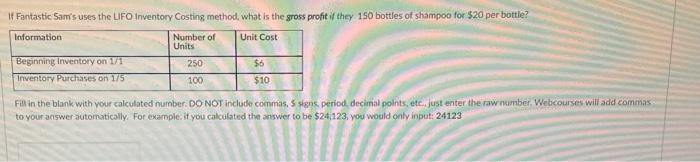

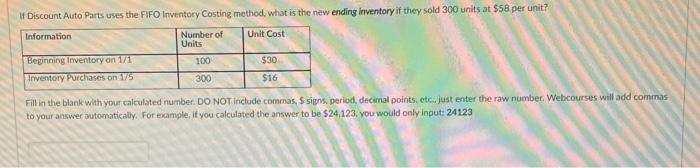

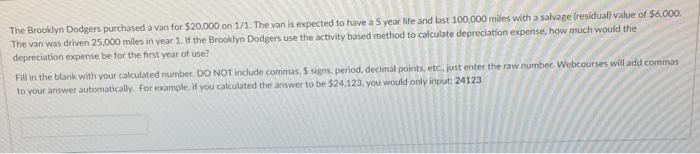

If Fantastic: Sam's uses the LIFO Inventory Costing method, what is the gross profit if they 150 bottles of shampoo for $20 per bottle? Information Unit Cost Number of Units 250 $6 Beginning inventory on 1/1 Inventory Purchases on 1/5 100 $10 Fill in the blank with your calculated number. DO NOT include commas, 5 signs period. decimal points, etc. just enter the raw number Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 1 Discount Auto Parts uses the FIFO Inventory Costing method, what is the new ending inventory if they sold 300 units at $58 per unit? Information Unit Cost Number of Units 100 $30 Beginning inventory on 171 Inventory Purchases on 1/5 300 $16 Fill in the black with your calculated number. DO NOT include commas. S signs, period, decimal points, etc. Just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 The Brooklyn Dodgers purchased a van for $20,000 on 1/1. The van is expected to have a 5 year life and last 100,000 miles with a salvage (residual value of $6,000 The van was driven 25,000 miles in year 1. If the Brooklyn Dodgers use the activity based method to calculate depreciation expense, how much would the depreciation expense be for the first year of use? Fill in the blank with your calculated number. DO NOT include commas, 5 signs, period. decimal points, etc, just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you talculated the answer to be $24, 123, you would only input: 24123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started